Rick Mills – “Graphite’s War-Fighting Capabilities”

The energy transition and digitalization have made critical minerals top of mind for policymakers and investors alike. However, little is said about the role that these minerals, including graphite, play in the defense sector, and the impact of supply chain disruptions on the world’s militaries.

The danger of running out of minerals needed to build weapons and defend territories is a heightened risk now, during a period of intensified global conflict. With wars raging on two fronts — Eastern Europe and the Middle East — not to mention numerous smaller wars like the conflicts in Yemen and the DRC, nations are girding for war and re-arming their militaries, pushing up demand for critical and non-critical minerals including graphite, aluminum, steel, iron, rare earths, nickel and titanium.

Militaries re-arming

Consider the following:

- According to the U.S. Department of Defense, the military is prioritizing maritime and air forces that would play central roles in the Indo-Pacific region, as the Chinese military flexes its muscles in the South China Sea and continues to hint at an invasion of independent Taiwan, a US ally.

- The US Navy, says DoD, want to grow its force to over 500 ships. In its fully-year 2024 budget request, the navy seeks to procure nine battle force ships, including one ballistic missile submarine, two destroyers and two frigates. The hulls of these ships are made of high-strength alloyed steel, containing metals like nickel, chromium, molybdenum and manganese. The Tomahawk cruise missile has an aluminum airframe and the Mark 48 torpedo has an aluminum fuel tank.The Air Force seeks to procure nearly 100 aircraft including 48 F-35 fighter jets, and for land forces in the Indo-Pacific, the US Army is bolstering long-range precision fires including artillery, rockets and missiles. The M30A1 rocket explodes with 82,000 tungsten ball bearings. Nearly 20% of the F-35 fighter jet’s weight is titanium, while Joint Air-to-Surface Standard Missiles have concrete-piercing casing made of tungsten steel.

Last fall, President Biden signed off an an $80 million grant to Taiwanfor the purchase of American military equipment.

- The defense department’s 2023 China Military Power Report estimates the Chinese have more than 500 operational nuclear warheads as of May 2023, and are developing new intercontinental ballistic missiles. These nuclear or conventionally armed missiles give the PRC the capability to strike targets in the continental United States, Hawaii and Alaska, an official said.Chinese leaders are seeking to modernize the People’s Liberation Army capabilities in all domains of warfare. On land, the PLA continues to modernize its equipment and focus on combined arms and joint training. At sea, the world’s largest navy has a battle force of more than 370 ships and submarines. In the past two years, China’s third aircraft carrier was launched, along with its third amphibious assault ship. The PLA Air Force “is rapidly catching up to western air forces,” the official said. The air force continues to build up manned and unmanned aircraft and the Chinese announced the fielding of the H-6N — its first nuclear-capable, air-to-air refueled bomber. (S. Department of Defense)

- Russia’s invasion of Ukraine has highlighted the need for robust defense in Europe. According to the Center for European Policy and Analysis (CEPA), the European Union has launched the European Defense Industrial Strategy and the European Defense Industrial Program, building on previous efforts to improve weapons procurement. With Russia’s shift to a war economy and dwindling US military assistance — additional funds for Kyiv have been stuck in Congress for months, although a $300 million stop-gap measurewas recently announced — CEPA notes European nations are urgently sourcing defense equipment from non-European suppliers, which often offer shorter delivery times.Poland has made significant acquisitions from South Korea, for example. Warsaw decided to purchase FA-50 light attack aircraft, K9 howitzers, K2 Black Panther tanks, and K239 Chunmoo multi-barreled missile launchers worth $5.8bn in 2022.

- As of August 2023, the Biden administration had committed more than $43 billiontowards defending Ukraine, including about 2,000 Stinger antiaircraft systems, 10,000 Javelin anti-armor systems, and greater than 2 million 155-mm artillery rounds.

- Russia has expanded its army and has material advantages over Ukraine notably in artillery. In a Feb. 13 study, military experts said Russia started the war with a highly disorganized force of about 360,000 troops. By the beginning of 2024, the Russian Operational Group of Forces in the occupied territories comprised 470,000 troops. The country has dug into its large inventory of older equipment to rebuild damaged tanks and other armored vehicles. Another analyst quoted by the CBCsaid the Russians now have stockpiles allowing them to fight for at least another year or two.

- Other experts suggest Russia is getting significant outside help. According to US intelligence, China has ramped up military aid to Russia, supplying components for navigation equipment in M-17 military helicopters, jamming technology for military vehicles, parts for fighter jets and components for defence systems like the S-400 Surface-to-Air Missile System. Iran has supported Moscow with Shahed 136s and the Mojaher 6 drones and plans to build a drone factory near the Russian town of Yelabuga. North Korea has provided artillery shells and munitions for Moscow’s war in Ukraine. (CBC News, Feb. 23, 2024). Last summer, The Telegraph via Business Insider reportedChina is helping to arm Russia with a range of military equipment, including helicopters, drones, optical sights, and key defense industry metals.

AH-64 Apache

Risk of metal shortages

Despite this re-arming trend, the US military and its NATO allies face dwindling stockpiles of minerals for military use. The problem is especially grave considering that China, now America’s strongest foe militarily, controls the market for most critical minerals and the United States is dependent on China (and Russia) for the materials required for building its military equipment and weaponry.

In a recent column in Real Clear Energy, Eastern New Mexico University professor Jim Constantopoulos notes that the United States does not have a national policy for mineral production, and that without action to maintain the defense stockpile, the US could be ill-prepared for a defense sector more reliant on batteries and renewable energy technologies, let alone a conflict with China, the world’s mineral superpower.

If a conflict were to escalate into a war, he says the US would have shortfalls in 69 minerals, most of them used in weapons production.

China is the leading producer of 29 of 43 industrial minerals, and the US relies on China for about half of the critical minerals including lithium, cobalt and rare earths.

China is also the world’s largest producer of gallium, germanium, natural and synthetic graphite — and the largest import source for these materials. While Syrah Resources was expected to start producing natural graphite-based anode materials in December, the US is otherwise 100% dependent on China for (refined) graphite imports.

M1126 Stryker Combat Vehicle

Last year China imposed export restrictions on gallium, germanium and graphite, disrupting supplies to the United States.

Graphite is an important component of helicopters, submarines, artillery and missiles, but 70% of graphite production comes from China (and 100% of processed graphite) — a problem highlighted last fall by European Council President Charles Michel.

A similar message was communicated in June 2023 by NATO Secretary General Jens Stoltenberg, who warned the alliance to avoid becoming overly dependent on Chinese minerals.

It isn’t only China. Russia supplies NATO members with other key defense metals, including aluminum, nickel and titanium.

Constantopoulos points out in his column that in the event of a mineral shortage, the U.S. could not depend on its closest allies for critical raw materials. NATO has limited mineral production. The European Union imports between 75% and 100% of most metals it consumes, and neither the EU nor its member countries have stockpiles. Nor do Canada or Great Britain have mineral stockpiles.

The Carnegie Endowment points out that the US government holds limited mineral inventories in its National Defense Stockpile, while the European Union (EU) has walked back its plans to develop a centralized mineral stockpile.

NDS inventories have dwindled since the 1950s, and as of March 2023 were valued at just $912.3 million — 1.2% of the stockpile’s 1962 value of $77.1 billion, adjusted for inflation.

Patriot Missile Long Range Air defence System

This is a complete 180 from before World War Two, when the Allies controlled most of the world’s minerals, a fact that proved instrumental in eventually defeating the Axis powers.

As Carnegie points out, mineral supplies can help sustain military power, while mineral shortages can severely undermine it.

The foundation says there are three main risks that could lead to mineral shortages: foreign export controls; rising military demand amid great power competition, including a possible US-China conflict; and disrupted sea-lanes.

If war breaks out with China, US merchant vessels carrying minerals across the Pacific risk attack by Chinese forces.

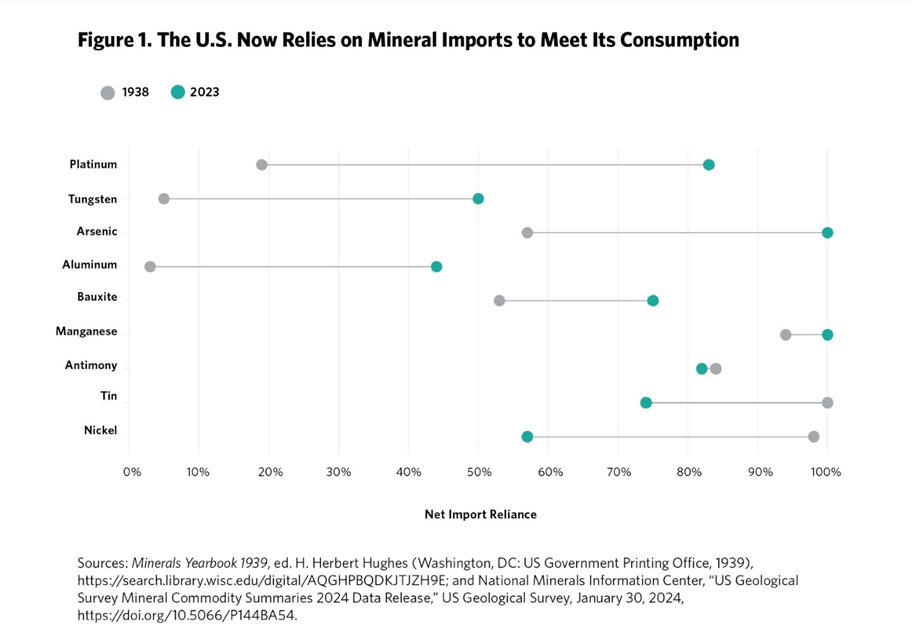

The chart below shows the US military and NATO are in a much weaker minerals position today compared to 1938.

Source: Carnegie Endowment for International Peace

Also from Carnegie:

A 2023 report from the Hague Centre for Strategic Studies found that European countries face high or very high supply risks for several critical minerals with military applications, including aluminum, beryllium, chromium, copper, and natural graphite for towed artillery, which Ukraine heavily relies on.

The United States faces similar mineral shortage risks from its efforts to supply Ukraine militarily.

Graphite’s properties

Virtually every US military system requires mineral components, from steel and titanium to graphite composites and cadmium alloys. Global defense spending shows that military demand is increasing for these platforms, munitions, and thus minerals. (Modern War Institute)

Graphite is the ideal material for defense purposes thanks to its unique properties, i.e., it is able to withstand very high temperatures with a high melting melting point; it is stable at these high temperatures; it is lightweight and easy to machine; and it is corrosion-resistant.

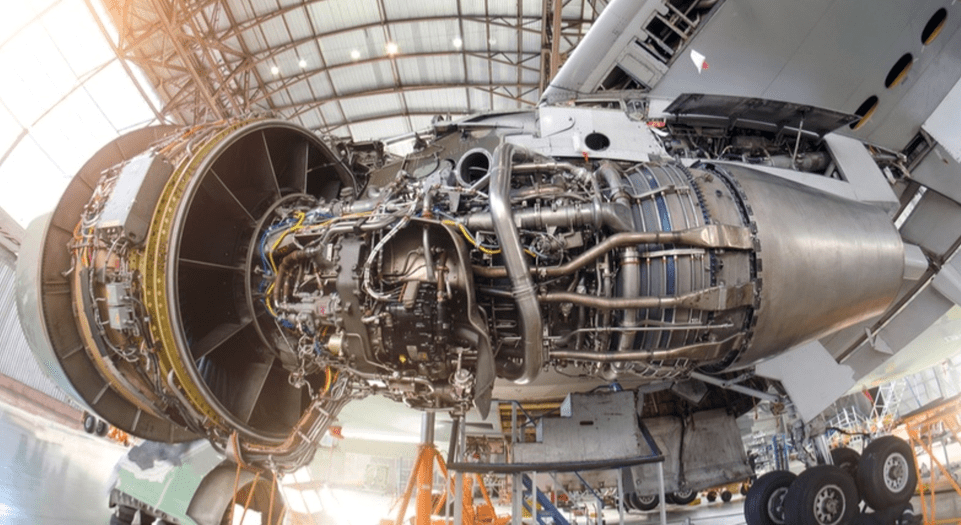

Four ways graphite has transformed aerospace engineering to make it more efficient, are increasing the service life of airplanes; improving fuel economy; having the ability to run hotter engines; and reducing the weight of airplanes.

Fun fact: when an industry giant replaced a single leaded bronze part with a graphite equivalent, it saw a weight decrease of 1.5 lbs. In aerospace, every pound saved equates to $5,000 a year in fuel costs.

Source: Metcar

Graphite is found in a wide range of consumer devices, including smartphones, laptops, tablets and other wireless devices, earbuds and headsets. Besides being integral to electric vehicles — graphite is used in the anode part of the lithium-ion battery — graphite is found in lubricants, nuclear reactors, graphene sheets, and in pencil lead.

Another significant characteristic is that it is chemically inert, meaning it is not affected by a majority of reagents and acids. (BYJU’s)

The European Commission last fall added synthetic graphite and aluminum to the list of strategic and critical raw materials outlined in the Critical Raw Materials Act.

In 2021, President Joe Biden signed an executive order aimed at strengthening critical US supply chains. Graphite was identified as one of four minerals considered essential to the nation’s “national security, foreign policy and economy.”

Graphite is:

- One of 14 listed minerals for which the US is 100% import-dependent.

- One of nine listed minerals meeting all six of the industrial/defense sector indicators identified by the US government report.

- One of four listed minerals for which the US is 100% import-dependent while meeting all six industrial/defense sector indicators.

- One of three listed minerals which meet all industrial/defense sector indicators — and for which China is the leading global producer and leading US supplier.

Military uses

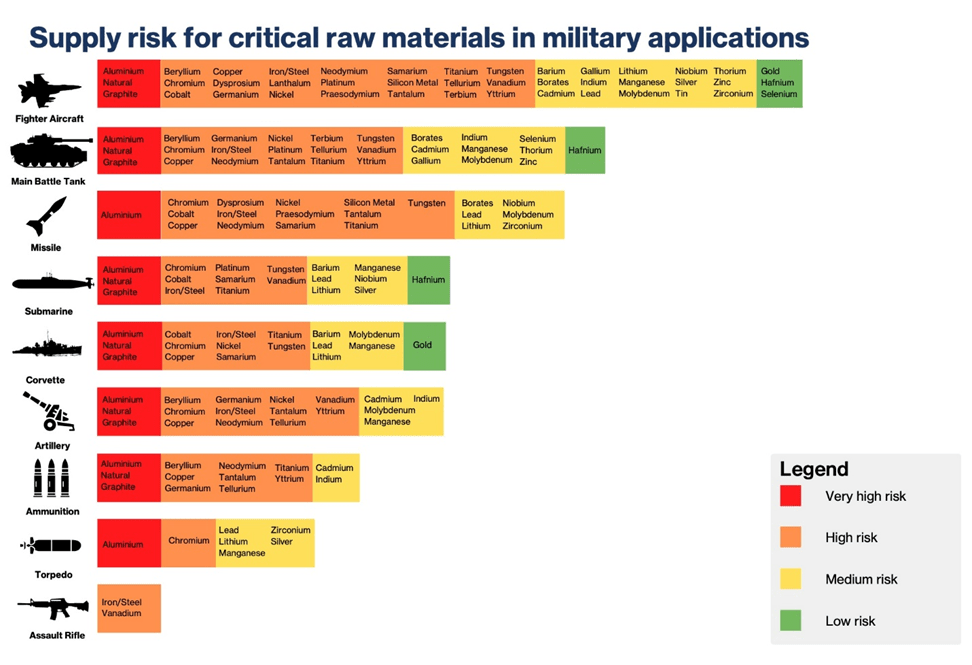

A report last year from the Hague Centre for Strategic Studies found that natural graphite and aluminium are the materials most commonly used across military applications and are also subject to considerable supply security risks that stem from the lack of suppliers’ diversification and the instability associated with supplying countries.

The report assessed the degree of criticality for each of 40 materials deemed critical or soon to be critical. Natural graphite was rated “very high-risk” for air applications, and “high-risk” for sea applications.

In the table below, natural graphite is rated red, very high risk, for its use in fighter aircraft, main battle tanks, submarines, corvettes, artillery and ammunition. Aluminum, used in fighters, tanks, missiles, submarines, corvettes, artillery, ammunition and torpedos, was also rated a very high-risk material.

Source: Hague Centre for Strategic Studies

The report says aluminum and natural graphite are the two most used materials in the defence industry and can be found in aircrafts (fighter, transport, maritime patrol, and unmanned), helicopters (combat and multi-role), aircraft and helicopter carriers, amphibious assault ships, corvettes, offshore patrol vessels, frigates, submarines, tanks, infantry fighter vehicles, artillery, and missiles. These materials are used in components such as airframe and propulsion systems of helicopters and aircrafts as well as onboard electronics of aircraft carriers, corvettes, submarines, tanks, and infantry fighter vehicles. The impact of supply security disruption would hence be very significant, given the multiplicity of aluminum and natural graphite’s applications.

In the fighter plane graphic below, notice the use of natural graphite (red dots) in almost every part of the plane, including the body, wings, tail, nose, nozzle, propulsion system, landing gear, electro-optical systems, and sensors and electronic systems.

According to the report, the most used of the 40 materials across the air domain are aluminum, natural graphite, copper and titanium:

These materials have several applications in aeronautics. In aircrafts (fighter, transport, maritime patrol, and unmanned) and helicopters (combat and multi-role), aluminium, natural graphite, and titanium find their main application in the airframe, where they are used in the body, wings, tail, nose, and axis of the aircraft. They are also employed in the production of propulsion systems’ components such as combustors, nozzle, drive shaft, and propellers, as well as in landing gears, connectors, and electronic systems.

Source: Hague Centre for Strategic Studies

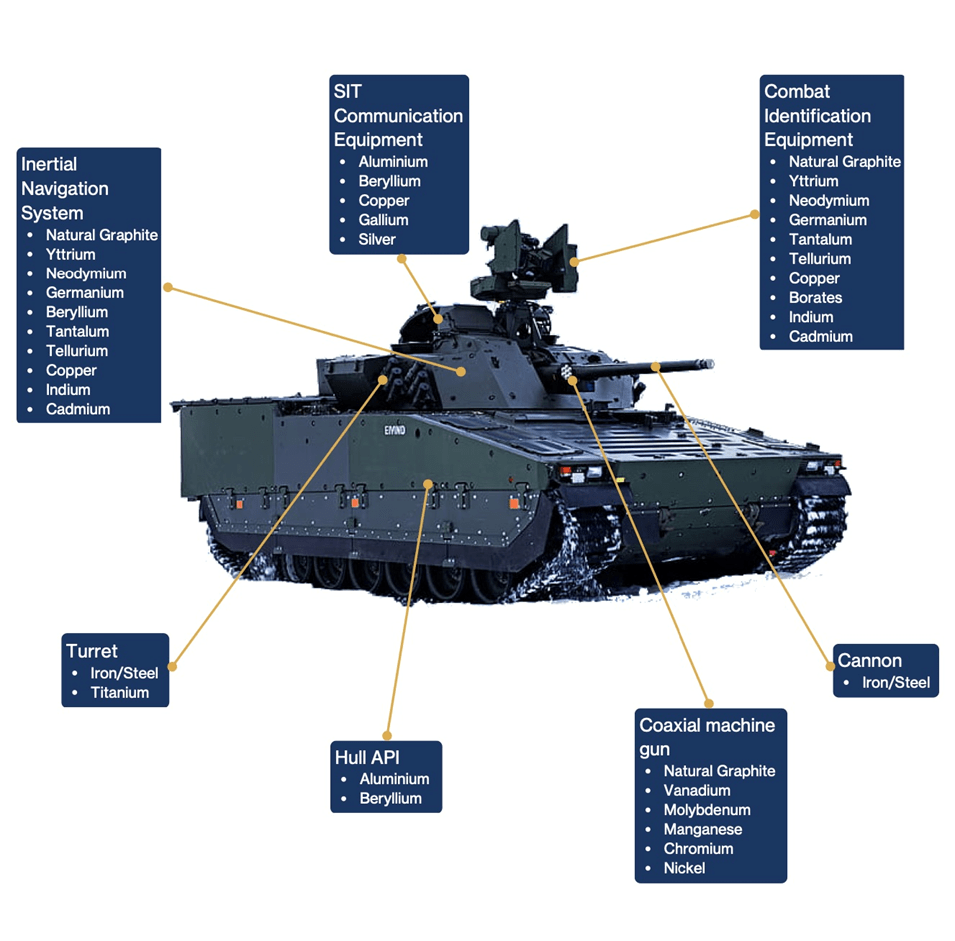

A second graphic of a tank shows natural graphite in the inertial navigation system, combat identification equipment, and coaxial machine gun. According to the report, For the construction of tank guns, Howitzer machine guns in infantry fighter vehicles, and GPS/SAL guidance systems in ammunition, natural graphite is found in combination with other materials to construct these components.

Source: Hague Centre for Strategic Studies

M1A2 Abrams

The amount of equipment used by the US military alone demonstrates a captive market for natural graphite. One source reported in 2018, the US government had roughly 440,000 vehicles, 780 strategic missiles, 278 combat ships and 14,000 aircraft.

It notes A key market risk for the US defense sector is a material reliance on a geopolitical competitor that can create a shortage of natural graphite on a whim that would directly impede manufacturing of critical defense systems and equipment in the US.

The Defense Logistics Agency, the same agency that manages the National Defense Stockpile, is reportedly looking for a domestic source of isomolded graphite production, used by the military in several applications, including tactical munitions, strategic rockets and missiles, and large advance-launch systems.

One of the more surprising defense applications of graphite is the so-called graphite bomb. According to Research Gate, the non-lethal weapon, also known as a soft bomb, is used for shutting down the power supply systems of the enemy. The working mechanism of the graphite bomb is relatively simple and is based on making suspensions of air/clouds of carbon filament chemically treated extremely fine over the electrical components, causing short circuits and electrical discharges within the infrastructure of electricity supply…

Carbon filaments used inside of graphite bombs are very small and may give rise to dense clouds, with a long persistence…. the effect of the graphite bomb is only over the equipment and facilities of uninsulated power supply.

A graphite bomb was used against Iraq in the First Gulf War (1990-91), neutralizing about 85% of the country’s electricity facilities. A US-made graphite bomb was deployed during the NATO military intervention in former Yugoslavia (1999), where it disabled more than 70% of national grid electricity supply.

The US military also uses graphite flakes to block electromagnetic waves that the enemy might detect and use to target troops in the field. Essentially a type of smoke, synthetic graphite flakes are released from ground-based systems that disperse bulk powders into the atmosphere. The powders, called Micro-260 and K-2, are composed of flakes of various sizes.

It should be pointed out that synthetic graphite, made from petroleum coke, is used in all the downstream industries that produce military equipment components, such as foundries (graphite electrodes) that make steel; and facilities that manufacture wheels for vehicles or body armor for soldiers (various types of graphite molds and dies).

Synthetic graphite is employed directly in graphite nozzles, used in high-powered rockets due to graphite’s ability to withstand extreme temperatures. These graphite components can be as simple as a hole drilled into a synthetic graphite block, or a more advanced, machined nozzle that has its own cooling system.

A new graphite application for military and industrial usages is a graphite oxide patented by the US Army. The water recycling system is designed for washing out tanks and trucks exposed to chemical and biological weapons.

The system filters out impurities at up to 600 gallons of wash water per hour, allowing dumped wastewater to be re-used or safely dumped.

Downstream from military applications, graphite is used widely in the aerospace industry. According to Semco Carbon, heat treating synthetic graphite is used as engineered material to create precision machined plates, posts, nuts and bolts along with heating elements and fixtures used in the heat treatment of aerospace metals such as titanium, stainless steel, and other alloys…

As an extension of heat treating for aerospace, a common graphite use is as a susceptor. “A susceptor is a material used for its ability to absorb electromagnetic energy and convert it to heat (which is sometimes designed to be re-emitted as infrared thermal radiation).”

Another use for graphite is as a mold. Graphite molds are used to cast titanium, aluminum, and stainless steel to near net shapes. Graphite molds are also used for molding non-metal composites. An example of this is for a satellite dish deployed on a satellite.

Graphite itself is used for jet and rocket engine nozzles and Carbon/Graphite vanes. Impellers and rotors move aviation fuel safely without the dangers of creating sparks to ignite fuel.

Paladin M109A7 155mm Artillery System

Other uses

Electric vehicles

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced in 2020.

Graphite has the largest component in batteries by weight, constituting 45% or more of the cell. Nearly four times more graphite feedstock is consumed in each battery cell than lithium and nine times more than cobalt.

Graphite is therefore indispensable to the EV supply chain.

BloombergNEF expects graphite demand to quadruple by 2030 on the back of an EV battery boom transforming the transportation sector. It is not an exaggeration to say that electrification of the global transportation system doesn’t happen without graphite.

The lithium-ion batteries in electric vehicles are composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

The cathode is where metals like lithium, nickel, manganese and cobalt are used, and depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, a material for which there are no substitutes.

Nuclear power

By far the greatest use of graphite in nuclear has been as a moderator and reflector. According to an International Atomic Energy Agency (IAEA) paper, Graphite has been used as a moderator and reflector of neutrons in more than 100 nuclear power plants and in many research and plutonium-production reactors. It is used primarily as a neutron reflector or neutron moderator, although graphite is also used for other features of reactor cores, such as fuel sleeves.

Graphene

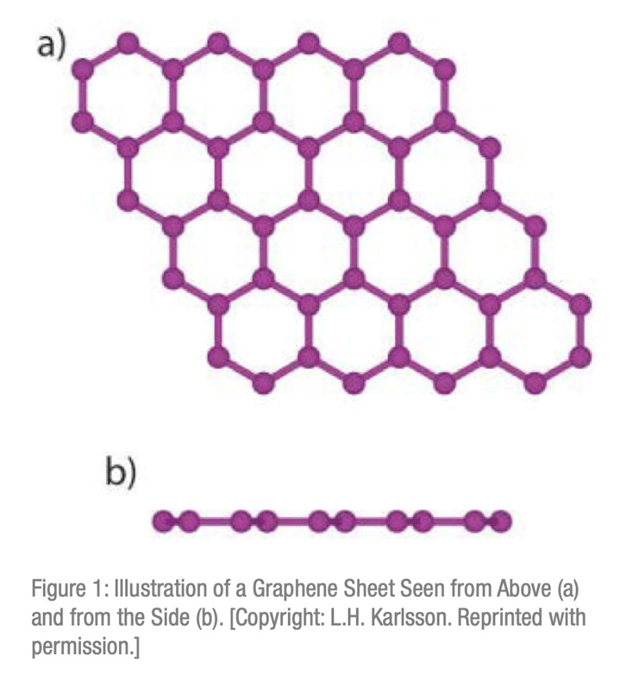

If you take a very close look at a graphite pencil lead, you will see layer upon layer of carbon atoms — multiple two-dimensional planes that are loosely bonded to their neighbors.

The reason graphite works so well as a writing material, and industrial lubricant, is because the layers of atoms slip easily over one another. Each of those single layer of atoms is graphene.

Source: NATO Science and Technology Organization

Graphene has unique combinations of optical, electrical and mechanical properties:

- Astonishing electrical conductivity – graphene has the highest current density (a million times that of copper) at room temperature; the highest intrinsic mobility (100 times more than in silicon); and can carry more electricity more efficient, faster and with more precision than any other material.

- Graphene also beats diamonds in thermal conductivity – it’s better than any other known material.

- It is the thinnest and strongest material known to man — 200 times stronger than steel, almost invisible and weightless, and stretches like rubber. Graphene can stretch up to 20% of its length, and yet it is the stiffest known material, even stiffer than diamonds.

- Graphene is the most impermeable material ever discovered; water molecules cannot penetrate it.

Graphite can be used to make graphene sheets that are said to be 100 times stronger and 10 times lighter than steel.

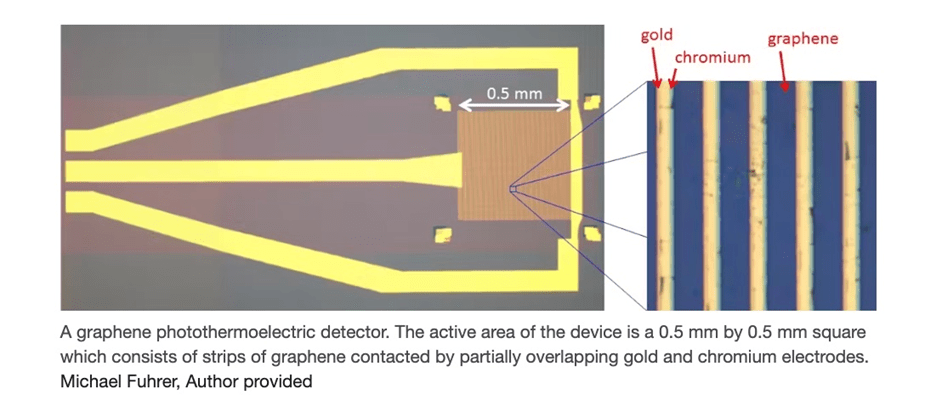

A future use of graphene is in building a detector of long wavelength light, which could improve night-vision goggles, chemical analysis tools and airport body scanners. Inventor and physicist Michael Fuhrer says the graphite detector is as sensitive as any existing detector, but far smaller and more than a million times faster.

Graphene truly is a wonder material.

Source: The Conversation

Hydrogen fuel cells

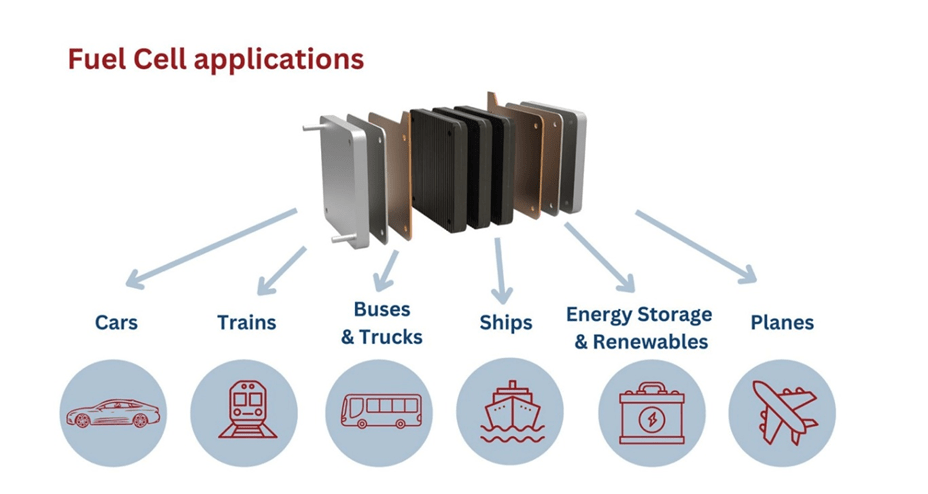

Another interesting yet under-reported usage of graphite is in hydrogen fuel cells. The latter are frequently used in fleet-type applications such as buses, which operate in a number of US states and the UK.

As the technology advances, however, car manufacturers are looking at it on a larger scale. That’s because vehicles powered by fuel cells can deliver electric power at ranges equivalent to internal combustion engines — a limitation of battery-powered EVs.

How is graphite used in fuel cells? According to Innovation News Network,

Graphite in fuel cells is used as a conductive material for the bipolar plates, which are an essential component of the fuel cell structure. Super thin graphite bipolar plates must be pure and of high quality to improve electrical and thermal conductivity, as well as ensure long-life operation.

The bipolar plates in proton-exchange membrane fuel cells, one of the most popular technologies, require large flake, high-purity graphite. Fine grained graphite is also used as additives and fillers, but this is a relatively small component of fuel cells.

Graphite is used also in GDL, where graphite is impacting the porosity of this layer.

Finally, high-purity graphite is used as catalyst substrate, enabling the precious catalyst metals to be in close contact with the reactant chemicals, while avoiding any contamination.

Source: Innovation News Network

Graphite market

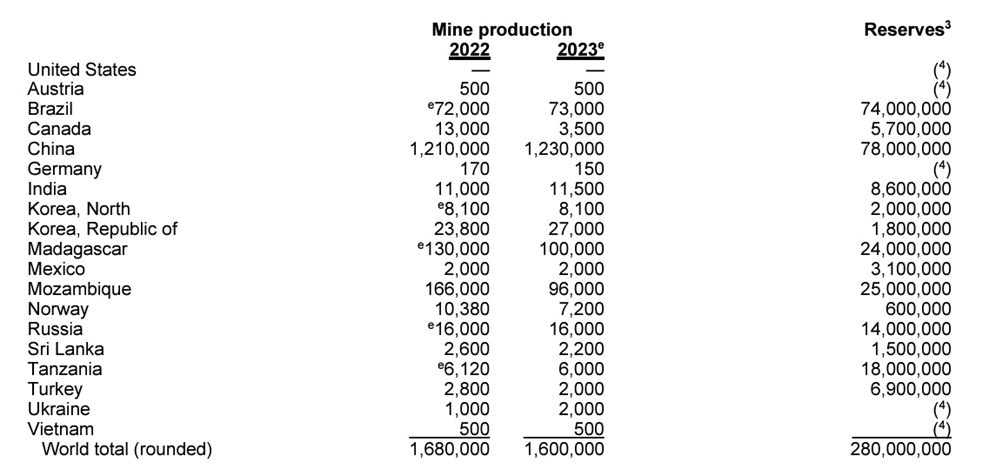

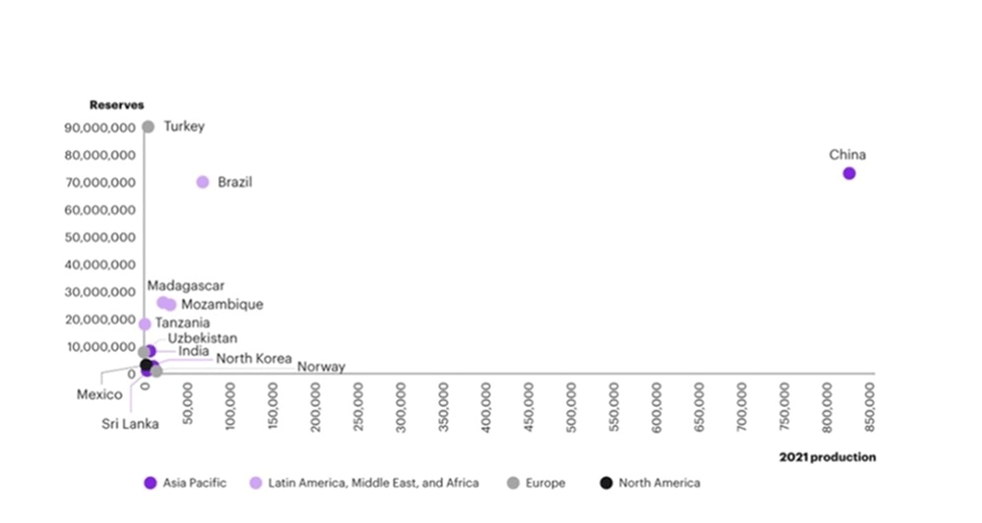

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

Source: USGS

Heavy reliance on Chinese graphite mine supply. Source: Kearney

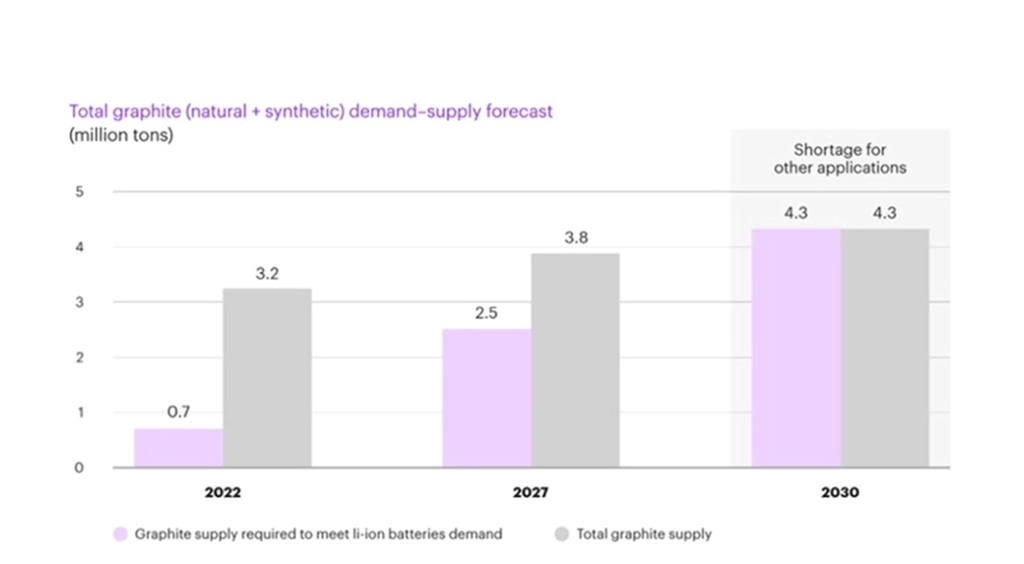

Deficits are expected to kick in by 2025 as new graphite mines fail to keep up with surging demand from automakers.

Some of the world’s largest auto and battery makers aren’t waiting until that happens. They, and the US government, are racing to secure graphite supplies ahead of a coming supply shortage.

Tesla and Panasonic are among the companies that have signed graphite off-take agreements. Syrah Resources, for example, has an off-take with Tesla to ship graphite from its mine in Mozambique to a processing facility in Louisiana.

According to the USGS, the battery end-use market for graphite has already leaped by 250% since 2018. It’s thought that battery demand could gobble up well over 1.6 million tonnes of natural flake graphite per year.

For context, 2023 mine supply was 1.6 million tonnes, which means we’re very close to entering, if not already, a period of deficits. Benchmark Mineral Intelligence projects natural graphite will have the largest supply shortfalls of all battery materials by 2030, with demand outstripping expected supplies by about 1.2 million tonnes.

According to a BMI analysis, graphite demand is likely to grow by a factor of eight by 2030 over 2020, and 25 times by 2040. That translates into a predicted supply shortfall of 30% for graphite, compared to 11% for lithium, 26% for nickel, and 6% for cobalt.

EV demand will absorb all graphite output at this rate. Source: Kearney

By then, the world’s graphite supplies will not even be able to cover demand for EVs, let alone all end-use sectors, BMI projections showed.

And this is just counting EV battery use; the mining industry still needs to supply other end-users. The automotive and steel industries remain the largest consumers of graphite today, with demand across both rising at 5% per annum.

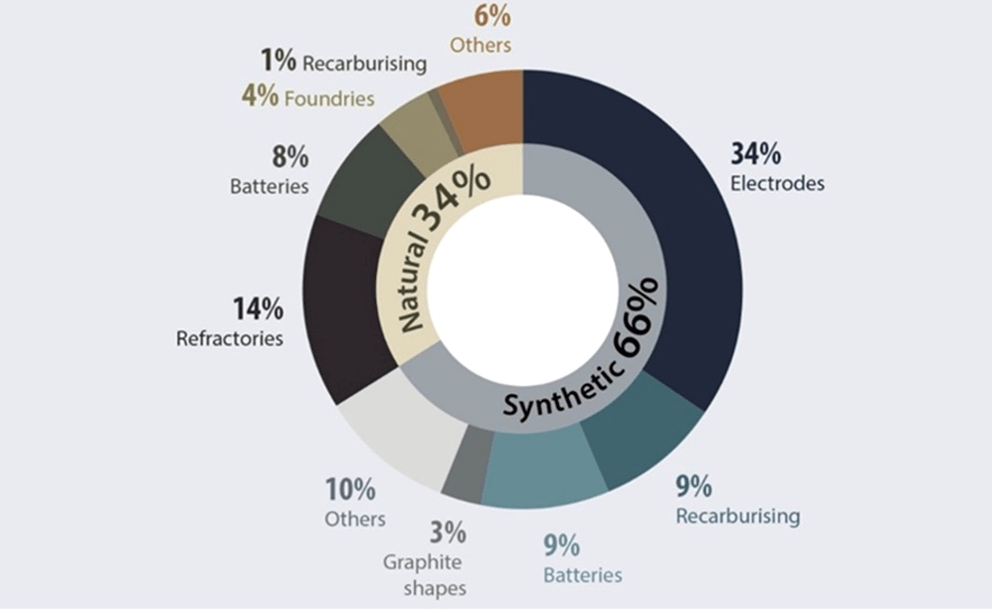

Graphite uses in 2021. Source: Natural Resources Canada

BMI has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand. That’s about eight new mines a year, which at first may seem doable but considering the number of graphite projects worldwide and the time it takes to develop them into mines, we’re really up against it.

Given that demand for graphite is accelerating at a rate never seen before, and the EV industry is gradually shifting towards natural graphite, the impending supply crunch could get serious.

Conclusion

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to economy and national security.

With the exception of Syrah Resources, which has a processing plant in the US not a mine, the United States currently imports 100% of its graphite. Another way of saying this is the US has zero production. With 70% of the world’s graphite supply coming from China, how will the United States compete in these new technologies that are shaping our world? Are we going to own what we need here or buy it from other countries? Current events are teaching us how dangerous it is to rely on foreign sources, in a world where adversaries can use access to materials as an economic weapon.

American manufacturing including equipping the US military with the most advanced weapons systems in the world is untenable without domestic production of graphite and other critical minerals. Take another look at the pictures above. Graphite is used in almost every component of the most advanced fighter planes, and in many tank parts. Graphite is used to make non-lethal bombs that disable electrical grids and as an obscurant smoke on the battle field. Synthetic graphite is employed directly in graphite nozzles, used in high-powered rockets.

If anyone needs a secure supply of graphite, it’s the U.S. Defense Department!

As much as the United States wants to keep pace with China in the global EV race, and militarily, it can’t do so without a reliable graphite supply. Remember, the US currently does not mine any graphite. It has to rely on imports.

In 2023 the US imported 84,000 tons of natural graphite, of which 89% was flake and high-purity. The top importers were China (42%), Mexico (16%), Canada (15%) and Madagascar (12%).

But taking into account the fact that EV batteries require run-of-mine graphite to go through purification and coating, a process controlled by China, the US is actually not 42% dependent on China for its battery-grade graphite, but 100%. This is a precarious position to be in, economically, strategically and militarily.

This is why graphite is firmly placed on the US government’s critical minerals list, and is identified as one of five key battery minerals that are at risk of supply disruptions.

The demand for graphite is only headed in one direction — up.

We have clearly reached a point when much more graphite needs to be discovered and mined.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE