Jordan Roy-Byrne – “Gold Stocks are Cheap and Hated”

This week, I published a video update evaluating whether gold stocks are cheap or undervalued. There is a difference. But I digress.

After publishing the video and reviewing the comments, my biggest takeaway was that gold stocks are hated.

After a nearly three-and-a-half-year-long bear market, one can imagine how investors and speculators feel about the sector. Here is a sample of the comments in response to my video.

It is safe to say that gold stocks are hated, and who can blame anyone for their disgust?

Precious metals have been in a bear market for 13 years, and mining margins have shrunk in recent years even as Gold has flirted with all-time highs.

The current level of hate coincides with historically low valuations.

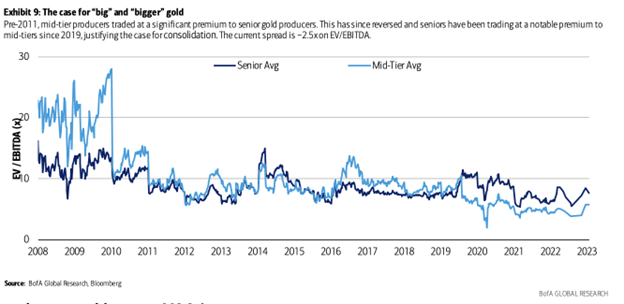

The chart below, constructed with data from Bank of America and Bloomberg, plots the Enterprise Value divided by EBITDA valuation for senior and mid-tier gold producers.

As of early 2023, senior producers were not far off from the valuation lows of 2013 (Gold crash) and 2015 (Gold price bottom). Mid-tier producers traded at a fraction of their 2016 and 2008-2009 valuation peaks.

Note, since the start of 2023, Gold has increased by $200/oz while GDX and GDXJ are lower. Valuations are likely lower than in this chart.

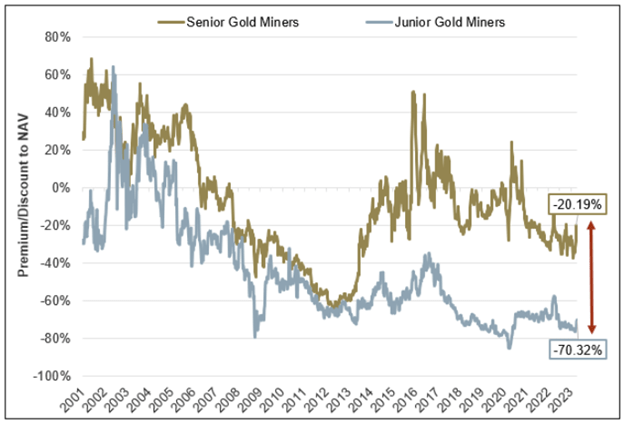

As of summer 2023, the junior gold stocks were trading at a deep discount to NAV, in line with the bottom levels in late 2008, 2013, and March 2020 (Covid crash).

The senior producers against NAV traded at nearly the largest discount in 10 years.

As the price of Gold and stock prices change, valuations fluctuate, but you can understand the point: the gold stocks are trading at near-record low valuations.

The combination of record-low valuations and investor disgust is a powerful rocket ship that will liftoff once the Gold price clears $2100/oz and begins a real bull market.

Valuations jump significantly following major lows. Note how much the valuations above moved after sector lows in 2008, 2015, and 2020.

Mining margins will expand with valuations after Gold clears $2100/oz.

But do not buy the entire sector.

The opportunity is finding inexpensive companies that can create value at current metals prices. Those companies can perform now and enjoy accelerated performance in a Gold bull market.

Meanwhile, one can wait on companies entirely dependent on metals prices. If metals prices don’t move for another 12 months, these cheap companies will continue to suffer.

I have turned my focus to finding high-quality gold and silver juniors that can perform in a static metals environment but have 500% to 1000% upside after the bull market begins. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE