CANTEX INTERSECTS AN OUTSTANDING 89.25 METRES OF MINERALIZATION AT ITS NORTH RACKLA DRILL PROJECT AND CLOSES FINAL TRANCHE OF PRIVATE PLACEMENT

Cantex Mine Development Corp. (TSX-V: CD), (OTCQB: CTXDF) is pleased to report that a 89.25 metre intersection of strong mineralization has been encountered at the Main Zone of the silver-lead-zinc-germanium Massive Sulphide project. The Company also is closing a final tranche of its financing.

Main Zone Drilling

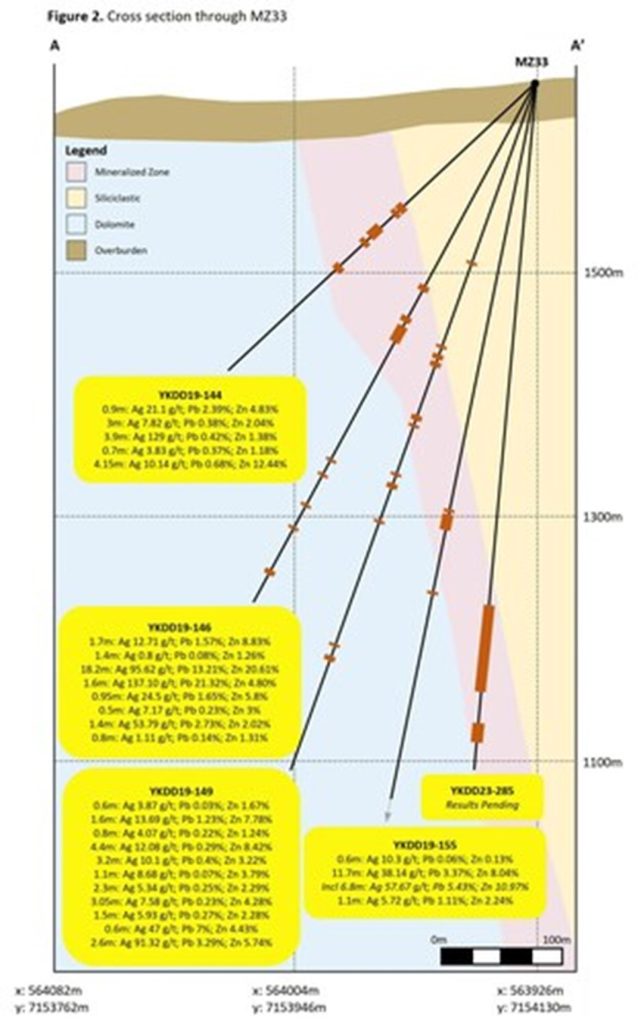

Hole YKDD23-285 was the final hole from the fall 2023 drill program. This hole contained an exceptional intercept from 416.75 to 506 metres depth drilled from pad MZ33 at a -85-degree dip and 166 degree azimuth (see Figures 1 and 2 for a map and cross section respectively)

Split core from this hole has been submitted to the CF Mineral Research, an ISO/IEC 17025:2005 accredited laboratory for preparation prior to being sent to ALS Chemex Laboratories in North Vancouver for analysis for silver-lead-zinc. Polished sections will be submitted to the University of British Columbia Okanagan for germanium analysis. All of the foregoing results as well as germanium results from samples already submitted will be reported when received.

Financings Complete

The Company announces that, further to its news release of September 20, 2023 and October 19, 2023 announcing a private placement (the “Offering”), the Company has closed the final tranche of the Offering (“the Final Tranche”) and has received $2,902,120 by the issuance of 6,833,734 flow through units and 3,276,923 non flow-through units. FT Units were issued at $0.30 per FT Unit and Units were issued at $0.26 per Unit; each FT Unit is comprised of a flow through share and one-half of a non-flow through warrant and each Unit is comprised of one non-flow through share and one-half of a warrant. Each whole warrant entitles the holder to acquire one common share of the Company at a price of $0.39 for a term of two years from closing.

Included in the Final Tranche is an investment by Crescat Capital LLP our previously announced strategic partner. Crescat purchased 1,923,077 Units for total proceeds of $500,000, bringing their total holdings to over 3.2 million shares.

Combined with the first tranche, the Offering has resulted in gross proceeds of $3,823,485 from the issuance of 8,258,284 FT Units and 5,176,923 Units.

Proceeds from the Final Tranche will be used to fund the Company’s North Rackla Project in the Yukon and for general working capital.

The Company was charged $178,500 in finders fees in connection with the Final Tranche; of this, $24,500 was paid in cash, with the remaining $154,000 in fees settled with the issuance of 592,308 Units at a deemed price of $0.26/Unit. The Units issued as settlement of the fees are comprised of 592,308 non-flow through shares and 296,154 warrants; the warrants are exercisable for a period of two years from issuance and have an exercise price of $0.39. The Company also issued 674,006 finders warrants, which have the same terms and conditions as the warrants issued in the Offering.

The securities issued in the Final Tranche are subject to a four month hold period, expiring on March 17, 2024.

Katherine MacDonald, a Director of the Company, subscribed for 200,000 Units for a total subscription price of $52,000. Ms. MacDonald acquired the Units for investment purposes. The Offering and the acceptance of the subscription by Ms. MacDonald was approved by unanimous resolution of the board of directors of the Company with Ms. MacDonald declaring her interest in the resolution and abstaining from voting. There was no formal valuation of the Company done in connection with the Offering nor has there been such a formal valuation in the past 24 months. The Company relied upon the exemptions contained in Section 5.5(b) and 5.7(b), of Multilateral Instrument 61-101 to avoid the formal valuation and shareholder approval requirements of MI 61-101. For the purposes of Section 5.5(b), the Company does not have any securities listed on any of the stock exchanges set out in Section 5.5(b) and for the purposes of Section 5.7(b) the exemption was available as the consideration paid for the Units subscribed for by Ms. MacDonald was less than $2,500,000.

The Company would also like to clarify that the Spring 2023 financing, which was originally announced on April 17, 2023, closed with only one tranche. This tranche closed on April 28, 2023, with the Company receiving gross proceeds of $1,268,500 by the issuance of 1,601,351 flow through units (issued at $0.37/flow through unit) and 2,112,500 non flow-through units (issued at $0.32/unit), with both flow through units and non-flow through units including one half of a warrant. Each whole warrants entitles the holder to acquire one common share of the Company at a price of $0.45 for a term of two years from closing. Please refer to our news release dated April 28, 2023 for further information.

About Cantex Mine Development Corp.

Cantex is focused on its 100-per-cent-owned, 20,000-hectare North Rackla project located 150 kilometres northeast of the town of Mayo in Yukon, Canada, where significant massive sulphide mineralization has been discovered. Over 60,000 metres of drilling has defined high-grade silver-lead-zinc-germanium mineralization over 2.3 kilometres of strike length and more than 700 metres depth. The mineralization remains open along strike and to depth. The company is led by Dr. Fipke CM, the founder of Ekati, Canada’s first diamond mine.

Cantex is pleased to report this outstanding intercept and look forward to the forthcoming drill and germanium results.

Figure 1 (CNW Group/Cantex Mine Development Corp.)

Figure 2 (CNW Group/Cantex Mine Development Corp.)

MORE or "UNCATEGORIZED"

Helius Minerals Announces Closing of C$40 Million Private Placement

Helius Minerals Limited (TSX-V: HHH) is pleased to announce the... READ MORE

Aldebaran Announces Closing of $40 Million Bought Deal Offering

Aldebaran Resources Inc. (TSX-V: ALDE) (OTCQX: ADBRF) is please... READ MORE

Erdene Announces Closing of $25 Million Bought Deal Private Placement

Erdene Resource Development Corp. (TSX:ERD) (MSE:ERDN) (OTCQX: ER... READ MORE

NOVAGOLD Announces Closing of Upsized Bought Deal for Gross Proceeds of US$310 Million

NOVAGOLD RESOURCES INC. (NYSE: NG) (TSX: NG) is pleased to report... READ MORE

Guanajuato Silver Sees Significant Growth in Resources at Valenciana

~ Inferred Mineral Resources Increased by 630% to 20.3M AgEq Ounc... READ MORE