Jordan Roy-Byrne – “Gold is the Next 13-Year Breakout”

Since its peak in August 2020, Gold has moved towards a breakout on multiple occasions but failed in every case.

Nevertheless, as of Thursday, November 16, Gold is within 4% of a daily all-time high and 2% of a weekly all-time high. It appears only weeks, if not months, from a historic breakout.

For months and months, I have explained the significance of the coming breakout in Gold.

Another interesting factor is that a gold breakout in 2024 would mark a breakout from a 13-year base, and the most significant historical breakouts have occurred from 13-year bases.

Let me explain.

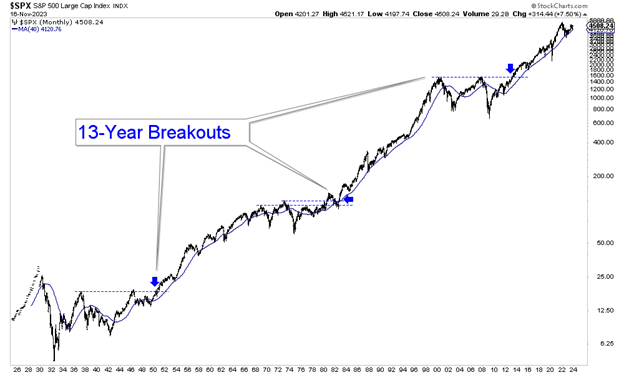

The three most significant breakouts in the stock market, occurring in 1950, 1982, and 2013, were from 13-year bases. Two breakouts were clean, while the stock market pulled away from the 1968 to 1982 bear market after 13 years.

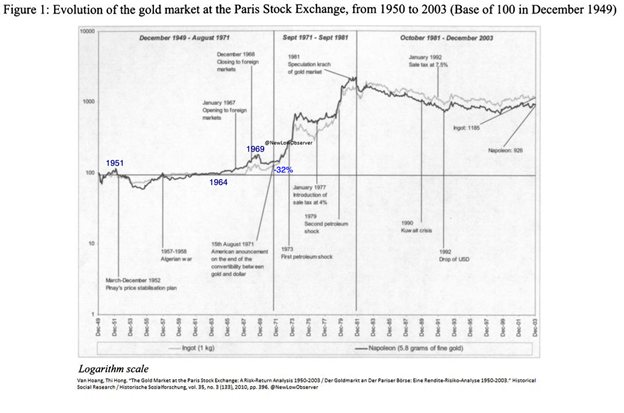

The Gold price was fixed until 1971, but there is Gold price data from the Paris Stock Exchange. See the chart below courtesy of @newlowobserver.

Gold’s breakout move in Paris began in 1964, 13 years after the peak (and commodity peak in 1961). Note, the best proxy for Gold in the US, gold stocks made a multi-decade breakout in 1964.

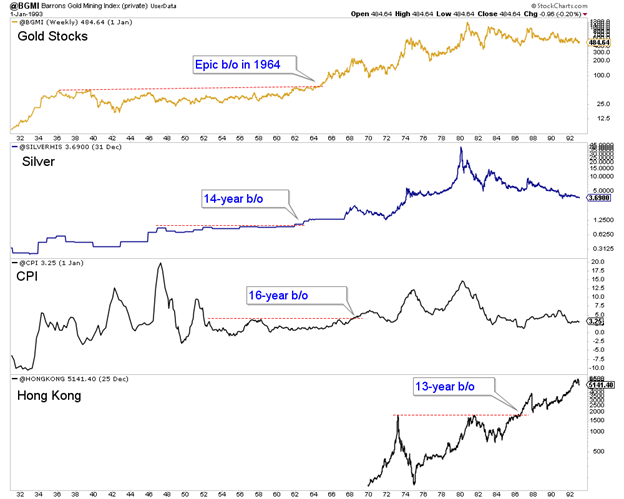

We plot other markets and data series below.

Silver broke out from a 14-year consolidation in 1961, while the inflation rate made a 16-year high in 1968. The Hang Seng, one of the largest stock markets in the world, broke out from a 13-year base in the mid-1980s.

Note that this analysis is more subjective than objective. Gold does not have to break out in the next 12 months solely because of the history of 13-year breakouts. But Gold is within striking distance, and history shows how common these 13-year breakouts are.

Gold is very close to triggering a new bull market just as sentiment towards the sector and mining companies is in the toilet. Meanwhile, fund redemptions and tax loss selling are driving these stocks lower even as a new bull market awaits.

That is creating some incredible buying opportunities.

I continue to focus on finding high-quality gold and silver juniors with 500% to 1000% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE