Jordan Roy-Byrne – “Key Levels in Gold into November”

Gold touched $2000/oz resistance last Friday but has so far held most of its gains in a bullish fashion. It closed Wednesday at $1995/oz.

Next Tuesday marks the monthly close.

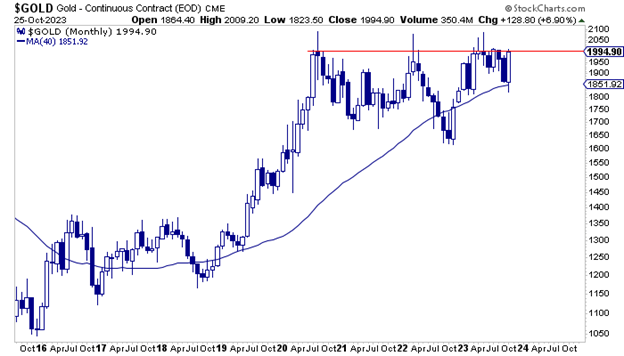

The monthly candle chart of Gold is below, with the resistance line at $2000. Gold has tested $2000/oz in seven of the past eight months.

After many tests of resistance, we need a convincing monthly close to qualify as a breakout. Think of $2020/oz at a minimum.

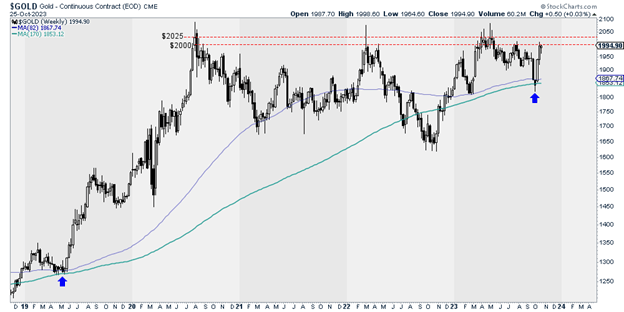

The $2000 level is also important resistance on the weekly chart.

Below, we plot the weekly candle chart with the equivalent to the 20-month and 40-month moving averages.

Weekly resistance is at $2000 and $2025 to $2030. The weekly high in 2020 was $2028; this past spring, Gold tested $2025 in six out of seven weeks.

Turning to potential support levels, Gold should find initial support at $1960 or $1940 should it lose more short-term momentum.

Gold has often tested its 150-day moving average a few months before major breakouts.

One possibility is Gold trades up to $2030-$2050 before correcting to the 150-day moving average, currently at $1962 and sloping higher.

Gold’s strength in recent days leads me to think it has a chance to test $2030-$2050 before a retracement. If that comes to pass, look for support at the 150-day moving average.

On the other hand, if $2000 resistance holds firm in November, then look for a test of $1940 and perhaps $1920.

Gold rallying back to $2000 so quickly is a positive sign for an eventual breakout. The miners, juniors, and Silver space need Gold to surpass $2100 before they can outperform.

Until then, I will focus on finding high-quality gold and silver juniors with 500% to 1000% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE