Lithium Ionic Announces PEA and Expanded Mineral Resource Estimate for Bandeira; Post-tax NPV8% US$1.6 Billion & IRR of 121%

Lithium Ionic Corp. (TSX-V: LTH) (OTCQX: LTHCF) ( FSE: H3N) is pleased to report the results of the Preliminary Economic Assessment and the updated Mineral Resource Estimate for its wholly owned Bandeira project located in Minas Gerais, Brazil.

The PEA was completed by independent Brazilian consultancy, GE21 Consultoria Mineral Ltda, with support of SNC Lavalin, and indicates that Bandeira has the potential to be a viable and highly economic mining project and a substantial and long-life producer of low-cost spodumene concentrate.

Bandeira PEA – Production & Economic Highlights ($USD unless otherwise stated):

- Post-tax Net Present Value8% of $1.6 billion (approximately C$2.2 billion)

- Post-tax Internal Rate of Return of 121%

- Underground mine scenario processing 1.3Mtpa of ore over a 20-year mine life

- After-tax payback of 14 months

- Avg. LOM annual production of 217,700t of high-quality spodumene concentrate at 5.5% Li2O (“SC5.5”) equivalent (187,230 tpa SC5.5, in addition to 56,860 tpa of spodumene tails concentrate at 3% Li2O, or “SC3”)

- Total capital expenditure of $233 million (including a 25% contingency)

- Pre-tax annual average free cash flow of $243 million

- All-in LOM operating costs of $349/t of spodumene concentrate SC5.5

Bandeira Updated MRE Highlights:

- Measured & Indicated: 13.72Mt at 1.40% Li20 (474,892t LCE) representing a 196% increase in tonnes compared to the June 2023 MRE for Bandeira of 4.63Mt at 1.35% Li20 (154,198t LCE)

- Inferred: 15.79Mt at 1.34% Li20 (523,118t LCE)

Commenting on the PEA, Blake Hylands, P.Geo, CEO of Lithium Ionic, “We congratulate our team on advancing the Project to this stage in a short time span. As a Company, we are focused on being the next significant Brazilian lithium producer and this is reflected in the approach we have taken. Commencing with a highly attractive underground project will result in significantly less surface disturbance and the experience of CBL on the adjacent mine site provides a proven production model for developing the mining operation. The Company has a highly experienced team in Brazil that has taken numerous projects through the permitting and development process and as such the Project is well advanced in this regard. We believe the deliverables in this PEA are achievable.”

Blake Hylands, P.Geo., continued, “The robust results of our PEA marks a major de-risking milestone towards our goal of becoming a near-term supplier of high-quality spodumene concentrate to the global lithium and electric vehicle supply chains. The Bandeira deposit has demonstrated its technical simplicity and remarkable economic viability, placing it among the lowest-cost spodumene concentrate producers globally. Furthermore, this PEA showcases an impressive 20-year mine life from just one of our deposits. The Bandeira project will serve as a solid foundation for further growth as we continue to expand both the mineral resources and potential production scale through ongoing drilling and exploration in the region. We are rapidly advancing Bandeira through the next phases of development, with a Definitive Feasibility and Environmental Impact Assessment expected by the end of 2023, paving the way for the initiation of the environmental permitting process. As a proposed underground operation, Bandeira benefits from a minimal environmental footprint and an expected accelerated permitting timeline.”

Helio Diniz, President of Lithium Ionic, stated, “We believe that the best approach for all of our stakeholders is to develop a significant producing operation in the shortest possible time frame. We will continue to expand the resources and develop our other targets, which will represent future expansions to support what we believe will be a multi-generational production center.”

Bandeira Project PEA Overview

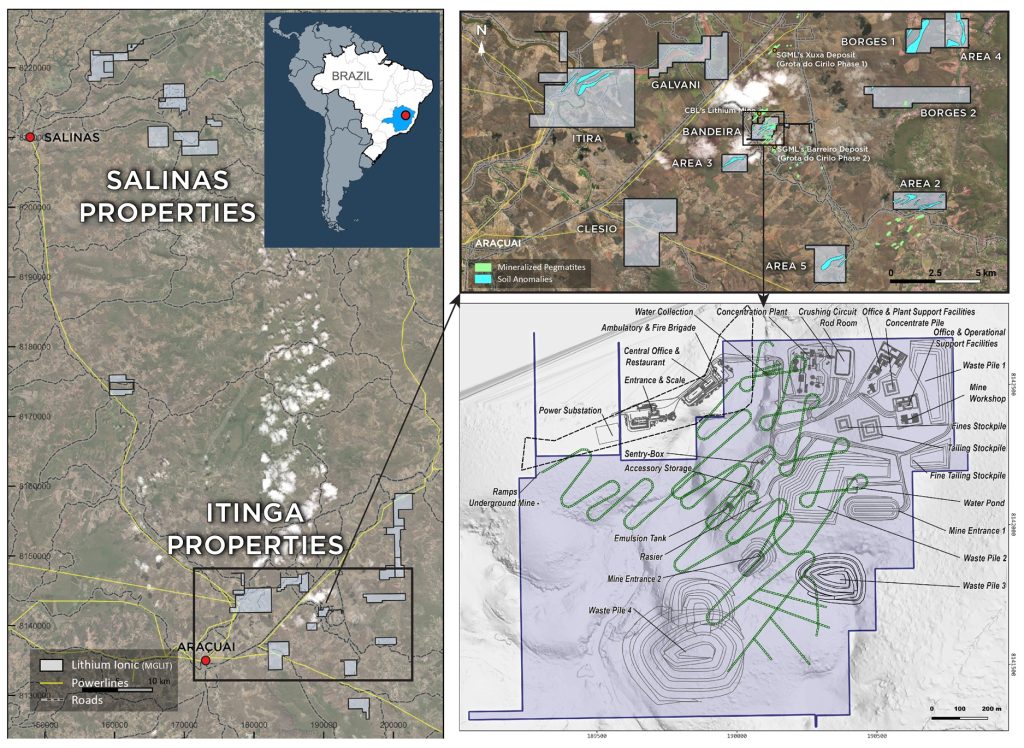

The Bandeira Project covers 175 hectares within Lithium Ionic’s large land package of 14,182 hectares and is located between the towns of Araçuaí and Itinga within Brazil’s “Lithium Valley” – a hard rock lithium district that is quickly emerging as an important global lithium producer (see Figure 1).

Table 1. Bandeira Project PEA Highlights ($USD unless otherwise stated)

| Project Economics | ||

| Post – Tax NPV8 | $1.6 billion | |

| Post – Tax IRR | 121% | |

| Pre – Tax NPV8 | $2.3 billion | |

| Pre – Tax IRR | 163% | |

| Annual Revenue – Average | $337 million | |

| Annual Free Cash Flow | $243 million | |

| Payback | 14 months | |

| Economic Assumptions & Parameters | ||

| SPO 5.5% Li2O Price, CIF China | $1,859/t | |

| SPO 3.0% Li2O Price, CIF China | $865/t | |

| Exchange rate | US$5.00 /R$ | |

| Discount Rate | 8% | |

| Production Profile | ||

| Total Project Life (LOM) | 20 years | |

| Total LOM production (ore mined) | 22.9 Mt | |

| Nominal Plant Capacity | 1.3 Mtpa | |

| Average plant throughput | 1.26 Mtpa | |

| Run-of-Mine grade, Li2O (ore diluted) | 1.23% | |

| Run-of-Mine underground mine dilution | 16.8% | |

| Waste generation Average | 439 ktpa | |

| SPO Annual Production @ 5,5% Li2O | 187 ktpa | |

| SPO Annual Production @ 3,0% Li2O | 56 ktpa | |

| SPO Annual Production @ 5.5% Li2O Equivalent | 218 ktpa | |

| SPO 5,5% Li2O metallurgical recovery | 67.0% | |

| SPO 3,0% Li2O metallurgical recovery | 10.7% | |

| SPO 5,5% Li2O mass recovery | 15.2% | |

| SPO 3,0% Li2O mass recovery | 4.5% | |

| Project Capital Costs | ||

| Mine (Development + Equipment’s + Pre-Production) | $72.5 million | |

| Plant | $80.5 million | |

| Environmental | $2.9 million | |

| Engineering Services | $20.0 million | |

| General Infrastructure & Others | $10.3 million | |

| Contingency (25%) | $46.6 million | |

| Total Capital Cost Estimate | $232.8 million | |

| SUDENE Incentive tax benefit over first 10 years | 75% | |

| Operating Costs (OPEX) | ||

| Operating costs (based on ore processed) | $61/t ore | |

| Mining | $45/ t ore | |

| Processing + Tailings handling | $12/ t ore | |

| SG&A | $4/t ore | |

| Operating costs (based on SPO 5.5 concentrate produced) | $349/t SPO 5.5E | |

| Mining | $258/t SPO 5.5E | |

| Processing + Tailings handling | $68/t SPO 5.5E | |

| SG&A | $23/t SPO 5.5E | |

| Transportation costs to customer destination (Mine in Itinga – Araçuaí to Shanghai Port, China) |

$120/t SPO | |

Figure 1. Bandeira Project Location

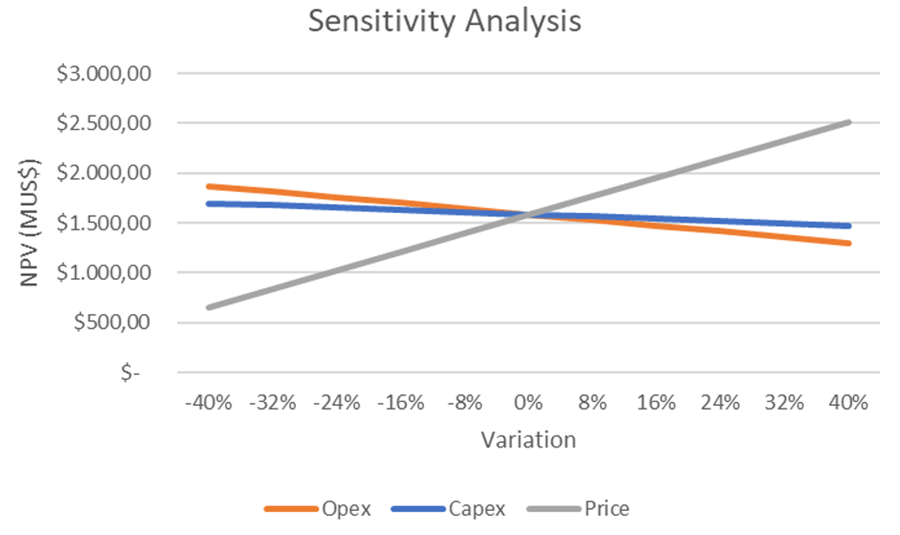

Figure 2. Post-Tax NPV8% Price Sensitivity Analysis

Mining

The Bandeira project engineering design contemplates dual underground mining operations. The primary orebodies, accounting for approximately 90% of the deposit, are proposed to be extracted using a bottom-up “sublevel stoping” method (Bandeira Sublevel Mine, “BSL mine”). Simultaneously, the secondary southeast orebody, comprising approximately 1.5 million tonnes, is expected to be mined using “room-and-pillar” technique (Bandeira Room and Pillar, “BRP mine”).

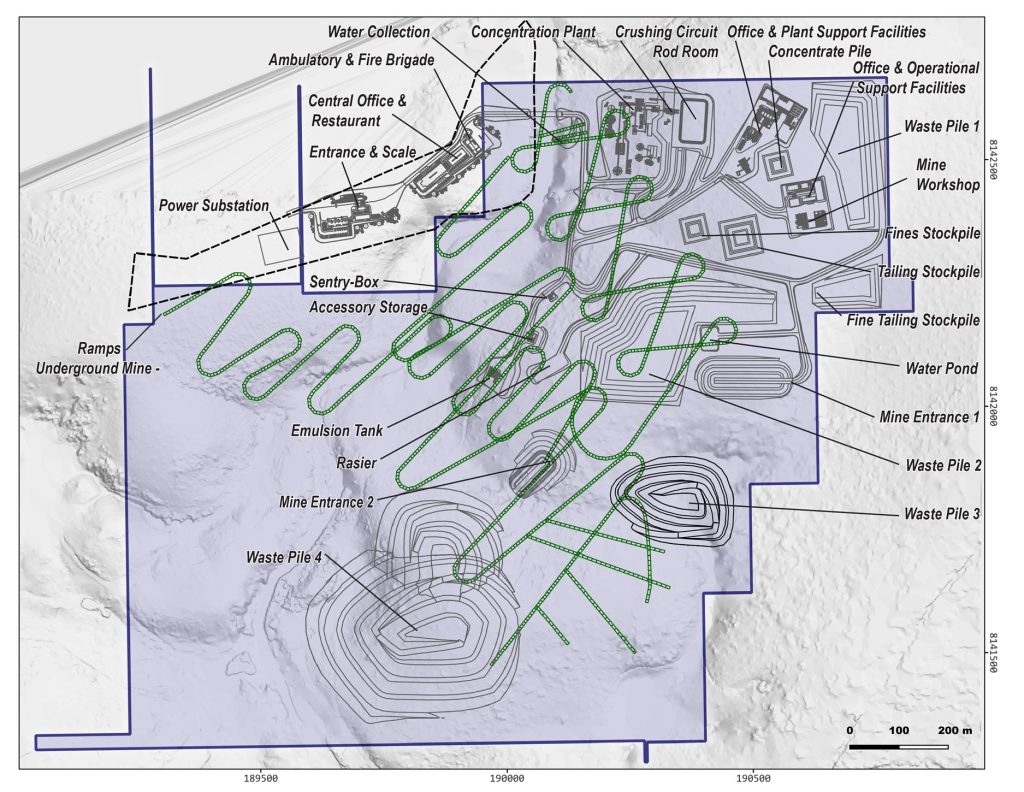

The BSL mine has been planned with two declines, extending along a NE/SW mineralized trend spanning 1.0 km. It is divided into 12 panels, each measuring 55 meters, and consists of two sublevels (see Figure 3).

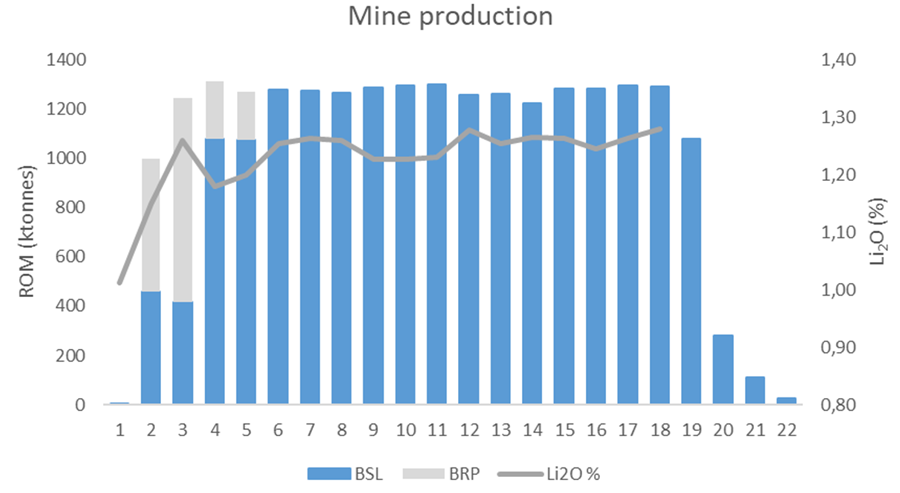

The BRP mine features a single panel with approximate dimensions of 380 meters in length, 330 meters in width, and 10 meters in height. Access to the ore chamber will be provided through five crosscuts originating from the southern decline. Once fully operational, the BSL and BRP mines are expected to achieve a combined production of approximately 1.3 million tonnes per annum. Figure 4 shows the annual plant feed along with Li2O grade.

Figure 3. Proposed Project Layout and Infrastructure

Figure 4. PEA Mine Plan and Schedule with Li2O, %

Mineral Processing

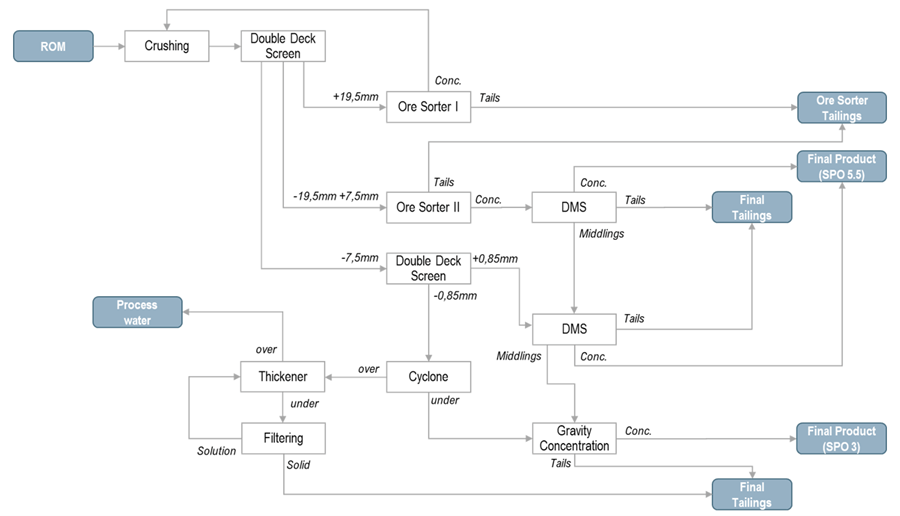

The mineral processing flowsheet is structured around a two-stage crushing circuit (comprising a Jaw crusher and Gyratory Cone crusher), ore size classification, the implementation of an ore sorter for coarse and medium materials, and the utilization of DMS (Dense Media Separation) for coarse and medium materials. Additionally, fines are subjected to gravity concentration with spirals. For a visual representation of the process, please refer to Figure 5, while Table 1 provides the specific design criteria for mineral processing.

The underground mine is anticipated to yield ore with an average Li2O grade of 1.23% over the Life of Mine, accounting for dilution at 16.8%. The ore sorting process will effectively purify the ore by removing undesirable dilution and non-lithium-bearing minerals like albite, feldspar, and quartz. This enrichment process will improve the lithium oxide grade to approximately 1.50%, ensuring a higher feed for the DMS I and II units. Based on the preliminary testwork program, Li2O recovery is projected to reach 67%, with an additional 10.7% achieved through gravity concentration in the fines fraction.

Figure 5. Block diagram for the Bandeira Process Flowsheet

Updated Mineral Resource Estimate for Bandeira

The PEA is based on an updated MRE for the Bandeira project summarized in Table 2. The Bandeira MRE contains Measured and Indicated (“M&I”) resources of 13.72Mt grading 1.40% Li2O, containing 474,892 tonnes of Lithium Carbonate Equivalent (“LCE”), the benchmark equivalent raw material used in the lithium industry, in addition to Inferred resources of 15.79Mt grading 1.34% Li2O, or 523,118 tonnes of LCE.

The updated MRE for Bandeira is based on 204 diamond drill holes conducted on the Bandeira property until August 30, 2023. This compares to drill data from 120 holes in the previous MRE for Bandeira announced on June 27, 2023. This additional drilling significantly expanded the MRE, with the tonnes in the Indicated category increasing by 196% compared to the previous estimate.

Table 2. Bandeira Mineral Resource Estimates (base case cut-off grade of 0.5 % Li2O)

| Category | Resource (tonnes) | Grade (% Li2O) |

Contained LCE (t) |

| Measured | 2,000,000 | 1.40 | 69,226 |

| Indicated | 11,720,000 | 1.40 | 405,666 |

| Measured + Indicated | 13,720,000 | 1.40 | 474,892 |

| Inferred | 15,790,000 | 1.34 | 523,118 |

Notes related to the Mineral Resource Estimate:

- The spodumene pegmatite domains were modeled using composites with Li2O grades greater than 0.3%

- The mineral resource estimates were prepared in accordance with the CIM Standards, and the CIM Guidelines, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

- Mineral Resources are not ore reserves and are not demonstrably economically recoverable.

- Grades reported using dry density.

- The effective date of the MRE was October 11, 2023.

- The MRE numbers provided have been rounded to the estimate relative precision. Values cannot be added due to rounding.

- The MRE is delimited by Lithium Ionic Bandeira Target Claims (ANM).

- The MRE was estimated using ordinary kriging in 12m x 12m x 4m blocks.

- The MRE report table was produced in Leapfrog Geo software.

- The reported MRE only contains fresh rock domains.

- The MRE was restricted by grade shell using 0.5% Li2O cut-off.

The complete NI 43-101 technical report associated with the PEA and updated MRE will be available on SEDAR+ at www.sedarplus.ca under the Company’s issuer profile, as well as the Company’s website at www.lithiumionic.com within 45 calendar days.

The Preliminary Economic Assessment is considered preliminary in nature and includes Inferred Mineral Resources that are considered too speculative, geologically, to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the PEA will be realized. The PEA is based on the material assumptions outlined in this document. These include assumptions about the availability of funding. While the Company considers all of the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct or that the range of outcomes indicated by the PEA can be achieved.

No mineral reserves have been estimated for the Project. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

About Lithium Ionic Corp.

Lithium Ionic is a Canadian mining company exploring and developing its lithium properties in Brazil. Its flagship Itinga and Salinas projects cover 14,182 hectares in the northeastern part of Minas Gerais state, a mining-friendly jurisdiction that is quickly emerging as a world-class hard-rock lithium district. The Itinga Project is situated in the same region as CBL’s Cachoeira lithium mine, which has produced lithium for +30 years, as well as Sigma Lithium Corp.’s Grota do Cirilo project, which hosts the largest hard-rock lithium deposit in the Americas.

Qualified Persons

The Technical information in this news release has been reviewed and approved by Independent Qualified Persons as defined in NI 43-101, Carlos José Evangelista Silva (MAIG Membership Number 7868) for the MRE, and Guilherme Gomides Ferreira (MAIG Membership Number: 7586) for the PEA, both from GE21.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE