Peter Krauth – “Approaching Peak Silver?”

As we reach September and summer winds down, the markets tread sideways. They seem to be waiting for a signal of direction from the Fed. Today I want to look at market expectations.

The most recent such sign was from Fed Chair Powell when he spoke at the annual symposium in Jackson Hole, Wyoming. Powell leaned hawkish on monetary policy, suggesting that their fight against inflation was not over. He explained that the Fed has a fair ways to go to tame inflation to the levels it is targeting, and that the Fed was prepared to raise rates.

That shouldn’t be a surprise. The Fed’s favourite inflation gauge is the Core PCE (Personal Consumption Expenditures) index since it leaves out “volatile” food and energy. Well, that was released late last week, and July’s reading was 4.2% year-on-year. That follows the June print at 4.1%; not going in the Fed’s desired direction.

While it’s only a very slight increase, it’s still more than double the Fed’s stated 2% goal, after the most aggressive rate hiking cycle in decades.

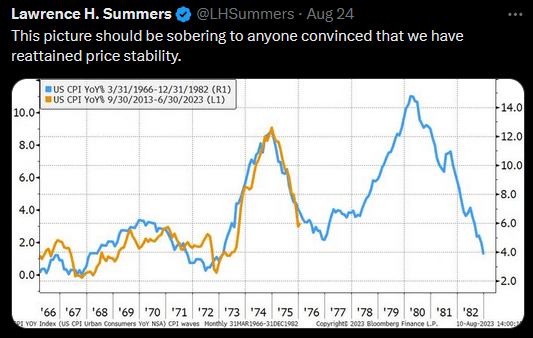

Even if inflation does retreat somewhat further, it’s unlikely to remain tame for any kind an extended period. Have a look at this char from Larry Summers, the former US Treasury Secretary, comparing our current wave to the 1970s. And note his comment above the chart.

As you can see, the current inflation reprieve, if you can call it that, may not last too long. And a next wave could well be worse than the last.

Meanwhile, the Fed continues to walk a proverbial tightrope.

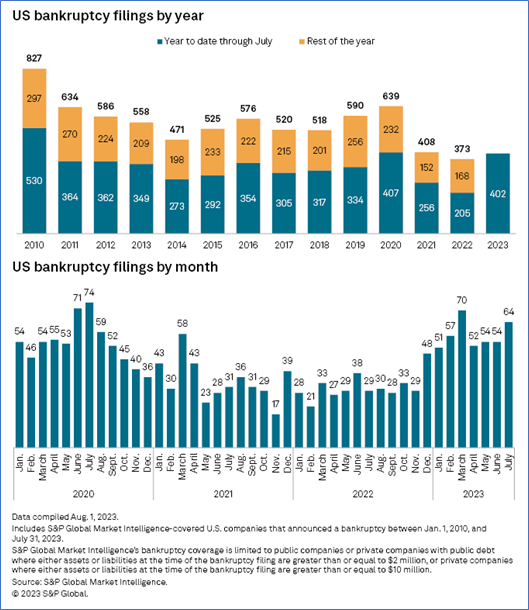

Thanks to the inevitable time lag, it’s likely we haven’t seen the full effect yet of their dramatic rate hikes. I think the odds of recession remain high. And there could still be some serious challenges ahead. According to S&P Global, U.S. bankruptcy filings are historically high.

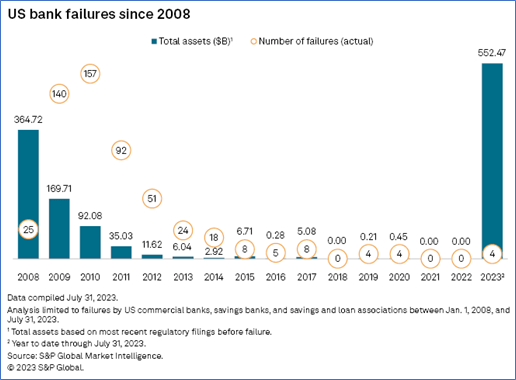

July registered 64 filings, the most since March and beyond any single month in the two past years. In fact, the total through July already surpasses all of 2022! Clearly, this high interest rate environment is wreaking havoc. Last month Tri-State Bank failed, pushing the U.S. total to $552.47 billion for 2023, easily surpassing the 2008 full year total of $364.72 billion.

I can’t help but think that we haven’t seen the last of these, and that banks and businesses will struggle for some time to come as interest rates remain elevated. Actually, S&P Global ratings downgraded five U.S. banks by one notch, while cutting its outlook for two others.

So how have gold and silver been acting recently, especially in the wake of Powell’s Jackson Hole comments and the latest inflation numbers? Not too badly, it seems.

In fact, silver bottomed before gold, and is up about 8.8% since mid-August, while gold is up about 2.6%. My sense is that silver may already be starting to look past a recession, and is gearing up for eventual Fed easing. Saxo Bank called their outlook for 2024 “stagflation light”, with sluggish growth coupled with persistent inflation. I concur. And in that environment, they see gold and silver as gaining an edge amongst commodities.

Where does that leave us? Silver producers seem to have some torque when the silver price moves. Besides that, I think opportunity lies mostly with significant discoveries, which I think the market is prepared to reward.

So I’m going to round out my four part series on financings with the final instalment, Part 4. My goal is to summarize financings and provide a “sneak peek” at what my new service, Silver Premium, will offer.

Financings Part 4: Silver Premium, My Next Project

There are plenty of reasons why you should understand financings, even if you don’t invest in them. They can, and often do, have an impact on your existing investment. Most of the companies that I invest in, and write about, access funding on a somewhat regular basis – it just comes with the territory.

In Part 3: How to Participate (bankers and brokers), I detailed how you can get into financings, and showed you the easiest way to subscribe.

In this fourth and final article I will summarize financings and explain how my new service, Silver Premium, will work and why it may make sense for you.

- If you are accredited, you can participate in any financing.

- If you are not accredited, you can participate in:

- Financings where the company has included the Suitability Advice exemption (you need a broker at an IIROC bank to support your suitability)

- Financings for companies where you are already a shareholder and the company includes the Existing Shareholder exemption

- Financings under the Listed Issuer Financing Exemption (LIFE); requires no minimum investment and no four-month hold period

- Prospectus offerings

- Direct Listing IPOs

- Prospectus offerings and direct listing IPOS are great because they do not include 4-month holds, allow anyone to participate, and involve almost no paperwork. Unfortunately, they are a lot more work and cost for the company so they are not common.

- To physically participate in financings:

- If you have a broker at a dedicated investment bank: you submit signed paperwork to your broker and ensure there is cash in your account. They deal with everything else

- If you trade through the online platform at a big bank and it’s a direct listing IPO or a prospectus offering: you call your bank and ask a broker to contact the investment bank that is running the financing. That investment bank can facilitate the transaction as long as your bank is amenable to the idea (not all are)

- If you trade through the online platform at a big bank and it’s a normal financing: you submit your forms to your bank and hope they approve the investment and do so in time, in which case the bank moves the money and accepts the shares into your account, or you submit forms and wire money directly to the company, in which case you receive physical share certificates that you have to deposit into your account

- It’s all about the warrants

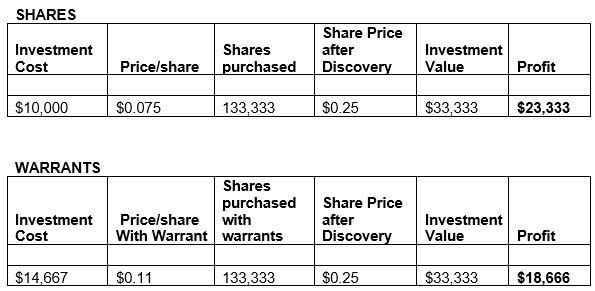

- Warrants can provide tremendous benefits you only get by participating in financings

- When included, it’s usually a half or a full warrant with each subscribed share

Each full warrant can be converted into a share at a set price for a set period of time.

|

|

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE