Lithium Ionic drills 1.63% Li2O over 11.2m, 1.39% Li2O over 11.9m and 1.57% Li2O over 8.9m at Bandeira and reports further results from the Salinas exploration program, Minas Gerais, Brazil

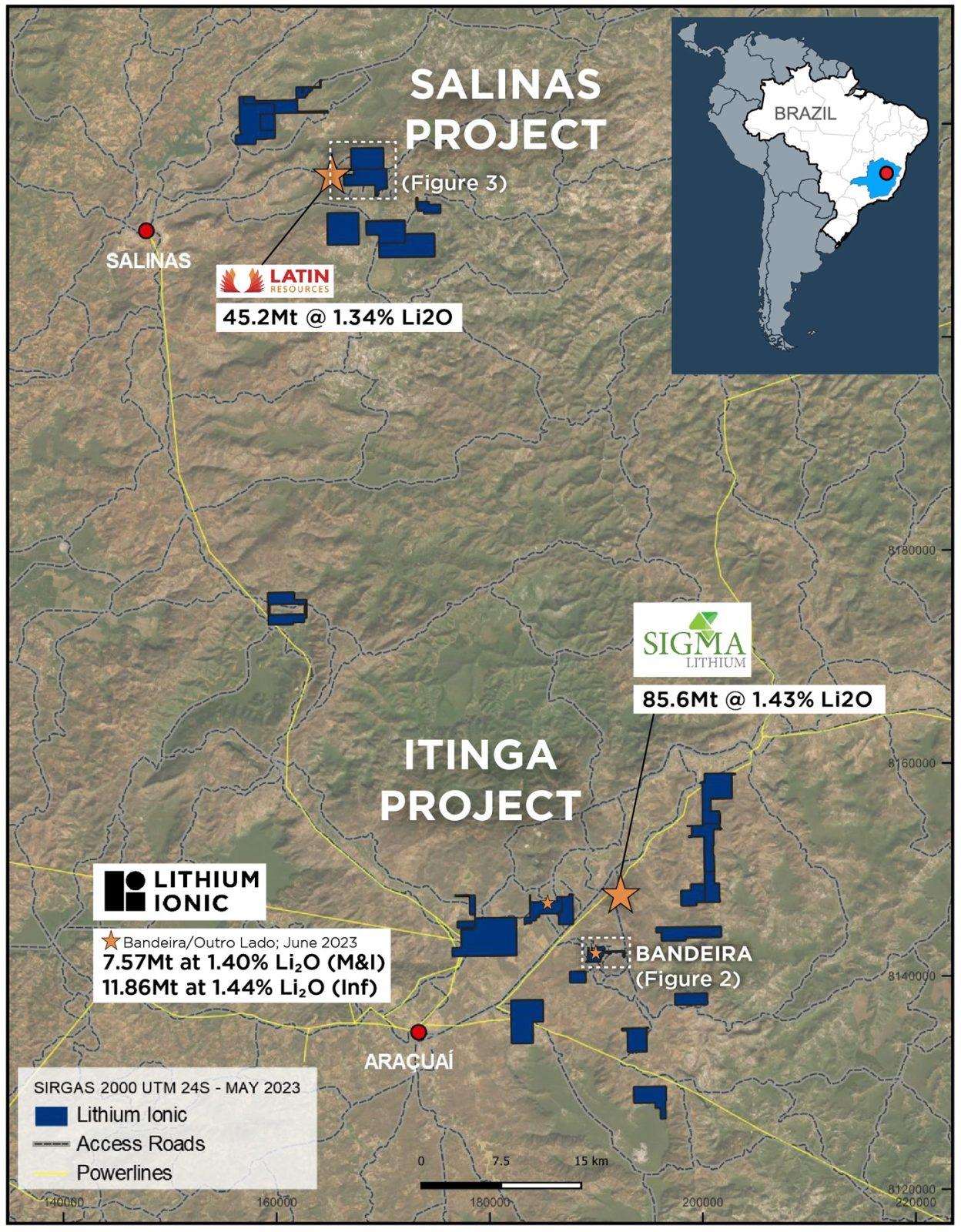

Lithium Ionic Corp. (TSX-V: LTH) (OTCQB: LTHCF) (FSE: H3N) reports additional infill results from Bandeira, as well as exploration drill results from Salinas. These are two of four targets presently being drilled within the Company’s large portfolio of properties which cover 14,182 hectares within the “Lithium Valley” district, an emerging, prolific hard rock lithium-producing region in northern Minas Gerais State, Brazil (See location map, Figure 1). These results form part of a large 50,000-metre drill program underway for H2 2023, with 13 drills currently operating.

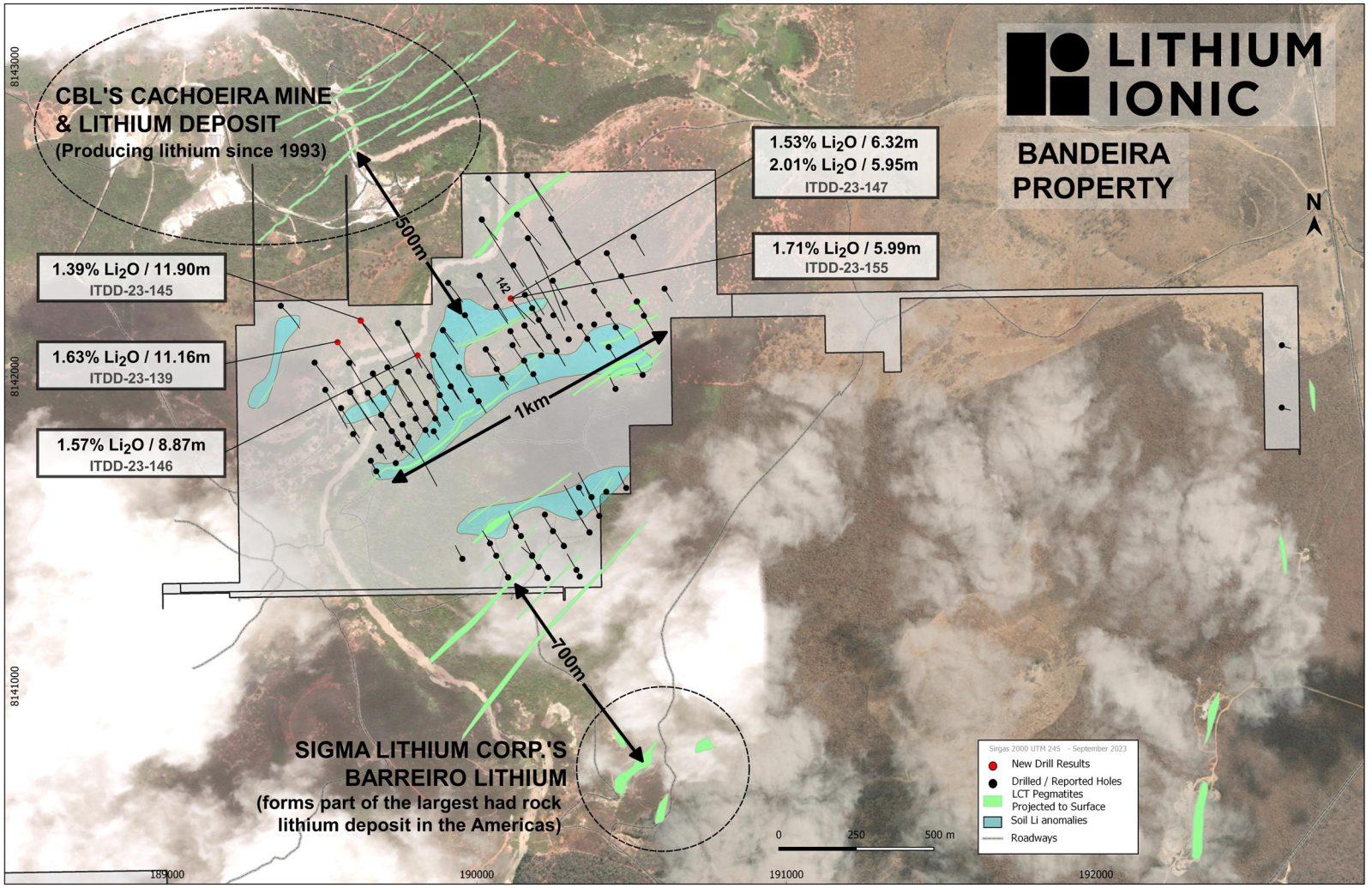

Bandeira Drill Intercept Highlights:

- 1.63% Li2O over 11.2m (hole ITDD-23-139)

- 1.39% Li2O over 11.9m (hole ITDD-23-145)

- 1.57% Li2O over 8.9m (hole ITDD-23-146)

- 2.01% Li2O over 6.0m and 1.53% Li2O over 6.3m (hole ITDD-23-147)

- 1.71% Li2O over 6.0m (hole ITDD-23-155)

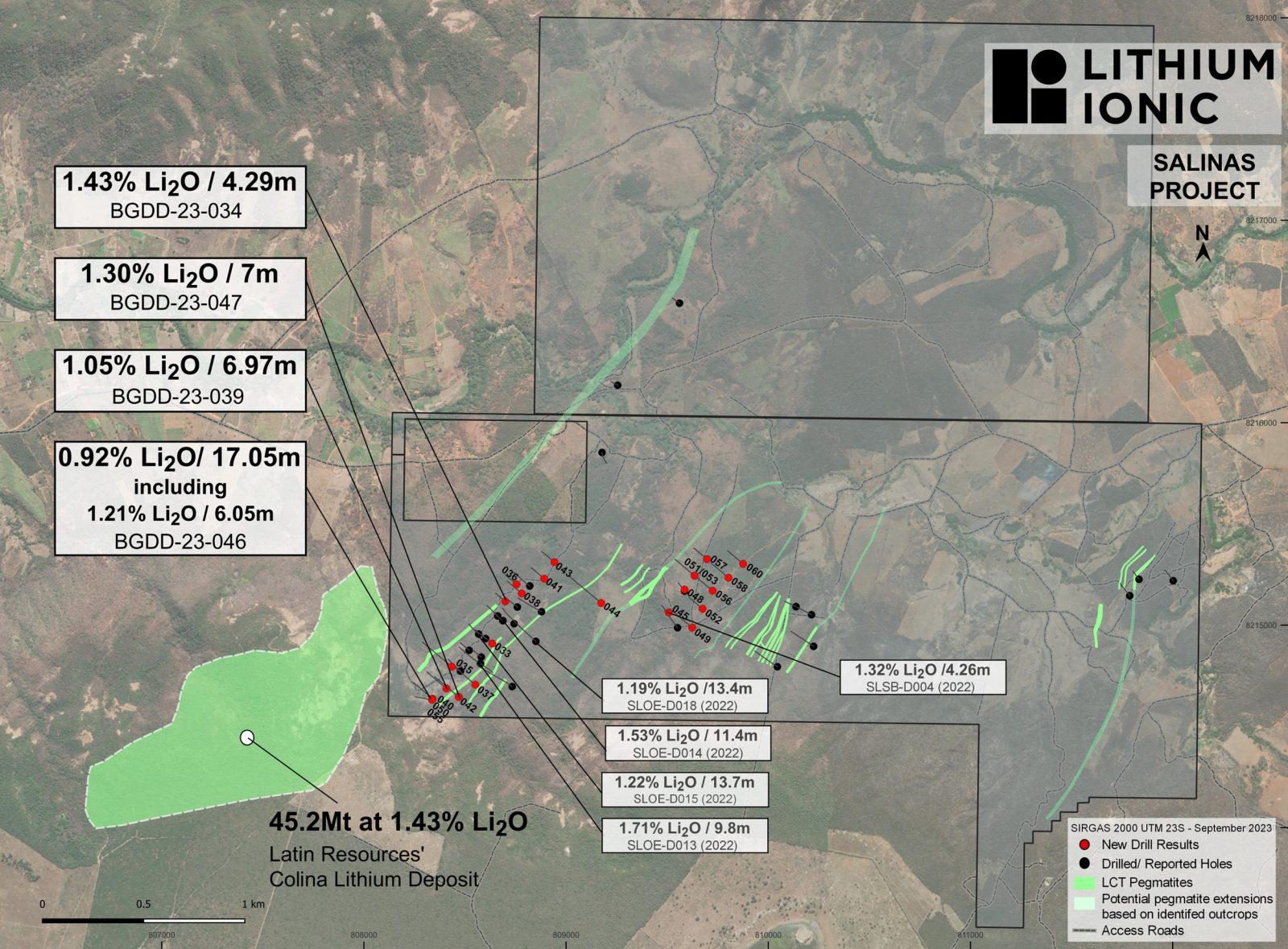

Salinas Drill Intercept Highlights:

- 1.21% Li2O over 6.0m and 1.23% Li2O over 3.0m, within a broader intersection of 0.92% Li2O over 17.1m (hole BGDD-23-046)

- 1.30% Li2O over 7.0m (hole BGDD-23-047)

- 1.05% Li2O over 7.0m (hole BGDD-23-039)

- 1.43% Li2O over 4.3m (hole BGDD-23-034)

Blake Hylands, P.Geo., Chief Executive Officer of Lithium Ionic, commented, “The infill drill program at Bandeira is progressing well and we are encouraged to see mineral continuity and consistent grades that we believe will bode well for our upcoming mineral resource update and engineering study. While still in the relatively early stages of exploration, Salinas continues to show positive progress and promising results that underscore the prospectivity of the area. Our team feels strongly about its potential as we continue to advance our understanding of the region with ongoing interpretation and modelling of new data from drilling, surface sampling and geophysics, which will only improve future targeting of our drilling.”

The Bandeira lithium deposit is located in the same district where CBL’s Cachoeira mine has been producing lithium for +30 years, and recent producer Sigma Lithium operates the Grota do Cirillo project, which hosts the largest hard rock lithium deposit in the Americas (See Figure 2). In late June 2023, the Company published an initial NI 43-101 compliant mineral resource estimate (“MRE”) at the Bandeira and Outro Lado deposits of 7.57 million tonnes (“Mt”) grading 1.40% lithium oxide (“Li2O”) of Measured and Indicated (“M&I”) and 11.86Mt grading 1.44% Li2O of Inferred resources (see press release dated June 27, 2023). The current focus of drilling at this target is to improve drill spacing to upgrade mineral resource classifications, as well as test mineral extensions with step out holes. The Company is focused on rapidly advancing these neighbouring deposits towards production, while it continues to explore and define regional targets. Project engineering is underway by independent Brazilian consultant, GE21 Consultoria Mineral Ltda., with a PEA expected in the near-term. Concurrently, WSP (formerly Golder) is expected to complete an Environmental Impact Assessment for the Itinga Project by year-end, which is expected to enable the Company to initiate the environmental licensing process.

Approximately 20,000-metres of the project-wide 50,000-metre drill program is dedicated to the Salinas target. The Company’s inaugural drilling program at Salinas commenced in May 2023, following the acquisition of the property in March (see press release dated March 13, 2023). Multiple outcropping spodumene-rich pegmatite bodies were identified in 2022, which extend directly east of Latin Resources’ Colina lithium deposit. Highlights from a 4,000-metre, 24-hole, drill program completed by the previous owner of Salinas in 2022 returned highlights of 1.53% Li2O over 11.4m, 1.22% Li2O over 13.8m, 1.71% Li2O over 9.8m and 1.19% Li2O over 13.4m. The current drill program aims to test and explore this highly prospective area with the aim to potentially develop a resource to expand on its existing portfolio of lithium deposits in the region.

Figure 1. Location Map Showing Lithium Ionic’s 14,182 Land Package

Figure 2. Bandeira Drill Collars and Traces with Intercept Highlights

Table 1. Bandeira Drill Results

| Hole ID | Az | Dip | From | To | Metres | Li2O (%) |

| ITDD-23-139 | 150 | -82 | 304.00 | 315.16 | 11.16 | 1.63 |

| ITDD-23-142 | 150 | -68 | 36.36 | 41.66 | 5.30 | 1.32 |

| and | 126.70 | 129.58 | 2.88 | 1.48 | ||

| ITDD-23-145 | 150 | -73 | 290.2 | 302.1 | 11.90 | 1.39 |

| ITDD-23-146 | 150 | -66 | 127.40 | 128.98 | 1.58 | 1.11 |

| and | 142.88 | 147.88 | 5.00 | 1.29 | ||

| and | 267.31 | 276.18 | 8.87 | 1.57 | ||

| ITDD-23-147 | 150 | -83 | 41.30 | 47.62 | 6.32 | 1.53 |

| and | 138.02 | 140.27 | 2.25 | 1.11 | ||

| and | 268.30 | 271.03 | 2.73 | 1.63 | ||

| and | 285.15 | 287.81 | 2.66 | 1.57 | ||

| and | 307.66 | 310.36 | 2.70 | 2.16 | ||

| and | 396.66 | 398.07 | 1.41 | 1.70 | ||

| and | 406.79 | 409.13 | 2.34 | 1.12 | ||

| and | 430.72 | 436.67 | 5.95 | 2.01 | ||

| and | 483.52 | 486.52 | 3.00 | 2.13 | ||

| ITDD-23-155 | 0 | -90 | 44.50 | 50.49 | 5.99 | 1.71 |

| and | 149.36 | 151.36 | 2.00 | 1.67 |

*Assays pending for ITDD-23-136, ITDD-23-143, and ITDD-23-148 to ITDD-23-154.

Figure 3. Salinas Drill Collars and Traces with Intercept Highlights

Table 2. Salinas Drill Results

| Hole ID | Az | Dip | From | To | Metres | Li2O (%) |

| BGDD-23-033 | 310 | -89 | no significant value (“nsv”) | |||

| BGDD-23-034 | 310 | -60 | 53.93 | 58.22 | 4.29 | 1.43 |

| BGDD-23-035 | 310 | -60 | 66.89 | 68.89 | 2.00 | 0.80 |

| BGDD-23-036 | 310 | -60 | nsv | |||

| BGDD-23-037 | 310 | -65 | nsv | |||

| BGDD-23-038 | 310 | -60 | nsv | |||

| BGDD-23-039 | 310 | -60 | 179.40 | 186.37 | 6.97 | 1.05 |

| including | 184.40 | 186.37 | 1.97 | 1.87 | ||

| BGDD-23-040 | 310 | -60 | 87.10 | 89.10 | 2.00 | 1.04 |

| and | 179.42 | 182.42 | 3.00 | 1.54 | ||

| BGDD-23-041 | 310 | -60 | nsv | |||

| BGDD-23-042 | 310 | -60 | 236.65 | 245.45 | 8.80 | 0.62 |

| BGDD-23-043 | 310 | -60 | nsv | |||

| BGDD-23-044 | 310 | -60 | nsv | |||

| BGDD-23-045 | 0 | -90 | 80.30 | 82.50 | 2.20 | 0.82 |

| BGDD-23-046 | 310 | -85 | 222.05 | 239.10 | 17.05 | 0.92 |

| including | 223.05 | 226.05 | 3.00 | 1.23 | ||

| including | 233.05 | 239.10 | 6.05 | 1.21 | ||

| BGDD-23-047 | 310 | -85 | 370.70 | 377.70 | 7.00 | 1.30 |

| BGDD-23-048 | 0 | -90 | 75.50 | 78.77 | 3.27 | 1.16 |

| BGDD-23-049 | 310 | -60 | nsv | |||

| BGDD-23-050 | 130 | -87 | nsv | |||

| BGDD-23-051 | 310 | -60 | nsv | |||

| BGDD-23-052 | 310 | -60 | nsv | |||

| BGDD-23-053 | 0 | -90 | 34.39 | 37.39 | 3.00 | 1.55 |

| BGDD-23-055 | 280 | -70 | 81.50 | 82.21 | 0.71 | 1.50 |

| and | 143.00 | 145.00 | 2.00 | 1.29 | ||

| and | 156.38 | 158.21 | 1.83 | 1.07 | ||

| BGDD-23-056 | 310 | -60 | 59.29 | 60.25 | 0.96 | 1.04 |

| BGDD-23-057 | 310 | -60 | 95.20 | 96.20 | 1.00 | 0.75 |

| BGDD-23-058 | 310 | -60 | nsv | |||

| BGDD-23-060 | 310 | -60 | nsv | |||

*BGDD-23-054 was cancelled and never sampled; assays pending for BGDD-23-059

Continuous Disclosure

Further to the Company’s press release dated July 31, 2023, the Company reports that an insider of the Company, Electrification and Decarbonization AIE LP (by virtue of owning more than 10% of the outstanding voting shares) purchased an aggregate of 800,000 Lithium Ionic common shares under the private placement announced in such press release, and such participation is considered to be a “related party transaction” as defined under Multilateral Instrument 61-101 (“MI 61-101”). The Company relied on exemptions from the valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 in respect of such related party participation as the fair market value of the participation in the private placement by the related party did not exceed 25% of the market capitalization of the Company, as determined in accordance with MI 61-101.

Lithium Ionic Engages Harbor Access

The Company reports the engagement of Harbor Access Inc., an Investor Relations firm with offices in the US and Canada, to enhance Lithium Ionic’s communications efforts and broaden its investor outreach efforts in North America and Europe.

“We are looking forward to working with Blake and the rest of the Lithium Ionic team to build upon the success of their existing IR program. Lithium Ionic is developing an exciting lithium project in Brazil, which will provide resources for the global demand. Retail and institutional investors are looking for investments in projects in mining-friendly jurisdictions such as Brazil to fuel the expanding EV and battery materials demand. Lithium Ionic’s projects, Itinga and Salinas, are emerging as world-class hard rock lithium developments and should be on every investor’s radar,” stated Jonathan Paterson, Founder of Harbor Access

Pursuant to the agreement, the Company will pay a cash fee of USD$8,000 per month to Harbor Access. Harbor Access does not control any common shares in the Company.

About Lithium Ionic Corp.

Lithium Ionic is a Canadian mining company exploring and developing its lithium properties in Brazil. Its flagship Itinga and Salinas projects cover 14,182 hectares in the northeastern part of Minas Gerais state, a mining-friendly jurisdiction that is quickly emerging as a world-class hard-rock lithium district. The Itinga Project is situated in the same region as CBL’s Cachoeira lithium mine, which has produced lithium for +30 years, as well as Sigma Lithium Corp.’s Grota do Cirilo project, which hosts the largest hard-rock lithium deposit in the Americas.

Quality Assurance and Control

During the drill program, assay samples were taken from NQ core and sawed in half. One-half was sent for assaying at SGS Laboratory, a certified independent commercial laboratory, and the other half was retained for results, cross checks, and future reference. A strict QA/QC program was applied to all samples. Every sample was processed with Drying, crushing from 75% to 3 mm, homogenization, quartering in Jones, spraying 250 to 300 g of sample in steel mill 95% to 150. SGS laboratory carried out multi-element analysis for ICP90A analysis.

Qualified Persons

The technical information in this news release has been prepared by Carlos Costa, Vice President Exploration of Lithium Ionic and Blake Hylands, CEO and director of Lithium Ionic, and both are “qualified persons” as defined in NI 43-101.

The technical information relating to the historical exploration conducted by Neolit is historical in nature and has not been independently verified by Lithium Ionic. A qualified person, as defined in National Instrument 43-101, has not done sufficient work on behalf of Lithium Ionic to classify the historical drilling reported above as current mineral resources or mineral reserves and Lithium Ionic is not treating the historical drill results as current mineral resources or mineral reserves.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE