LAHONTAN DRILLS 30.5 METRES GRADING 0.74 g/t Au Eq OXIDE, EXPANDS YORK MINERALIZED ZONE at SANTA FE

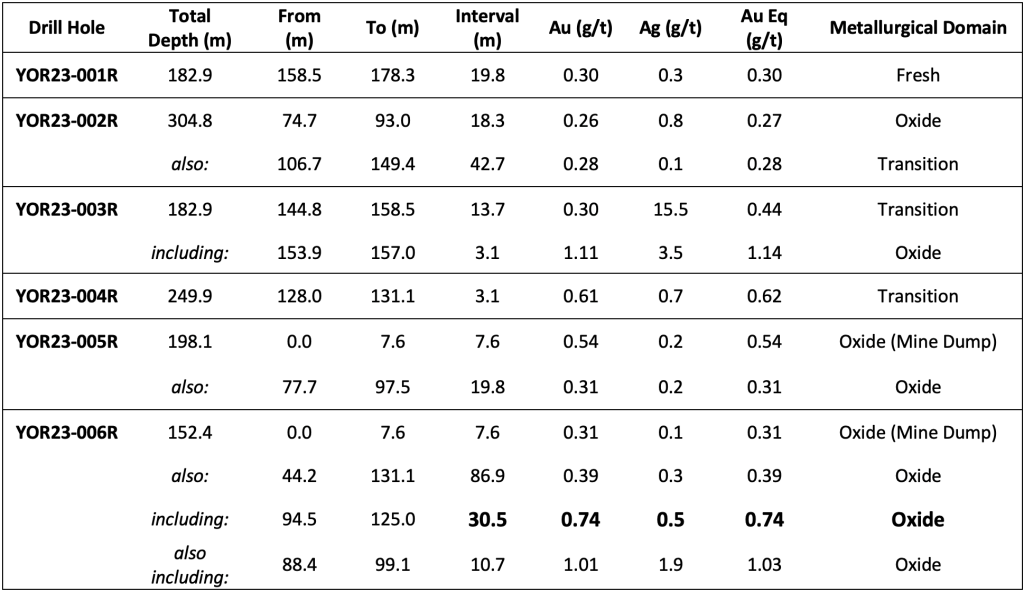

Lahontan Gold Corp (TSX-V:LG) (OTCQB:LGCXF) is pleased to announce results from an additional six reverse-circulation rotary drill holes from the Company’s 2023 7,000 metre Phase Three drilling campaign at the Company’s 19 km2 Santa Fe Mine Project in Nevada’s Walker Lane. These drill holes are first exploratory drill holes completed in the York pit area in over 30 years, historic drilling had outlined significant oxide domain gold and silver resources (Canadian NI 43-101 compliant) that remained open along strike and down-dip*. The six drill holes reported herein, totaling 1,271 metres, targeted potential extensions to these gold and silver resources. Highlights include:

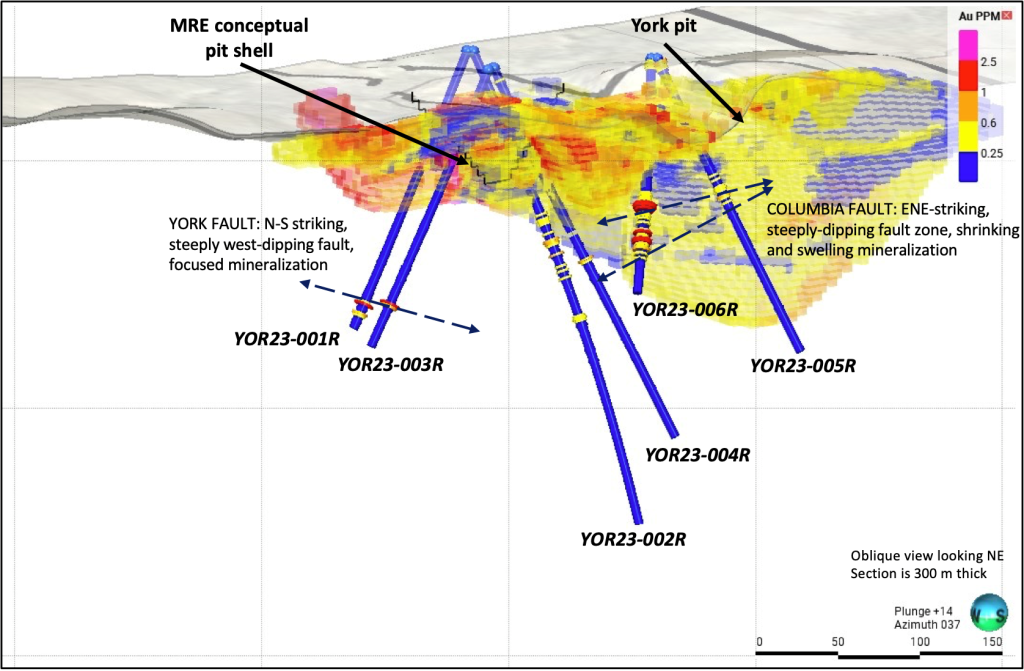

- 30.5 metres grading 0.74 g/t Au and 0.5 g/t Ag (0.74 g/t Au Eq)of oxide metallurgical domain mineralization in drill hole YOR23-006R including 10.7 metres grading 1.01 g/t Au and 1.9 g/t Ag (1.03 g/t Au Eq). This drill hole shows that oxide gold and silver mineralization extends below the York pit and opens the entire York area for resource expansion (please see location map, cross section, and table below).

- The York drill holes interceptedsignificant widths of oxide and transition metallurgical domain gold and silver mineralization below and east of the Mineral Resource Estimate conceptual pit shell and the as-mined York pit. The York drill holes confirm the historic drill data and will greatly expand the scale of the conceptual pit shell used to constrain mineral resources in future resource estimates (note the small size of the conceptual pit shell in the cross section below).

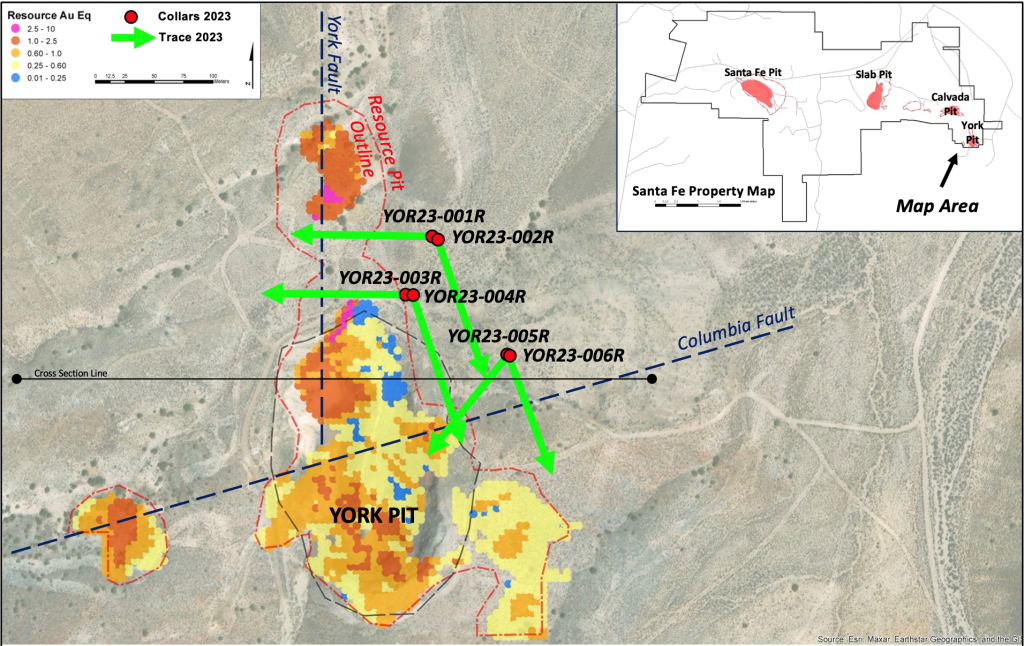

Plan view of the York pit area, Santa Fe Mine, Nevada. The outline of the York pit is shown in black with MRE conceptual pit shell shown in dashed red. Resource blocks are color-coded for Au Eq grade in g/t. The six drill holes reported herein are shown with heavy green drill hole traces, the line of the cross section (above) is also shown. The plan view map shows only Au Eq blocks that are within the conceptual pit and therefore included in the MRE. The cross section shows all Au Eq blocks modeled from historic drilling, both within and outside of the conceptual pit shell.

In the cross section (above), the York drill holes are east of the known resources targeting mineralization under historic drilling (please see plan view and cross section above), therefore the intercepts expand the area of known gold mineralization. Also, during the pit optimizing process, the new intercepts can potentially “pull-down” the conceptual pit shell to capture resource blocks outside the current conceptual shell, which should expand the pit constrained MRE.

Kimberly Ann, Lahontan Founder, CEO, President, and Director commented: “These York drill holes are vital in validating historic drilling in the York target area. The grades seen these drill holes is similar to that reported from the mine operations at York and confirm the presence of extensive oxide domain gold and silver mineralization beneath and adjacent to the York open pit. The geologic interpretation of the York drill holes also identified important north-south (the “York” fault) and east-northeast (the “Columbia” fault) structural controls to mineralization, opening new target areas for resource expansion drilling (please see cross section above). The Columbia hosts higher grades, e.g. 3.0m grading 2.07 g/t Au (YOR23-006R, 94.5-97.5m) that may be outlining important “feeders” to the hydrothermal system. Together with the successful Calvada area drill results announced earlier (press release dated June 27, 2023), our Phase Three resource expansion drill campaign is off to a great start, and we look forward to announcing more drill results in the weeks and months ahead.”

Notes: Au Eq equals Au (g/t) + ((Ag g/t/75)*0.66). Ag grade for calculating Au Eq is adjusted to consider historic metallurgical recovery as described in the Santa Fe Project Technical Report*. True thickness of the intercepts is estimated to be 80-90% of the drilled interval. Numbers may not total precisely due to rounding.

* Please see the Santa Fe Project Technical Report, Authors: Trevor Rabb and Darcy Baker, P. Geos. Effective Date: December 7, 2022, Report Date: March 2, 2023. The Technical Report is available on the Company’s website and SEDAR.

|

About Lahontan Gold Corp.

Lahontan Gold Corp. is a Canadian mineral exploration company that holds, through its US subsidiaries, four top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan’s flagship property, the 19 km2 Santa Fe Mine, had past production of 345,000 ounces of gold and 711,000 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing (Nevada Bureau of Mines and Geology, 1995). The Santa Fe Mine has Canadian National Instrument 43-101 compliant Indicated Mineral Resources of 1,112,000 oz Au Eq (grading 1.14 g/t Au Eq) and an Inferred Mineral Resource of 544,000 oz Au Eq (grading 1.00 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report*). The Company will continue to aggressively explore Santa Fe during 2023 and begin the process of evaluating development scenarios to bring the Santa Fe Mine back into production. Quentin J. Browne, P.Geo., Consulting Geologist to Lahontan Gold Corp., is the Qualified Person for the Company and approved the technical content of this news release.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE