NOVA TO ACQUIRE ROYALTY ON NEWMONT’S SADDLE NORTH DEPOSIT IN BRITISH COLUMBIA

Nova Royalty Corp. (TSX-V: NOVR) (OTCQB: NOVRF) is pleased to announce that it has entered into an agreement with an arm’s length private party pursuant to which Nova will acquire an existing 0.25% net smelter return royalty, on the Tatogga Property, which contains the Saddle North copper-gold-silver deposit located in British Columbia, Canada, owned by Newmont Corporation (NYSE: NEM) (TSX: NGT). Nova will also be granted a Right of First Refusal with respect to an additional 0.25% NSR royalty owned by the Seller covering the same area as the Royalty.

Hashim Ahmed, Nova’s Interim CEO, commented, “The acquisition of the Tatogga Royalty further demonstrates Nova’s ability to execute on our strategy of sourcing and securing royalties on high-quality copper projects from third party holders. The Saddle North deposit has a significant copper-gold-silver resource and is situated in B.C.’s Golden Triangle, one of Canada’s premier mining camps. Additionally, Tatogga is owned by Newmont, an industry-leading mining company with a proven track record of success. We view this Transaction as an accretive acquisition that improves both the quality and value of Nova’s portfolio.”

Transaction Highlights

- Saddle North is a large-scale resource in a top-tier jurisdiction with the potential to become a significant copper and gold producer.

- Newmont is one of the world’s most prolific mining companies, with a proven track record of discovering, developing, and operating world-class assets.

- The potential merger between Newmont and Newcrest Mines Limited, which owns 70% of the nearby Red Chris copper-gold mine, has the potential to unlock synergies for the development of Saddle North and the larger Tatogga property.

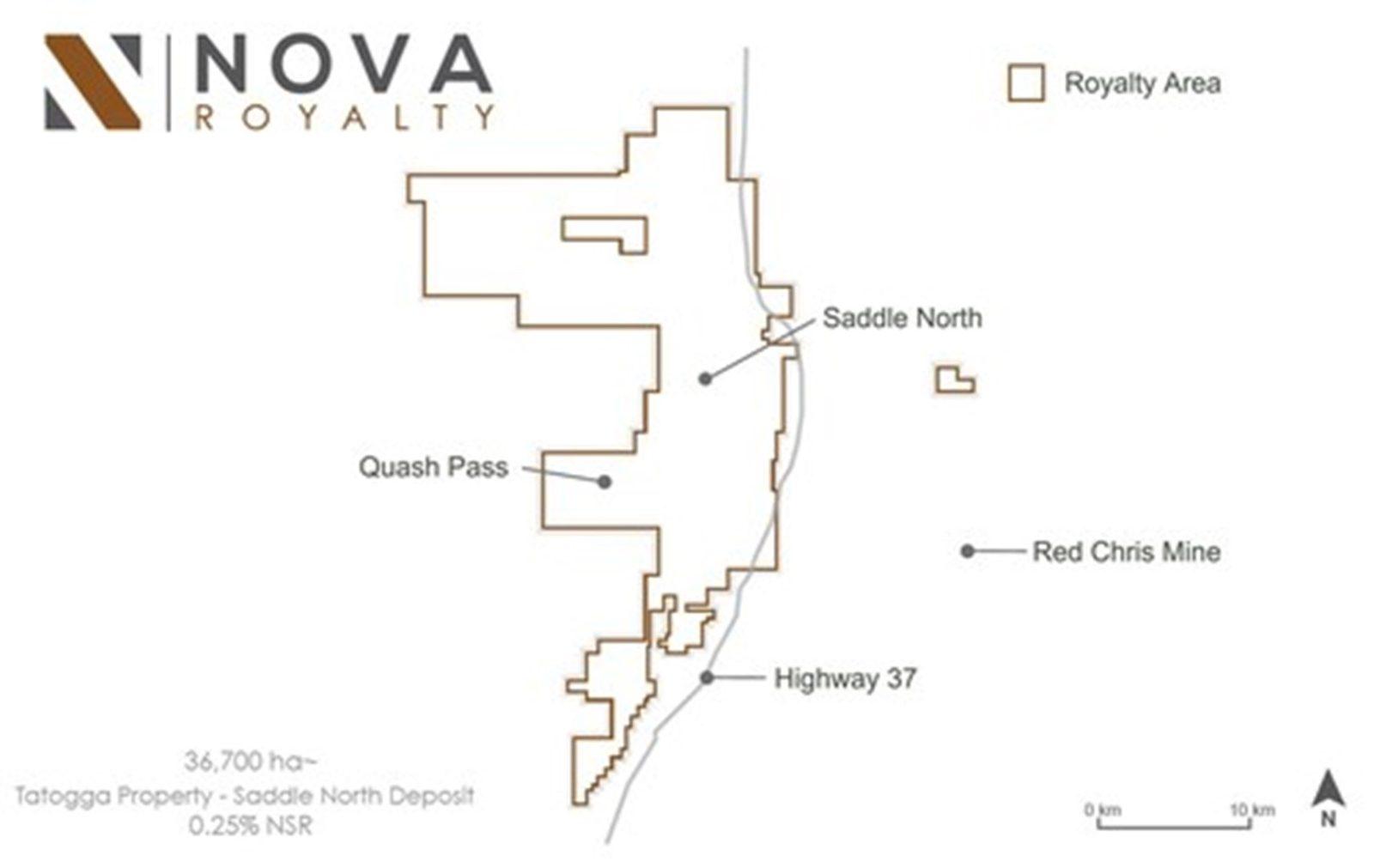

- The Royalty covers nearly 37,000 hectares in British Columbia’s Golden Triangle, one of Canada’s premier mining camps, with considerable upside potential from additional exploration.

Royalty Description

The Royalty is part of a broader, existing 2.00% NSR royalty on Tatogga. The Seller is the sole legal and beneficial owner of 50% of the 2.00% NSR, thereby owning a 1.00% NSR royalty on Tatogga.

The Seller’s Interest is subject to a 50% buyback right in favour of Newmont, which, if exercised, would reduce the Seller’s Interest to a 0.50% NSR royalty.

Pursuant to the Agreement, Nova will acquire a 0.25% NSR Royalty from the Seller and will be granted a ROFR in respect to an additional 0.25% NSR Royalty, which in aggregate is equivalent to 100% of the Seller’s Interest after providing for the Buyback. Nova’s Royalty portion is not subject to the Buyback.

The Royalty applies to the sale of any and all minerals produced and sold from a portfolio of mining claims that covers a surface area of approximately 36,700 hectares and comprises the entirety of Tatogga and Saddle North. A map of the Royalty Area is included in this press release.

Saddle North Overview

Saddle North is a gold-rich copper porphyry deposit located in the Golden Triangle in northwest British Columbia, Canada. Before being acquired by Newmont in 2021, Saddle North was owned by GT Gold Corp. which published a maiden resource estimate for Saddle North in 2020, which included 1.81 billion pounds of copper, 3.47 million ounces of gold, and 7.58 million ounces of silver contained in Indicated Resources, and 2.98 billion pounds of copper, 5.46 million ounces of gold, and 11.64 million ounces of silver contained in Inferred Resources.(1)

The last reported mineral resource estimates for Saddle North are as follows:

Tatogga Project Saddle North Mineral Resources Amenable to Open Pit Mining Methods(1)

| Average Grade | Contained Metal | |||||||||

| Material Type | Category | Tonnes (Mt) | Cu

(%) |

Au (g/t) | Ag (g/t) | CuEq (%) | Cu (Mlbs) | Au (Koz) | Ag (Koz) | CuEq (Mlbs) |

| Transition | Indicated | 21 | 0.15 | 0.16 | 0.5 | 0.24 | 72 | 108 | 340 | 112 |

| Inferred | 13 | 0.20 | 0.12 | 0.6 | 0.27 | 58 | 49 | 260 | 76 | |

| Fresh | Indicated | 196 | 0.26 | 0.30 | 0.7 | 0.42 | 1,105 | 1,906 | 4,210 | 1,808 |

| Inferred | 241 | 0.22 | 0.25 | 0.5 | 0.35 | 1,174 | 1,907 | 4,090 | 1,877 | |

| Total | Indicated | 217 | 0.25 | 0.29 | 0.7 | 0.40 | 1,177 | 2,014 | 4,550 | 1,920 |

| Inferred | 254 | 0.22 | 0.24 | 0.5 | 0.35 | 1,232 | 1,956 | 4,350 | 1,953 | |

Tatogga Project Saddle North Mineral Resources Amenable to Underground Mining Methods(1)

| Average Grade | Contained Metal | |||||||||

| Material Type | Category | Tonnes (Mt) | Cu (%) | Au (g/t) | Ag (g/t) | CuEq (%) | Cu (Mlbs) | Au (Koz) | Ag (Koz) | CuEq (Mlbs) |

| Fresh | Indicated | 81 | 0.35 | 0.56 | 1.2 | 0.65 | 632 | 1,457 | 3,030 | 1,168 |

| Inferred | 289 | 0.27 | 0.38 | 0.8 | 0.48 | 1,750 | 3,499 | 7,290 | 3,039 | |

Tatogga Project Saddle North Mineral Resources for Combined Mining Methods(1)

| Average Grade | Contained Metal | |||||||||

| Material Type | Category | Tonnes (Mt) | Cu (%) | Au (g/t) | Ag (g/t) | CuEq (%) | Cu (Mlbs) | Au (Koz) | Ag (Koz) | CuEq (Mlbs) |

| Total | Indicated | 298 | 0.28 | 0.36 | 0.8 | 0.47 | 1,809 | 3,471 | 7,580 | 3,088 |

| Inferred | 543 | 0.25 | 0.31 | 0.7 | 0.42 | 2,982 | 5,455 | 11,640 | 4,992 | |

Mineralization at Saddle North remains open at depth and to the northwest and southeast. Additional upside potential exists from near-mine exploration, with the larger Tatogga property demonstrating early signs of district potential. Furthermore, the proximity of Saddle North and Red Chris creates the potential for development and operating synergies, which may positively impact Saddle North if the potential merger between Newmont and Newcrest is successfully completed.

Transaction Details and Financing

The aggregate purchase price for the Transaction is $3,750,000 and will be paid as follows:

- $1,000,000 in cash, payable upon closing of the Transaction; and

- $2,750,000 in common shares of Nova, payable upon closing of the Transaction.

The number of Consideration Shares to be issued in connection with the Transaction will be based on the 20-day volume weighted average trading price on the TSX Venture Exchange of Nova’s common shares prior to the effective date of the Definitive Agreement. Nova anticipates paying for the cash portion of the purchase price from existing cash on hand.

The Transaction is subject to the acceptance of the TSXV.

About Nova

Nova Royalty Corp. is a copper and nickel focused royalty company. Nova has assembled a portfolio of royalties on a significant proportion of the next generation of major copper projects located in 1st-tier jurisdictions, providing investors exposure to some of the most critical resource assets for the clean energy transition. These projects are being advanced by the world’s premier mining companies, which include First Quantum, Lundin Mining, Hudbay, Anglo American and Glencore, among others.

Royalty Area Map (CNW Group/Nova Royalty Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE