Orezone Reports First Quarter 2023 Results

Orezone Gold Corporation (TSX: ORE) (OTCQX: ORZCF) reported its operational and financial results for the three months ended March 31, 2023. The consolidated financial statements and Management’s Discussion and Analysis are available at www.orezone.com and on the Company’s profile on SEDAR at www.sedar.com.

Patrick Downey, President and CEO, commented “Earnings from mine operations exceeded $39 million in Bomboré’s first full quarter of commercial production and have provided a strong start to the Company’s net earnings and free cash flow for 2023. Gold production of 41,301 oz was helped by excellent performance of the process plant with mill throughput at 13% above design and recoveries at a steady 92.2%. Our operational efficiency and stringent cost management assisted in offsetting cost pressures from a stronger local currency and high in-country diesel prices. With robust gold prices, AISC margin was $966 per oz sold or an impressive 51%.

Our safety record continues to be exemplary with no lost time injuries for the quarter from 928,000 hours worked and an LTIFR of zero since 2021 when construction of the Phase I Oxide plant commenced.

On the growth front, work on our grid power connection is advancing at a steady rate with the awards of all major installation contracts and order placements for schedule-critical equipment. Significant savings from current on-site power generation will be realized once the connection is energized, expected in Q4-2023. Lastly, work on the Bomboré Phase II Expansion study update remains on track for completion by the end of this third quarter.”

FIRST QUARTER 2023 HIGHLIGHTS

Operational

- Produced 41,301 gold oz

- Sold 43,139 gold oz at an average realized price of $1,892 per oz

- AISC1 of $926 per gold oz sold

- Zero lost-time injuries with 928,000 personnel hours worked

Financial

- Revenue of $81.7 million

- Earnings from mine operations of $39.7 million

- Net income and net income per share (basic) attributable to Orezone shareholders of $22.6 million and $0.07, respectively

- Adjusted earnings1 and adjusted earnings per share1 (basic) attributable to Orezone shareholders of $24.6 million and $0.07, respectively

- Cash flow from operations before changes in non-cash working capital of $41.1 million ($38.9 million after changes in non-cash working capital)

- Free cash flow1 of $31.5 million

- Cash of $45.2 million at March 31, 2023

Corporate

- Rob Henderson appointed as VP Technical Services and Kevin MacKenzie appointed as VP Corporate Development and Investor Relations on January 5, 2023

- Non-brokered private placement of 13.0 million common shares at C$1.27 per share arranged with a large, well-established, global institutional fund manager and closed on March 8, 2023, resulting in net proceeds of $11.6 million

1 Non-IFRS measures. See “Non-IFRS Measures” section below for additional details.

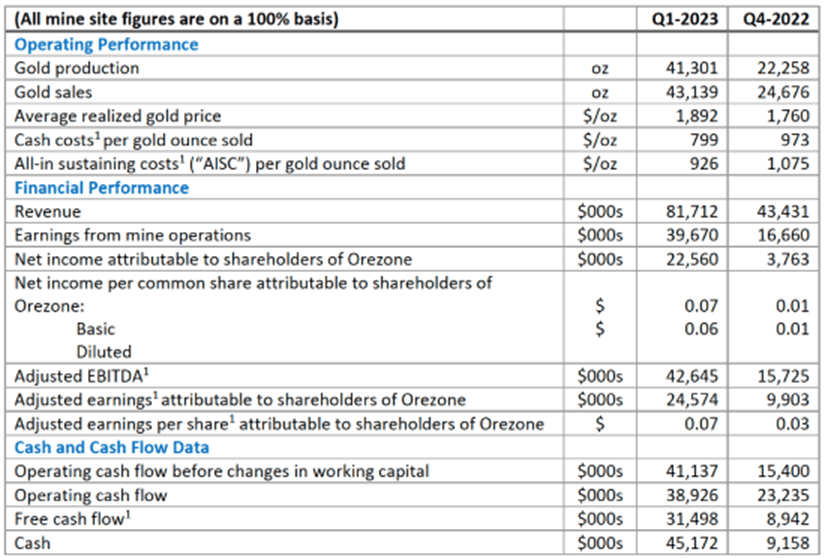

PRODUCTION AND FINANCIAL SUMMARY

1 Non-IFRS measures. See “Non-IFRS Measures” section below for additional information.

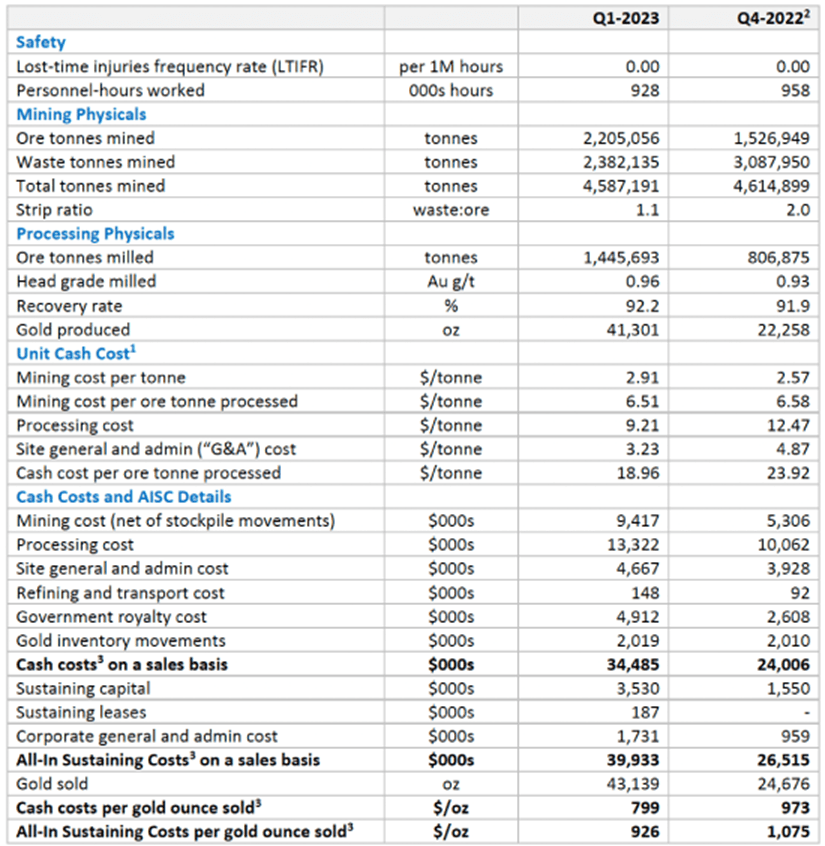

BOMBORÉ GOLD MINE (100% BASIS) – OPERATING HIGHLIGHTS

1 The Bomboré Mine entered into commercial production on December 1, 2022. Unit cash costs during pre-commercial production are not representative of cost performance expected under steady-state operations. Cost figures presented for Q4-2022 include a blend of costs before and during commercial production.

2 The Bombore Mine did not process any significant quantity of ore for the month of October 2022 due to insufficient power as the power plant underwent repairs. As a result, departmental costs for processing and site general and admin have been excluded from the cash cost and AISC figures presented for Q4-2022. These costs have been capitalized as commissioning costs.

3 Non-IFRS measure. See “Non-IFRS Measures” section below for additional details.

Commissioning of the process plant with ore commenced in late August 2022, resulting in the pouring of first gold on September 10, 2022 but commissioning was interrupted in late September 2022 when one of the two working permanent gensets experienced a major failure. As a consequence, mill operations were stopped in October 2022 and only recommenced in November 2022 when replacement rental gensets were mobilized, installed, and put into service. With full and reliable power, the process plant quickly ramped-up daily mill tonnages which led to Bomboré declaring commercial production on December 1, 2022.

Bomboré Production Results

Gold production in Q1-2023 was 41,301 oz, an increase of 86% from the 22,258 oz produced in Q4-2022. The higher gold production is attributable to a 79% jump in plant throughput combined with slight increases in ore grades and plant recoveries. The process plant performed exceptionally well in Q1-2023 with throughput averaging 16,063 tonnes per day which exceeded nameplate by approximately 13% while process recoveries were consistent with design levels. Favourable ore characteristics and high levels of plant availability and utilization led to a strong quarterly performance. Scheduled maintenance was conducted during the quarter with major mill shutdowns for mill re-line and scheduled change-outs of wear parts planned for in later quarters of the year.

Bomboré Operating Costs

AISC per gold ounce sold in Q1-2023 was $926, a decrease of 14% from the AISC per gold ounce sold of $1,075 in Q4-2022. The lower AISC was driven mainly by improved performance in unit costs and a 3% increase in ore grades milled. Cash cost per ore tonne processed covering mining, processing and site G&A declined by 21% or $4.96 from $23.92 in Q4-2022 to $18.96 in Q1-2023 as a result of the higher mill throughput and the corresponding decrease in fixed unit costs. In addition, processing costs benefitted from the optimized consumption of major reagents through enhancements in operator controls and a better understanding of field operating conditions. However, cost of power generation remains elevated and above budget due to persistently high in-country diesel prices set by the Burkina Faso government. The Company had expected a moderation in diesel prices starting in 2023 to reflect falling global oil prices in H2-2022 but decreases in diesel prices have not yet materialized. This high diesel cost also had a negative effect on unit mining costs.

Bomboré Growth Capital Projects

Grid Power Connection

The project to connect Bomboré to Burkina Faso’s national grid is progressing well and remains on schedule for completion before the end of the 2023 year. The Company has engaged ECG Engineering Pty Ltd. (“ECG”) to manage the design, construction, and commissioning of the new high voltage transmission line and dedicated substations, and will work closely with SONABEL, Burkina Faso’s state-owned electricity company, to ensure timely deliverables and adherence to schedule. ECG is a specialized engineering firm that has successfully delivered on similar projects in West Africa, including Burkina Faso.

To-date, all long lead equipment orders have been placed and all major contracts have been awarded. Land compensation for the transmission line corridor has commenced under the direction of SONABEL and work to clear this ground corridor will follow shortly upon the mobilization of contractor equipment and personnel. Drawings and designs for the powerline and substations have been submitted to SONABEL and are pending their final review and approval.

RAP Phases II and III

RAP Phases II and III involve the construction of four new resettlement villages (MV3, MV2, BV2, and BV1). The Company has sequenced MV3 as the first village to construct in order to gain access to mining areas that are currently contemplated in the 2024 mine plan. MV3 is the largest of the resettlement villages and requires the new erection of over 1,200 private homes and public structures.

The start of construction for the MV3 village encountered a slight delay in the first two months of 2023 as communities conducted sacred ceremonies for the new resettlement grounds. Earthwork for MV3 is now complete and contractors have commenced the mobilization of personnel, materials, and equipment to site.

RAP compensation for displaced households is organized to begin in Q2-2023.

2023 Feasibility Study Update for the Phase II Expansion

The 2019 feasibility study contemplated the construction of a 2.2M tonnes per annum hard rock facility which would commence production in the third year of oxide operations. Based on the mineral reserves outlined in this 2019 FS, the overall plant capacity was to remain at a nominal 5.2Mtpa, comprising of 3.0Mtpa of oxides and 2.2Mtpa of hard rock, resulting in an average gold production profile of 134,000 oz per year for the first ten years of commercial operations.

Subsequent to the 2019 FS, over 100,000 metres of drilling have been completed leading to the discovery of the near surface P17NE deposit and extensions of other known higher grade hard rock zones with the main Bomboré deposit. Results of drilling undertaken in 2022 are expected to successfully convert Inferred resources of higher grade hard rock material into the Measured and Indicated categories. The updated resource modelling is progressing and a new resource, reserve, and mine plan are targeted for completion in Q3-2023.

Metallurgical test work is also nearing completion which confirms more rapid leach kinetics and a resultant significant decrease in required leach time from the 42 hours shown in the 2019 FS to the estimated 24 hours to be used in plant design for the 2023 FS. The Company expects the new hard rock expansion will be sized as a 4.4Mtpa standalone circuit to operate independently to the existing 5.7Mtpa oxide circuit, a notable increase to the 5.2Mtpa combined circuit in the 2019 FS. The Company has chosen to expand the circuit size as it believes recent drilling successes have demonstrated that the Bomboré mine is capable of supporting a larger annual operation. The Bomboré deposit remains open to further extensions and potential new discoveries from future drilling.

For the 2023 FS, the Company has engaged the same consultants (Lycopodium and Knight Piésold) that completed the development and construction of the current Phase I operations to ensure continuity and consistency. Flowsheet development is complete, and equipment and capital costs are well advanced. Of note is that the carbon-in-leach and elution circuits will be copies of those in current operations.

The Company has held early discussions with its senior lender, Coris Bank, about their participation in this future Phase II Expansion. Coris Bank has indicated they are supportive of this expansion and look forward to furthering discussions as the Company draws closer to completing its 2023 FS.

NON-IFRS MEASURES

The Company has included certain terms or performance measures commonly used in the mining industry that is not defined under IFRS, including “cash costs”, “AISC”, “EBITDA”, “adjusted EBITDA”, “adjusted earnings”, “adjusted earnings per share”, and “free cash flow”. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures presented by other companies. The Company uses such measures to provide additional information and they should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. For a complete description of how the Company calculates such measures and reconciliation of certain measures to IFRS terms, refer to “Non-IFRS Measures” in the Management’s Discussion and Analysis for the three months ended March 31, 2023 which is incorporated by reference herein.

QUALIFIED PERSONS

The scientific and technical information in this news release was reviewed and approved by Dr. Pascal Marquis, Geo., Senior Vice President of Exploration, Mr. Rob Henderson, P. Eng, Vice President of Technical Services, and Mr. Patrick Downey, P.Eng. President and CEO, all of whom are Qualified Persons as defined under NI 43-101 Standards of Disclosure for Mineral Projects.

About Orezone Gold Corporation

Orezone Gold Corporation is a Canadian mining company operating the open pit Bomboré Gold Mine in Burkina Faso.

Orezone is focusing on mining and processing the Phase I near surface free-dig oxides at a planned annual throughput of 5.7 million tonnes. The Company believes that Bomboré has a significant underlying sulphide resource to support a substantially larger Phase II expansion. The Company has recently completed a resource definition drill program, and plans to issue an updated mineral resource, reserve and life of mine plan, as part of this Phase II expansion. It is expected that the pending study will be completed in Q3-2023 to be followed by a production decision.

Orezone is led by an experienced team focused on social responsibility and sustainability with a proven track record in project construction and operations, financings, capital markets and M&A.

The technical report for the 2019 Feasibility Study on the Bomboré Project entitled NI 43-101 Technical Report (Amended) Feasibility Study of the Bomboré Gold Project is available on SEDAR under the Company’s profile at www.sedar.com.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE