Jordan Roy-Byrne – “More Upside in Gold & Silver Stocks”

Although Gold put in a bearish reversal on Friday and failed to breakout, do not expect the sector (and miners specifically) to begin a significant correction.

When I say significant I mean something that would last more than a few days to a few weeks.

Bull markets often register overbought conditions. Strong markets and strong trends reach overbought extremes. In other words, precious metals attaining overbought status is a good thing.

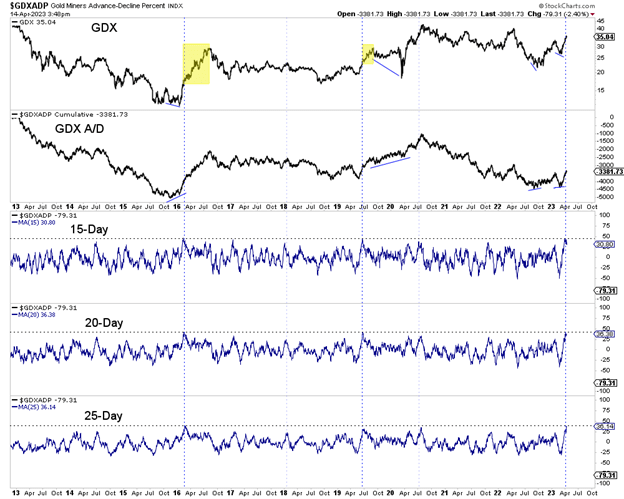

Gold stocks as measured by the rate of change in the GDX advance decline line over several short periods registered only the third breadth thrust in the last decade.

A breadth thrust occurs when there is a sudden burst of very strong participation following a deep correction or bear market and very weak participation. Note the 15-day, 20-day and 25-day readings of the GDX advance decline line.

The yellow highlights the performance of GDX following the last two breadth thrusts.

The corrections that followed the breadth thrusts were brief and relatively shallow.

Coming into the week, 100% of HUI stocks were trading above the 20-day, 50-day and 200-day moving averages. Over 90% of GDXJ stocks were trading above those same moving averages.

That kind of strength begets more momentum and strength but does not preclude a rest or a pause.

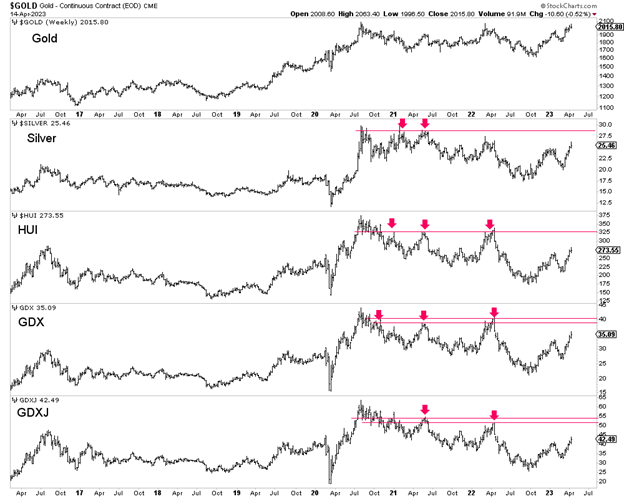

There are clear resistance levels that could mark the end of the recent move and the start of a sustained correction.

That is $28 for Silver and around the 2021 and 2022 highs for the gold stocks.

Corrections or sell offs within a new bull market are difficult to deal with because investor psychology and sentiment require more time to catch up. The fear of a big correction or lower lows lingers.

Let’s review the facts.

Gold stocks and Silver have steadily outperformed Gold over the past month. While gold stocks are very overbought on a short-term basis, they just triggered only the third breadth thrust in the last decade.

Meanwhile, Gold is a hair away from beginning what could be the biggest breakout in a half century.

Now is not the time to be bearish or bashful.

Right now I am looking for the companies with fundamental value that have huge upside potential but are not overbought or stretched.

I continue to focus on finding high-quality gold and silver juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE