Gwen Preston – “Patterns & Signals”

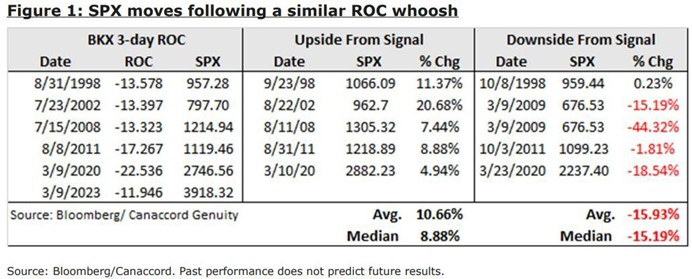

Canaccord published an interesting look back at times the KBW Bank Stocks Index (BKX) dropped more than 10% in three days. It happened March 7-9; BKX fell 11.9%.

Greater than 10% drops in three days have happened five times since the index was created in 1995. Each time, overall markets rallied shortly after but each time the rally proved a bounce in the middle of a decline. And each time the SPX touched (once time) or fell below levels from before the bank index drop.

So far, SPX has rallied 4.4% over two weeks since its post-KBX-decline low. If the pattern repeats, the bounce is almost done.

For a bit of context, here’s what was happening the last five times this happened:

- 1998: buildup to Long Term Capital Management hedge fund failure

- 2002: post 9/11 dotcom bust

- 2008: Great Financial Crisis

- 2011: European Debt Crisis

- 2020: Global Pandemic

Not small events, any of them!

Why would this pattern exist? Because optimistic investors buy after a bank crisis in the hopes the worst is over, only to find that a banking crisis did indeed precede or cause tightening financial conditions that pushed stocks lower.

Is that the case today? We shall see, but it’s certainly possible. Rate hikes had already tightened financial conditions significantly before a half-dozen banks failed. Now we’re likely to see stronger regulations and more conservative capital decisions from banks, which will tighten things further.

Jerome Powell even said as much in his post-rate hike press conference last week: “As a matter of fact, you can think of [the impact of these bank failures on money availability] as being the equivalent of a rate hike, or perhaps more than that.”

Tighter financial conditions are good for gold, overall, but they are not good for companies that require capital market funding. (Junior explorers obviously fall into that trap.) Investors gravitate to large caps with stable earnings, clean balance sheets, and no need to finance when money gets tight. Gold miners fit that bill.

Finally: A Signal on Timing from the Endlessly Inverted Yield Curve

For the last year analysts have reminded investors nonstop that the yield curve is highly inverted and that yield curve inversions are reliable recession indicators.

The problem is that the yield curve can invert years before the recession hits. It’s a reliable indicator that a recession is coming but it gives no indication when.

Thankfully, when the recession gets close, the yield curve makes another reliable move. And it just happened.

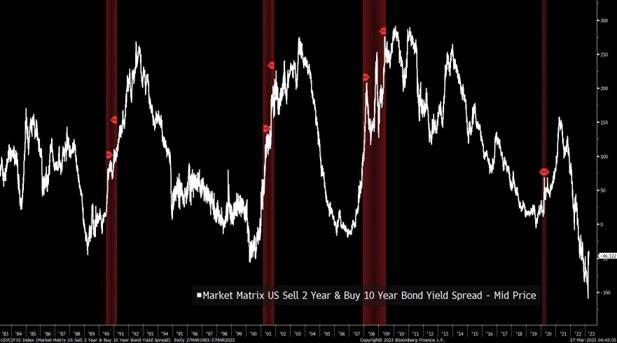

Over the last week, the 2-year—10-year yield curve started steepening again. It’s still very inverted – you still get paid more to lend money to the government for only 2 years rather than 10 years – but it’s less negative.

It’s steepening because short-term rates have been plunging now that people expect that the Fed will have to start cutting rates in the next while. And this un-inversion is how the yield curve signals that a recession is imminent.

For the last 40 years, the yield curve re-steepened sharply just before every recession (the red bars) as investors priced in the rate cuts that always happen in a recession.

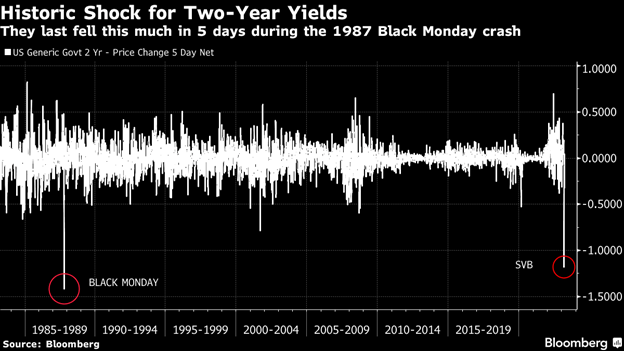

The re-steepening might be an over-reaction. To be sure, investors dove into bonds as the banking crisis unfolded, for two reasons. One: to move money from low-interest and perhaps insufficiently insured deposits to higher-yielding bonds. Two: to bet on a slowing economy and rate cuts coming. The reasons were valid but so many people moved on those rationales that the 2-year yield fell historically in the week after the failure of SVB, a drop not seen since the Black Monday crash of 1987.

The 2-year hasn’t rebounded much in the two weeks since that colossal move, which suggests investors still believe in those reasons. And investors acting like a recession is nigh helps make that happen.

Either recession signals and rationales that have worked for decades are wrong…or we are currently in the calm before the storm. My bet is on the latter.

If that’s the case, gold is the only investment that makes sense in the mining space. Gold the metal is the safest. Gold royalty companies and major miners are next; they could both get pulled down in a market dump but would likely rally strongly in short order.

Gold juniors will struggle with tight capital markets until the storm is over, which means investors should preference companies with money in the bank or financing right now.

Of course, discoveries can shine whatever’s happening in the markets. That’s why I bought two in the last two weeks.

Courtesy of the Resource Maven

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE