VOX PROVIDES PROJECT UPDATES ACROSS GOLD ROYALTY PORTFOLIO ASSETS

Vox Royalty Corp. (TSX-V: VOX) (NASDAQ: VOXR) a returns focused mining royalty company, is pleased to provide recent North American development and exploration updates from royalty operating partners Treasury Metals Inc. (TSX: TML), Alamos Gold Inc. (TSX: AGI), and Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA). All amounts are in U.S. dollars unless otherwise indicated.

Spencer Cole, Chief Investment Officer stated: “We are excited to report promising development progress across key Canadian and US development gold royalties, including the release of the Goldlund-Goliath (gold) pre-feasibility study, major permitting milestones at Lynn Lake (gold), and exploration success at South Railroad (gold). Vox’s ~80% weighting to Canada, USA and Australia is further unpinned by the advancement of these North American development projects. In an ever-changing global geopolitical landscape, Vox’s growth pipeline in these three Tier 1 mining jurisdictions continues to support management confidence around Vox’s long-term value creation for our shareholders.”

Key Updates

- Treasury announced positive results for its pre-feasibility study over the Goldlund gold project, which is part of the Goliath Gold Complex in Ontario;

- Major permitting milestones were achieved by Alamos at the Lynn Lake gold project, with the completion of an Environmental Impact Assessment and a positive Decision Statement issued by the Minister of Environment and Climate Change Canada; and

- Significant South Railroad gold drilling results were announced by Orla, with continued resource expansion exploration drilling scheduled for 2023 in Nevada.

Goldlund (Pre-Feasibility – Canada) – Positive Results from the Pre-Feasibility Study Released(1)

- Vox holds a 1% net smelter royalty on part of the Goldlund gold project (below 50m shaft collar depth), which is part of the Goliath Gold Complex in Ontario, Canada;

- On February 22, 2023, Treasury announced:

- The results of the PFS. Highlights include:

- Post-tax net present value at a 5% discount rate of C$336 million and post-tax internal rate of return of 25.4%, using a long-term gold price of $1,750 per ounce and an exchange rate of US$1.00 to C$1.34;

- Average annual production increased from 79,000 ounces to 90,000 ounces per year, with peak production increasing from 119,000 ounces to 128,000 ounces (year two), compared to the 2021 Preliminary Economic Assessment for the project;

- Expected total ounces to be produced has increased from 1.065 million ounces to 1.175 million ounces, with increased production in the first nine years of mine life based on Proven and Probable Mineral Reserve of 1.3 million ounces gold (30.3 million tonnes @ 1.3 g/t Au);

- Estimated initial capital of C$335 million, which includes a 30% increase to process plant capacity (compared to the PEA), with life of mine capital of C$552 million including closure costs and salvage values and a post-tax payback period of 2.8 years;

- Cash costs of $820/oz, All-In Sustaining Costs of $1,008/oz and annual EBITDA and free cash flows of C$145 million and C$106 million, respectively, over the first five years of production; and

- Optimization work to commence to unlock further value towards a Feasibility Study.

- The results of the PFS. Highlights include:

- On February 23, 2023, Treasury announced:

- Treasury President-CEO Jeremy Wyeth stated, “If all goes well with permitting and other studies, mining operations could begin as early as 2026“;

- Mining at Goliath is expected to occur in stages from three separate deposits; Goliath, Goldlund and Miller; and

- Open-pit mining is expected to commence at the Goliath deposit with one year of pre-production and two years of production before activity shifts to the northwest to Goldlund for open-pit mining during years 2 – 7.

- Vox Management Summary: The legacy Goldlund royalty was acquired from an Ontario-based prospector in June 2022 and this PFS study confirms Vox’s technical due diligence on the potential future value of the Goldlund project. We look forward to Treasury continuing to enhance the value of this royalty asset through the upcoming feasibility study and as the asset progresses towards operations “as early as 2026”.

Lynn Lake (MacLellan) (Feasibility – Canada) – Major Permitting Milestones

- Vox holds a 2% gross revenue royalty (post initial capital recovery) on part of the MacLellan deposit at the Lynn Lake gold project;

- On March 6, 2023 Alamos announced:

- The federal EIA for the Lynn Lake Gold Project has been completed;

- A positive Decision Statement has been issued by the Minister of Environment and Climate Change Canada;

- An updated Feasibility Study is expected to be completed during the first half of 2023;

- Exploration will remain a key ongoing focus with $5 million budgeted at the Lynn Lake Project in 2023, which includes 8,000 metres of drilling focused on several advanced regional targets, and potential expansion of Mineral Reserves and Resources;

- The continued evaluation and advancement of a pipeline of prospective exploration targets within the 58,000-hectare Lynn Lake Property is also a key area of focus for 2023; and

- John A. McCluskey, President and Chief Executive Officer, said, “Achieving both of these important regulatory milestones for the Lynn Lake Gold Project represents a multi-year, collaborative effort by our team and our commitment to environmental sustainability.”

- Vox Management Summary: Alamos management is very optimistic on the opportunity for Lynn Lake to drive significant future growth. The completed EIA and positive decision statement further de-risks Lynn Lake’s development pathway. Vox management is excited to note these major permitting milestones for Lynn Lake and looks forward to Alamos continuing to progress the project towards a development decision.

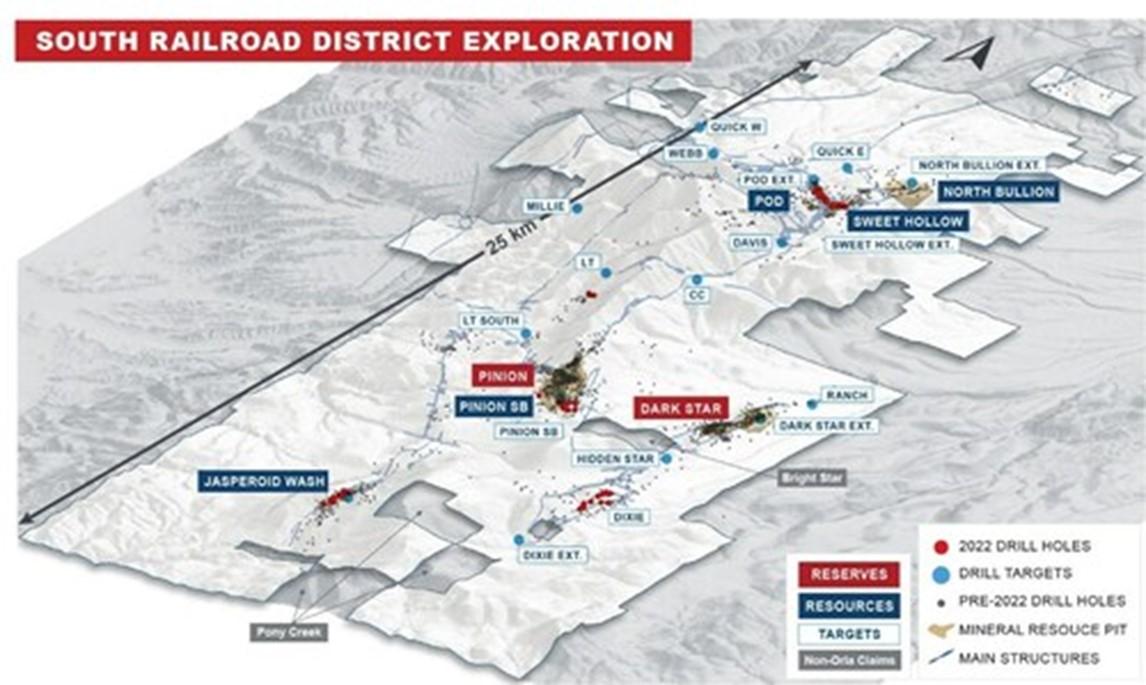

South Railroad (Feasibility – United States) – Significant RC Drill Results

- Vox holds a 0.633% NSR with advance minimum royalty payments over key portions of the South Railroad gold project, which is located in the prolific Carlin Trend of Nevada;

- On February 8, 2023, Orla announced:

- The resumption of exploration activities in mid-2022 resulted in promising drill results from multiple satellite oxide mineralized zones and targets across the 21,000-hectare South Railroad land package, with the following notable reverse circulation drilling results from the royalty linked deposits Pinion SB, Jasperoid Wash and POD:

- 0.85 g/t Au over 53.3 m (Oxide), and 1.03 g/t Au over 32.0 m (Oxide) in drillhole PR22-01;

- 4.87 g/t Au over 25.9 m (Transition), incl. 8.52 g/t Au over 13.7m (Oxide) in drillhole POD22-15;

- 1.37 g/t Au over 21.3m (Oxide), and 4.96 g/t Au over 24.4m (Sulphide) in drillhole POD22-09;

- 0.62 g/t Au over 18.3 m (Transition) in drillhole JW22-04;

- 0.29 g/t Au over 38.1 m (Oxide) in drillhole JW22-03;

- In total, 10,573m of drilling (9,796m of RC in 61 holes and 777m of core in 7 holes) were completed at South Railroad in 2022, focused on oxide resource definition and expansion at multiple targets;

- Inferred mineral resource estimates for Pinion SB, POD, Sweet Hollow, and Jasperoid Wash are expected to be updated in the second half of 2023; and

- A $10 million exploration budget is planned for South Railroad in 2023, which would include approximately 22,400m of drilling (16,500m of RC drilling and 5,900m of core).

- The resumption of exploration activities in mid-2022 resulted in promising drill results from multiple satellite oxide mineralized zones and targets across the 21,000-hectare South Railroad land package, with the following notable reverse circulation drilling results from the royalty linked deposits Pinion SB, Jasperoid Wash and POD:

- Vox Management Summary: Given South Railroad is situated along the prolific Carlin Trend in Nevada, ongoing drilling activity provides significant opportunity for future resource expansion and conversion and the discovery of new deposits. Vox management anticipates additional significant permitting, resource expansion and development newsflow from Orla in 2023.

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a “Qualified Person” under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties and streams spanning eight jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 25 separate transactions to acquire over 50 royalties.

Figure 1: Ongoing South Railroad District Exploration in Nevada’s Carlin Trend (Source: https://orlamining.com/news/orla-mining-drills-significant-gold-intersections-at-multiple-oxide-targets-upon-reactivation-of-exploration-at-south-railroad/) (CNW Group/Vox Royalty Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE