Jordan Roy-Byrne – “Gold to Breakout As Recession Hits”

Gold’s winter rebound thwarted a 2013-like scenario. However, the sharp February selloff and nasty monthly candles reflect no bull market yet.

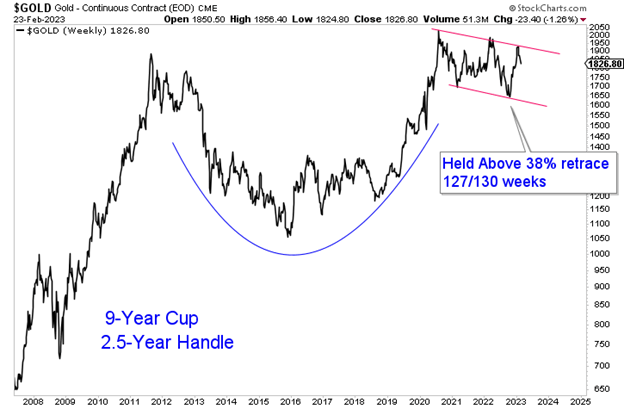

Gold is stuck but remains in a larger handle consolidation within a super-bullish cup and handle pattern.

I am not a fan of trendline and channel analysis as it is prone to error, but the handle consolidation is trading within parallel trendlines.

More importantly, the handle, now two-and-a-half years old, has spent 98% of its time above the 38% retracement ($1675).

Gold has not broken out yet because of the Federal Reserve’s delayed but aggressive rate hikes, the large increase in real interest rates, and, most recently, the economy avoiding recession.

However, while a recession is not imminent, it is inevitable.

Leading economic indicators like the LEIs (leading economic indicators) and yield curve inversions are issuing stark warnings for the second half of this year.

Furthermore, rates above 3% have only been in effect for several months, and moving from 0% to 2.5% or even 3% is not that restrictive. Let’s see how the economy fares when 4%-5% rates are in effect for another four or five months.

Precious Metals are getting hit because the adage of “higher for longer” is becoming a reality, at least for now. However, it likely increases the odds of a hard landing later.

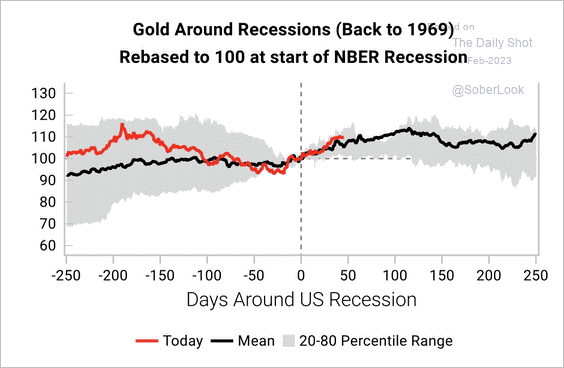

The average performance of Gold around a recession entails a move of nearly 20% from a low a few months before the recession through the first four months of the recession.

The performance of the 80th percentile is a 20% gain in the first four months of the recession.

Ultimately, Gold should begin its move to a breakout as the recession hits. Should Gold hold above $1700 over the next few months and a recession hits in the third quarter, then look for Gold to retest its all-time high by year-end.

The threats of lower prices and more time until a breakout move presents us another chance to buy the highest quality juniors with the most potential. Recently, I have introduced a larger watch list of these types of companies for my subscribers.

I focus on finding high-quality juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE