Alamos Gold Reports Record Fourth Quarter 2022 Production and Provides Three-Year Production and Operating Guidance

Alamos Gold Inc. (TSX:AGI) (NYSE:AGI) reported fourth quarter and annual 2022 production. The Company also provided updated three-year production and operating guidance.

“With our strongest performance of the year coming in the fourth quarter, including record production, we met full year 2022 production guidance. We also expect to meet cost guidance with a significant decrease in costs in the second half of the year driven by the ramp up of low-cost production from La Yaqui Grande. We expect this trend to continue over the next several years with a 9% increase in production and 5% decrease in all-in sustaining costs in 2023 driven by a full year of production from La Yaqui Grande, and strong ongoing performances at our Canadian operations,” said John A. McCluskey, President and Chief Executive Officer.

“As outlined in our updated three-year guidance, our strong outlook remains intact. We have increased our production guidance for 2023 and 2024, reflecting a stronger outlook at both Mulatos and Island Gold, and we remain on track to deliver a substantial decrease in costs over the next three years. With higher production and lower costs, we expect to generate growing free cash flow while funding the Phase 3+ Expansion at Island Gold. Once completed in 2026, we expect this to drive a significant increase in production, a further reduction in costs and substantial free cash flow growth,” Mr. McCluskey added.

2023 – 2025 Guidance Summary: Operating Mines

| 2023 | 2024 | 2025 | |||

| Current | Previous | Current | Previous | Current | |

| Total Gold Production (000 oz) | 480 – 520 | 460 – 500 | 470 – 510 | 460 – 500 | 470 – 510 |

| Total Cash Costs(1) ($/oz) | $825 – $875 | $775 – $875 | $675 – $775 | $650 – $750 | $650 – $750 |

| All-in Sustaining Costs(1),(2) ($/oz) | $1,125 – $1,175 | $1,075 – $1,175 | $975 – $1,075 | $950 – $1,050 | $950 – $1,050 |

| Total sustaining & growth capital(1),(3) (Operating mines; ex. exploration) ($ millions) |

$280 – 320 | $280 – 320 | $290 – 330 | $290 – 330 | $290 – 330 |

| (1) | Refer to the “Non-GAAP Measures and Additional GAAP” disclosure at the end of this press release for a description of these measures. |

| (2) | All-in sustaining cost guidance for 2024 and 2025 includes the same assumptions for G&A and stock based compensation as included in 2023. |

| (3) | Sustaining and growth capital guidance is for producing mines and excludes capital for Lynn Lake, other development projects, and capitalized exploration. Growth capital and total capital were revised higher by $60m in each of 2023 and 2024 with the release of the Island Gold Phase 3+ Expansion Study on June 28, 2022. |

Fourth Quarter and Full Year 2022 Operating Highlights

- Record quarterly production: of 134,200 ounces of gold, a 9% increase from the third quarter. This was driven by solid performances from all three operations, including a substantial increase at Mulatos with the ramp up of La Yaqui Grande

- Met 2022 annual production guidance: with the strong fourth quarter performance, production of 460,400 ounces was in line with annual guidance and consistent with 2021

- Costs expected to meet 2022 guidance: total cash costs and all-in sustaining costs (“AISC”) for 2022 have not been finalized but are expected to decrease in the fourth quarter to the lowest levels of the year. Full year costs are expected to be in line with guidance for total cash costs of between $875 and $925 per ounce and AISC of between $1,190 and $1,240 per ounce, a solid performance given industry-wide inflationary pressures

- Record revenues: sold 133,164 ounces of gold in the fourth quarter at an average realized price of $1,741 per ounce for record revenues of $232 million. Full year sales totaled 456,574 ounces of gold at an average realized price of $1,799 per ounce for revenues of $821 million

- Stronger cash position: ended the year with approximately $130 million of cash and cash equivalents, up from $117 million as of September 30, 2022. The Company remains debt-free

Fourth Quarter and Full Year 2022 Operating Results

| Q4 2022 | Q4 2021 | 2022 | 2021 | 2022 Guidance | |

| Gold production (ounces) | |||||

| Young-Davidson | 44,500 | 51,900 | 192,200 | 195,000 | 185,000 – 200,000 |

| Island Gold | 40,600 | 37,500 | 133,700 | 140,900 | 125,000 – 135,000 |

| Mulatos District | 49,100 | 23,100 | 134,500 | 121,300 | 130,000 – 145,000 |

| Total gold production | 134,200 | 112,500 | 460,400 | 457,200 | 440,000 – 480,000 |

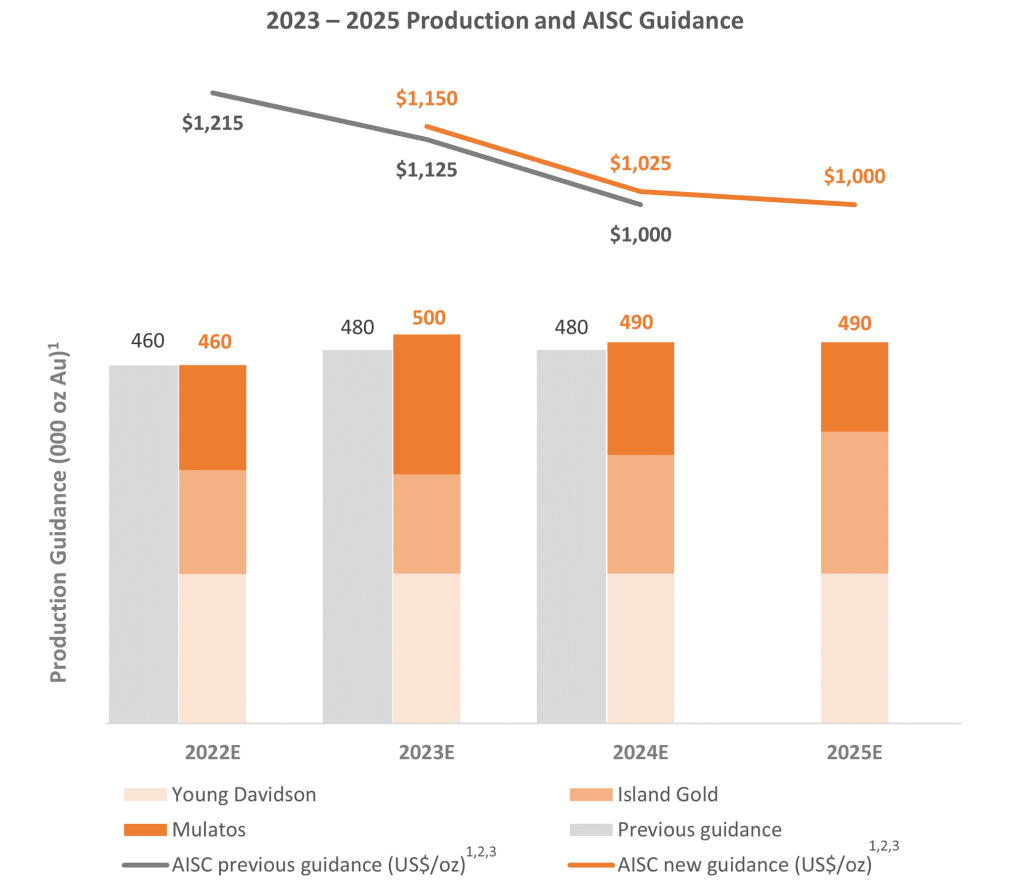

Three Year Guidance Overview1 – Operating Mines

- Multi-year production guidance increased with 9% growth expected in 2023: production is expected to increase to between 480,000 and 520,000 ounces in 2023 and remain at similar levels in 2024 and 2025. Production guidance was increased for 2023 and 2024 with stronger production expected from Island Gold and Mulatos

- Additional upside potential in 2025 with further growth expected in 2026: newly issued 2025 guidance excludes the higher-grade Puerto Del Aire (“PDA”) project which represents potential production upside at Mulatos. This upside is expected to be outlined in a new development plan for PDA to be completed in the second half of 2023. A further increase in production is expected in 2026 with the completion of the Phase 3+ Expansion at Island Gold

- Total cash costs expected to decrease 6% in 2023 to between $825 and $875 per ounce, and 22% by 2025 to $650 to $750 per ounce: costs are expected to decrease substantially over the next three years driven by low-cost production growth from La Yaqui Grande and Island Gold. A further improvement in costs is expected in 2026 following the completion of the Phase 3+ Expansion. Cost guidance for 2023 and 2024 increased a modest 3% on average over previous guidance reflecting industry-wide cost pressures

- All-in sustaining costs expected to decrease 5% to $1,125 to $1,175 per ounce in 2023, and 18% by 2025 to $950 to $1,050 per ounce: consistent with total cash costs, AISC are expected to decrease significantly over the next three years with a further improvement expected in 2026 following the completion of the Phase 3+ Expansion at Island Gold

- Total capital guidance maintained and stable over the next three years: total capital (excluding capitalized exploration) is expected to range between $292 to $332 million in 2023, consistent with 2022 guidance. This includes $280 to $320 million of capital at producing mines, with a similar rate expected in 2024, both unchanged from previous guidance. Capital spending for producing mines is expected to remain at similar levels in 2025 and decrease significantly in 2026 following the completion of the Phase 3+ Expansion. The total capital budget for 2023 includes:

- Sustaining capital guidance of $105 to $115 million: up approximately 13% from 2022, primarily reflecting higher sustaining capital at Island Gold. Sustaining capital is expected to remain at similar levels through 2025

- Growth capital guidance for producing mines of $175 to $205 million: down 11% from 2022 with the increase in growth capital at Island Gold more than offset by the decrease at Mulatos with the completion of construction at La Yaqui Grande in 2022

- Exploration budget of $47 million: similar to expected 2022 spending with the majority allocated towards following up on ongoing exploration success at Island Gold and the Mulatos District, including at the higher-grade underground PDA deposit

- Fully funded growth with strong free cash flow: higher production and declining costs are expected to drive strong free cash flow over the next three years while continuing to fund the Phase 3+ Expansion at Island Gold. A further increase in free cash flow is expected in 2026 with the completion of the Phase 3+ Expansion

- Strong ongoing returns to shareholders: through the existing $0.10 per share annualized dividend (paid quarterly) and share repurchases under the Normal Course Issuer Bid. In 2022, the Company returned $48 million to shareholders between dividends and share repurchases, consistent with 2021

1 Guidance statements in this release are forward-looking information. See the Assumptions and Sensitives section of this release along with the cautionary note at the end of this release.

Upcoming 2023 catalysts

- 2022 year-end Mineral Reserve and Resource update: February 2023

- Island Gold and Mulatos exploration updates: ongoing

- Lynn Lake Environmental Impact Statement Approval and updated Feasibility Study: H1 2023

- PDA development plan: H2 2023

2023 Guidance

| 2023 Guidance | 2022 Guidance | |||||

| Young-Davidson | Island Gold | Mulatos District | Lynn Lake | Total | Total | |

| Gold production (000 oz) | 185 – 200 | 120 – 135 | 175 – 185 | 480 – 520 | 460 (actual) | |

| Cost of sales, including amortization ($ millions)(2) |

$625 | $610 | ||||

| Cost of sales, including amortization ($/oz)(2) |

$1,250 | $1,325 | ||||

| Total cash costs ($/oz)(1) | $900 – 950 | $600 – 650 | $900 – 950 | – | $825 – 875 | $875 – 925 |

| All-in sustaining costs ($/oz)(1) | $1,125 – 1,175 | $1,190 – 1,240 | ||||

| Mine-site all-in sustaining costs ($/oz)(1)(3) | $1,175 – 1,225 | $950 – 1,000 | $950 – 1,000 | – | ||

| Capital expenditures ($ millions) | ||||||

| Sustaining capital(1) | $50 – 55 | $45 – 50 | $10 | – | $105 – 115 | $90 – 105 |

| Growth capital(1) | $5 – 10 | $165 – 185 | $5 – 10 | $12 | $187- 217 | $215 – 240 |

| Total Sustaining and Growth Capital(1) ($ millions) | $55 – 65 | $210 – 235 | $15 – 20 | $12 | $292 – 332 | $305 – 345 |

| Capitalized exploration(1) ($ millions) | $5 | $11 | $4 | $5 | $25 | $27 |

| Total capital expenditures and capitalized exploration(1) ($ millions) | $60 – 70 | $221 – 246 | $19 – 24 | $17 | $317 – 357 | $332 – 372 |

| (1) | Refer to the “Non-GAAP Measures and Additional GAAP” disclosure at the end of this press release for a description of these measures. |

| (2) | Cost of sales includes mining and processing costs, royalties, and amortization expense, and is calculated based on the mid-point of total cash cost guidance. |

| (3) | For the purposes of calculating mine-site all-in sustaining costs at individual mine sites, the Company does not include an allocation of corporate and administrative and share based compensation expenses to the mine sites. |

Gold production in 2023 is expected to increase approximately 9% over 2022 (based on the mid-point of guidance) driven by higher production from the Mulatos District, with La Yaqui Grande contributing a full year of production. Production guidance for 2023 has increased 4% from previous three-year guidance provided in January 2022 reflecting stronger outlooks for both Mulatos and Island Gold. Production is expected to be relatively balanced between the first and second half of the 2023.

Total cash costs and AISC are expected to decrease 6% and 5%, respectively, from 2022 (based on the mid-point of guidance) reflecting a full year of low-cost production from La Yaqui Grande. Costs are expected to decrease through the year, primarily driven by increasing grades and declining costs at Young-Davidson.

Capital spending is expected to decrease slightly from 2022 and is consistent with previous three-year guidance for 2023. Approximately 55% of full year capital is expected to be spent during the first half of the year. Capital spending and costs are expected to decline in the second half of the year, which is anticipated to drive stronger free cash flow.

Despite significant industry-wide inflationary pressures, the Company has maintained 2023 capital guidance and the upper end of the range of its total cash cost and AISC guidance. Furthermore, the Company remains on track to deliver a substantial decrease in costs over the next three years highlighting the strength and quality of its asset base.

2023 – 2025 Guidance: Operating Mines

| 2023 | 2024 | 2025 | |||

| Current | Previous | Current | Previous | Current | |

| Gold Production (000 oz) | |||||

| Young-Davidson | 185 – 200 | 185 – 200 | 185 – 200 | 185 – 200 | 185 – 200 |

| Island Gold | 120 – 135 | 115 – 125 | 145 – 160 | 140 – 155 | 175 – 190 |

| Mulatos District | 175 – 185 | 160 – 175 | 140 – 150 | 135 – 145 | 110 – 120 |

| Total Gold Production (000 oz) | 480 – 520 | 460 – 500 | 470 – 510 | 460 – 500 | 470 – 510 |

| Total Cash Costs(1) ($/oz) | $825 – $875 | $775 – $875 | $675 – $775 | $650 – $750 | $650 – $750 |

| All-in Sustaining Costs(1),(2) ($/oz) | $1,125 – $1,175 | $1,075 – $1,175 | $975 – $1,075 | $950 – $1,050 | $950 – $1,050 |

| Sustaining capital(1),(3) ($ millions) | $105 – 115 | $95 – 110 | $105 – 115 | $95 – 110 | $105 – 115 |

| Growth capital(1),(3),(4) ($ millions) | $175 – 205 | $185 – 210 | $185 – 215 | $195 – 220 | $185 – 215 |

| Total sustaining & growth capital(1),(3) (Operating mines; ex. exploration) ($ millions) |

$280 – 320 | $280 – 320 | $290 – 330 | $290 – 330 | $290 – 330 |

| (1) | Refer to the “Non-GAAP Measures and Additional GAAP” disclosure at the end of this press release for a description of these measures. |

| (2) | All-in sustaining cost guidance for 2024 and 2025 includes the same assumptions for G&A and stock based compensation as included in 2023. |

| (3) | Sustaining and growth capital guidance is for producing mines and excludes capital for Lynn Lake and other development projects, and capitalized exploration. |

| (4) | Growth capital was revised higher by $60m in each of 2023 and 2024 to reflect the Island Gold Phase 3+ Expansion Study released on June 29, 2022. |

Gold production is expected to remain at similar levels in 2024 and 2025, with increasing production from Island Gold offsetting a decrease in production at Mulatos. Consistent with 2023, production guidance for 2024 was increased reflecting stronger outlooks for both Island Gold and Mulatos. Production guidance for 2025 excludes any production from the higher-grade PDA project which represents potential upside within the Mulatos District. This potential upside is expected to be outlined in a new development plan for the project to be completed in the second half of 2023. The completion of the Phase 3+ Expansion at Island Gold is expected to drive a further increase in production in 2026, with additional growth potential from Lynn Lake beyond that.

Total cash costs and AISC are expected to improve significantly in 2024, decreasing 15% and 11%, respectively, from 2023. This reflects a further decrease in costs from the Mulatos District, with La Yaqui Grande providing the majority of production, as well as lower costs at Island Gold, reflecting the mining and processing of higher grades. A growing contribution of low-cost production from Island Gold is expected to drive a further decrease in costs in 2025 such that total cash costs and AISC are expected to decrease 22% and 18%, respectively, from 2022. Costs are expected to decrease further in 2026 following the completion of the Phase 3+ Expansion at Island Gold.

Capital spending at existing operations (excluding Lynn Lake) is expected to decrease slightly in 2023, primarily driven by lower capital at Mulatos with the completion of construction of La Yaqui Grande in 2022, offset in-part by a higher rate of capital spending on the Phase 3+ Expansion at Island Gold. Capital spending at existing operations is expected to remain at similar levels in 2024 and 2025 and then decrease substantially following the completion of the Phase 3+ Expansion at Island Gold in 2026. Sustaining capital spending at existing operations is expected to remain relatively stable over the next several years.

| (1) | Production and AISC are based on mid-point of guidance. |

| (2) | Refer to the “Non-GAAP Measures and Additional GAAP” disclosure at the end of this press release for a description of these measures. |

| (3) | Total consolidated all-in sustaining costs include corporate and administrative and share based compensation expenses. |

Young-Davidson

| Guidance | |||||||

| Young-Davidson | Q3 YTD 2022 | Q4 2022 | 2022A | 2022E (3) | 2023E | 2024E | 2025E |

| Gold Production (000 oz) | 148 | 45 | 192 | 185 – 200 | 185 – 200 | 185 – 200 | 185 – 200 |

| Previous Guidance (000 oz) | 185 – 200 | 185 – 200 | |||||

| Total Cash Costs(1) ($/oz) | $858 | – | – | $850 – 900 | $900 – 950 | ||

| Mine-site AISC(1),(2) ($/oz) | $1,087 | – | – | $1,125 – 1,175 | $1,175 – 1,225 | ||

| Tonnes of ore processed (tpd) | 7,919 | 7,585 | 7,835 | 8,000 | 8,000 | ||

| Grade processed (g/t Au) | 2.31 | 2.31 | 2.31 | 2.15 – 2.35 | 2.15 – 2.35 | ||

| Average recovery rate (%) | 91% | 91% | 91% | 90 – 92% | 90 – 92% | ||

| Sustaining capital(1) ($ millions) | $34 | – | – | $50 – 55 | $50 – 55 | ||

| Growth capital(1) ($ millions) | $14 | – | – | $5 – 10 | $5 – 10 | ||

| Total sustaining & growth capital(1) (ex. exploration) ($ millions) | $47 | – | – | $55 – 65 | $55 – 65 | ||

| Capitalized exploration(1) ($ millions) | $4 | – | – | $4 | $5 | ||

| (1) | Refer to the “Non-GAAP Measures and Additional GAAP” disclosure at the end of this press release and the Q3 2022 MD&A for a description and calculation of these measures. |

| (2) | For the purposes of calculating mine-site all-in sustaining costs at individual mine sites, the Company does not include an allocation of corporate and administrative and share based compensation expenses to the mine sites. |

| (3) | Refers to 2022 guidance announced on January 17, 2022. |

Gold production at Young-Davidson over the next three years is expected to be consistent with 2022 and previous guidance for 2023 and 2024, reflecting similar grades and mining and processing rates.

Grades mined and processed are expected to range between 2.15 and 2.35 grams per tonne of gold in 2023 and remain at similar levels through 2025. Grades mined are expected to increase in 2027 and beyond and average closer to Mineral Reserve grade, as YD West becomes more of a significant contributor to production.

Total cash costs and mine-site AISC are expected to increase slightly from 2022 levels, primarily reflecting industry-wide cost inflation. Costs are expected to remain at similar levels over the next three years.

Capital spending in 2023 (excluding exploration) is expected to range between $55 and $65 million, similar to 2022. Capital spending is expected to remain at similar levels in 2024 and 2025.

Young-Davidson is expected to generate mine-site free cash flow of approximately $100 million in 2022, a significant milestone for the second consecutive year. Given the strong ongoing performance of the operation since the completion of the lower mine expansion, and with a 15-year Mineral Reserve life as of the end of 2021, Young-Davidson is well positioned to generate similar free cash flow in 2023 and over the long-term.

Island Gold

| Guidance | |||||||

| Island Gold | Q3 YTD 2022 | Q4 2022 | 2022A | 2022E(3) | 2023E | 2024E | 2025E |

| Gold Production (000 oz) | 93 | 41 | 134 | 125 – 135 | 120 – 135 | 145 – 160 | 175 – 190 |

| Previous Guidance (000 oz) | 115 – 125 | 140 – 155 | |||||

| Total Cash Costs(1) ($/oz) | $650 | – | – | $550 – 600 | $600 – 650 | ||

| Mine-site AISC(1),(2) ($/oz) | $941 | – | – | $850 – 900 | $950 – 1,000 | ||

| Tonnes of ore processed (tpd) | 1,233 | 1,304 | 1,251 | 1,200 | 1,200 | ||

| Grade processed (g/t Au) | 9.25 | 10.70 | 9.64 | 8.8 – 10.8 | 8.6 – 10.2 | ||

| Average recovery rate (%) | 95% | 97% | 96% | 96 – 97% | 96 – 97% | ||

| Sustaining capital(1) ($ millions) | $26 | – | – | $35 – 40 | $45 – 50 | ||

| Growth capital(1) ($ millions) | $63 | – | – | $145 – 160 | $165 – 185 | ||

| Total sustaining & growth capital(1) (ex. exploration) ($ millions) | $90 | – | – | $180 – 200 | $210 – 235 | ||

| Capitalized exploration(1) ($ millions) |

$14 | – | – | $20 | $11 | ||

| (1) | Refer to the “Non-GAAP Measures and Additional GAAP” disclosure at the end of this press release and the Q3 2022 MD&A for a description and calculation of these measures. |

| (2) | For the purposes of calculating mine-site all-in sustaining costs at individual mine sites, the Company does not include an allocation of corporate and administrative and share based compensation expenses to the mine sites. |

| (3) | Refers to 2022 guidance announced on January 17, 2022. |

Production guidance for Island Gold has increased 6% for 2023 and 3% for 2024, relative to previous three-year guidance, reflecting increased grades. Gold production in 2023 is expected to remain at similar levels as 2022 with similar grades and mining and processing rates. As outlined in the Phase 3+ Expansion study released in June 2022, grades mined are expected to increase in 2024, driving production higher. A further increase in grades and increase in mining rates toward the latter part of 2025, are expected to drive another increase in production in 2025. Mining rates are expected to increase in 2026 following the completion of the Phase 3+ Expansion, driving a more significant increase in production.

Total cash costs and mine-site AISC are expected to increase slightly in 2023 compared to 2022, reflecting industry-wide cost inflation. Costs are expected to decrease slightly in 2024 and 2025, reflecting higher grades processed. A further decrease in mine-site AISC is expected in 2026 and beyond following the completion of the Phase 3+ Expansion.

Capital spending at Island Gold (excluding exploration) is expected to be between $210 and $235 million in 2023 as spending on the Phase 3+ Expansion ramps up. The first half of 2023 will be focused on construction of the hoist house and headframe, with the sinking of the shaft expected to commence in the latter part of the year. Capital spending is expected to be weighted earlier in the year with approximately 55% of the full year budget planned to be spent in the first half of the year. Consistent with the Phase 3+ Study, capital spending is expected to remain at similar levels in 2024 and 2025 and then drop considerably in 2026 once the expansion is complete.

Mulatos District

| Guidance | |||||||

| Mulatos District | Q3 YTD 2022 | Q4 2022 | 2022A | 2022E(3) | 2023E | 2024E | 2025E |

| Gold Production (000 oz) | 85.4 | 49 | 134 | 130 – 145 | 175 – 185 | 140 – 150 | 110 – 120 |

| Previous Guidance (000 oz) | 160 – 175 | 135 – 145 | |||||

| Total Cash Costs(1) ($/oz) | $1,298 | – | – | $1,225 – 1,275 | $900 – 950 | ||

| Mine-site AISC(1),(2) ($/oz) | $1,426 | – | – | $1,325 – 1,375 | $950 – 1,000 | ||

| Tonnes of ore stacked – Mulatos crusher (tpd) (4) | 16,600 | 16,100 | 16,500 | 17,000 | 15,000 – 17,000 | ||

| Grades stacked – Mulatos (g/t Au) | 0.72 | 0.78 | 0.73 | 0.7 – 1.0 | 0.8 – 1.0 | ||

| Recovery ratio (%) | 52% | 32% | 47% | – | 50 – 55% | ||

| Tonnes of ore stacked – La Yaqui Grande (tpd) | 6,159 | 11,100 | 7,800 | – | 10,000 | – | – |

| Grades stacked – La Yaqui Grande (g/t Au) | 1.33 | 1.43 | 1.38 | – | 1.15 – 1.45 | – | – |

| Recovery ratio (%) | 63 % | 79 % | 71% | – | 80 – 85% | – | – |

| Sustaining capital(1) ($ millions) | $9 | – | – | $5 – 10 | $10 | ||

| Growth capital(1) ($ millions) | $47 | – | – | $50 – 55 | $5 – 10 | ||

| Total sustaining & growth capital(1) (ex. exploration) ($ millions) |

$56 | – | – | $55 – 65 | $15 – 20 | ||

| Capitalized exploration(1) ($ millions) | $1 | – | – | – | $4 | ||

| (1) | Refer to the “Non-GAAP Measures and Additional GAAP” disclosure at the end of this press release and the Q3 2022 MD&A for a description and calculation of these measures. |

| (2) | For the purposes of calculating mine-site all-in sustaining costs at individual mine sites, the Company does not include an allocation of corporate and administrative and share based compensation expenses to the mine sites. |

| (3) | Refers to 2022 guidance announced on January 17, 2022. |

| (4) | Tonnes stacked are expected to range between 15,000 – 17,000 tpd during the first half of the year until the main Mulatos pit has been depleted. |

Combined gold production from the Mulatos District (including La Yaqui Grande) is expected to be between 175,000 and 185,000 ounces in 2023. This represents a 34% increase from 2022 (based on the mid-point of guidance) driven by a full year of low-cost production from La Yaqui Grande. Production guidance for 2023 and 2024 has increased 7% and 4%, respectively, from previous three-year guidance, primarily reflecting the stacking and processing of additional stockpiled ore during the first half of 2023.

Production from the Mulatos District will be weighted towards the first half of 2023 with the main Mulatos pit, including El Salto, expected to be depleted mid-year. Grades stacked at La Yaqui Grande are also expected to decrease in the second half of the year and range between 1.15 and 1.45 g/t Au for the full year. In addition to ongoing production from La Yaqui Grande, the Mulatos District will benefit from residual leaching of El Salto and stockpiled ore at declining rates of production in the second half of 2023, through to the middle of 2024.

Total cash costs are expected to remain relatively stable through the year while mine-site AISC are expected to decrease in the second half of 2023 with the majority of sustaining capital expected to be spent during the first half of the year.

Gold production is expected to decrease to a range of 140,000 to 150,000 ounces in 2024 with La Yaqui Grande providing the majority of production and driving a further improvement in costs. Production guidance was increased for 2024 reflecting additional expected production through residual leaching at Mulatos.

Production guidance for 2025 of 110,000 to 120,000 ounces is for La Yaqui Grande only and excludes potential upside from the PDA higher-grade underground deposit. This upside is expected to be outlined in a new development plan for PDA to be completed in the second half of 2023.

Grades at La Yaqui Grande are expected to average slightly below the Mineral Reserve grade of 1.25 g/t Au in 2025 after averaging above in 2023 and 2024. Mulatos District production is expected to increase in 2026 reflecting higher grades at La Yaqui Grande and the potential ramp up of production from PDA.

Capital spending is expected to total $15 to $20 million in 2023, a considerable decrease from 2022, with La Yaqui Grande construction complete. Capital spending is expected to decrease further in 2024 and 2025 (excluding PDA development).

2023 Global Operating and Development Capital Budget

| 2023 Guidance | 2022 Guidance | ||||

| Sustaining Capital(1) | Growth Capital(1) | Total | Total | ||

| Operating Mines ($ millions) | |||||

| Young-Davidson | $50 – 55 | $5 – 10 | $55 – 65 | $55 – 65 | |

| Island Gold | $45 – 50 | $165 – 185 | $210 – 235 | $180 – 210 | |

| Mulatos District | $10 | $5 – 10 | $15 – 20 | $55 – 65 | |

| Total – Operating Mines | $105 – 115 | $175 – 205 | $280 – 320 | $290 – 330 | |

| Development Projects ($ millions) | |||||

| Lynn Lake | – | $12 | $12 | $11 | |

| Total – Development Projects | – | $12 | $12 | $15(2) | |

| Capitalized Exploration(1) ($ millions) | |||||

| Young-Davidson | – | $5 | $5 | $4 | |

| Island Gold | – | $11 | $11 | $20 | |

| Mulatos District | – | $4 | $4 | – | |

| Lynn Lake | – | $5 | $5 | $3 | |

| Total – Capitalized Exploration(1) | – | $25 | $25 | $27 | |

| Total Consolidated Budget ($ millions) | $105 – 115 | $212 – 242 | $317 – 357 | $332 – 372 | |

| (1) | Refer to the “Non-GAAP Measures and Additional GAAP” disclosure at the end of this press release for a description and calculation of these measures. |

| (2) | Includes $4 million of other capital largely attributed to the Esperanza project that was sold on April 12, 2022. |

2023 Capital Budget for Lynn Lake

Capital spending on the Lynn Lake project, excluding exploration, is expected to total $12 million. The focus will be on advancing detailed engineering and permitting, as well as completing an updated Feasibility Study. The Environmental Impact Statement for Lynn Lake is expected to be approved during the first half of 2023 after which the Company expects to release an updated Feasibility Study. Additionally, $5 million has been budgeted for exploration at Lynn Lake for a total capital budget of $17 million at the project.

As part of the Company’s balanced approach to growth and capital allocation, no significant capital is expected to be spent on the construction of Lynn Lake until the Phase 3+ Expansion at Island Gold is well underway.

2023 Exploration Budget

The global exploration budget for 2023 is $47 million, similar to expected spending in 2022. Mulatos District accounts for the largest portion with an increased budget of $17 million. This is followed by $14 million at Island Gold, $8 million at Young-Davidson and $5 million at Lynn Lake. The increased budget at Mulatos was partially offset by a lower exploration budget at Island Gold reflecting an expanded underground drilling program, which is lower cost than surface directional drilling. Approximately 55% of the 2023 budget will be capitalized.

Mulatos District

A total of $17 million has been budgeted at Mulatos for exploration in 2023, more than double the $7 million budget for 2022. This includes 16,000 metres (“m”) of surface exploration drilling at PDA, a higher-grade underground deposit, adjacent to the main Mulatos pit. PDA is comprised of five zones including PDA1, PDA2, Gap, Victor and Estrella. The 2023 program will include drilling at all five zones, continuing to expand on a successful 2022 drill program that extended high-grade mineralization beyond currently defined Mineral Reserves and Resources.

Additionally, the regional exploration budget has doubled to 34,000 m with the focus on several high priority targets including Halcon, Halcon West, Carricito, Bajios, and Jaspe.

Island Gold

A total of $14 million has been budgeted primarily for underground exploration at Island Gold in 2023. This is down from the 2022 budget of $22 million, reflecting the transition from higher cost surface directional drilling to a more cost effective expanded underground drilling program.

For the past several years, the exploration focus has been on adding high-grade Mineral Resources at depth in advance of the Phase 3+ Expansion study, primarily through surface directional drilling. This exploration strategy has been successful in nearly tripling the Mineral Reserve and Resource base since 2017 to over five million ounces of gold. With an 18-year mine life, and with work on the expansion ramping up, the focus will be shifting to a more cost-effective expanded underground drilling program that will leverage existing underground infrastructure. This drilling is much lower cost on a per metre basis, is less technically challenging, and requires significantly fewer metres per exploration target.

The underground exploration drilling program has been expanded from 27,500 m in 2022 to 45,000 m in 2023. The program is focused on defining new Mineral Reserves and Resources in proximity to existing production horizons and infrastructure including along strike, and in the hanging-wall and footwall. These potential high-grade Mineral Reserve and Resource additions would be low cost to develop and could be incorporated into the mine plan and mined within the next several years, further increasing the value of the operation. To support the underground exploration drilling program, 444 m of underground exploration drift development is planned to extend drill platforms on the 490, 790, 945, and 980-levels. In addition to the exploration budget, 36,000 m of underground delineation drilling has been planned and included in sustaining capital for Island Gold.

The 2022 exploration program was successful at further extending high-grade gold mineralization laterally and at depth within Island East, Main and West, as well as within newly defined sub-parallel structures adjacent to existing infrastructure. This included extending high-grade mineralization 225 m west of existing Mineral Reserves and Resources in Island West (97.21 g/t Au (58.55 g/t cut) over 5.05 m (MH33-01)). High-grade gold mineralization was also extended 160 m below Inferred Mineral Resources in Island Main in one of the deepest intersections to date at Island Gold with a vertical depth of 1,666 m (23.21 g/t Au over 2.50 m in drill hole MH30-02; see press release dated November 29, 2022). With the deposit open laterally and at depth, these results highlight the significant potential for further growth in Mineral Reserves and Resources .

A regional exploration program including 7,500 m of drilling is also budgeted in 2023. The focus will be on evaluating and advancing exploration targets outside the Island Gold Deposit on the 15,500-hectare Island Gold property.

Young-Davidson

A total of $8 million has been budgeted for exploration at Young-Davidson in 2023, up from $5 million in 2022. The 2023 program includes 21,600 m of underground exploration drilling, and 400 m of underground exploration development to extend drill platforms on the 9220, 9270, and 9590-levels.

The focus of the underground exploration drilling program will be to expand Mineral Reserves and Resources in five target areas in proximity to existing underground infrastructure. This includes targeting additional gold mineralization within the syenite which hosts the majority of Mineral Reserves and Resources, as well as within the hanging wall and footwall of the deposit where higher grades have been previously intersected.

Through ongoing exploration success, Young-Davidson has maintained at least a 13-year Mineral Reserve life since 2011 and more recently increased to 15-years as of the end of 2021. With the deposit open at depth and to the west, there is excellent potential for this track record to continue.

In addition, 5,000 m of surface drilling is planned to test near-surface targets across the 5,900 hectare Young-Davidson Property.

Lynn Lake

A total of $5 million has been budgeted for exploration at the Lynn Lake project in 2023. This includes 8,000 m of drilling focused on several advanced regional targets, expansion of Mineral Reserves and Resources in proximity to the Gordon deposit, as well as the targeting and evaluation of the Burnt Timber and Linkwood deposits. Burnt Timber and Linkwood contain Inferred Mineral Resources totaling 1.6 million ounces grading 1.1 g/t Au (44 million tonnes) as of December 31, 2021 and represent potential future upside.

The other key area of focus for 2023 is the continued evaluation and advancement of a pipeline of prospective exploration targets within the 58,000-hectare Lynn Lake Property including the Tulune greenfields discovery and Maynard.

Assumptions and Sensitivities

| Assumptions & Expenses | 2023 | |

| Gold price | $/oz | $1,650 |

| Canadian dollar | USD/CAD | $0.75:1 |

| Mexican peso | MXN/USD | 20.0:1 |

| Amortization | $/oz | $400 |

| General & Administrative(1) | $ millions | $25 |

| (1) | Excludes stock-based compensation. |

The 2023 to 2025 production forecast, operating cost and capital estimates are based on a gold price assumption of $1,650 per ounce, a USD/CAD foreign exchange rate of $0.75:1 and MXN/USD foreign exchange rate of 20.0:1. Cost assumptions for 2024 and 2025 are based on 2023 input costs and have not been increased to reflect potential inflation in those years. These estimates may be updated in the future to reflect inflation beyond what is currently forecast for 2023.

Amortization expense in 2023 is expected to total approximately $400 per ounce, a decrease from 2022, reflecting the increase in Mineral Reserves at all three operations announced in February 2022. General and administrative expenses in 2023 are expected to total $25 million (excluding stock-based compensation), consistent with 2022 spending.

| Sensitivities | 2023 | Operating Sites Local Currency Exposure | Change | Free Cash Flow Sensitivity (1) |

| Gold price | $1,650 | – | $100 | ~$45 – 50 million |

| USD/CAD | $0.75:1 | 95% | $0.05 | ~$20 – 25 million |

| MXN/USD | 20.0:1 | 40% | 1.00 | ~$3 – 4 million |

| (1) | Free cash flow sensitivities include the impact of foreign exchange and short term gold hedging arrangements noted below. |

Current foreign exchange and gold hedging commitments

The Company has entered into the following foreign exchange and short-term hedging arrangements to date:

- Canadian dollar: approximately 75% of Canadian dollar-denominated operating and capital costs for 2023 have been hedged, ensuring a maximum USD/CAD foreign exchange rate of $0.77:1 and allowing the Company to participate in weakness in the USD/CAD down to an average rate of $0.72:1 (if the USD/CAD rate weakens beyond $0.72:1, the average rate increases to $0.74:1).

- Mexican peso: approximately 49% of Mexican peso-denominated operating and capital costs in 2023 have been hedged, ensuring a minimum MXN/USD foreign exchange rate of 20.5:1 and allowing the Company to participate in weakness in the MXN/USD up to an average rate of 24.9:1 (if the MXN/USD rate weakens beyond 24.9:1, the average rate decreases to 22.7:1).

- Gold collar contracts: The Company also periodically enters into short term gold hedging arrangements. Currently, the Company has hedged 56,100 ounces in 2023, ensuring an average minimum gold price of $1,765 per ounce and participation up to an average gold price of $2,148 per ounce. This represents approximately 11% of 2023 production (based on mid-point of guidance).

Qualified Persons

Chris Bostwick, Alamos’ Senior Vice President, Technical Services, who is a qualified person within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this press release.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos mine in Sonora State, Mexico. Additionally, the Company has a strong portfolio of growth projects, including the Phase 3+ Expansion at Island Gold, and the Lynn Lake project in Manitoba, Canada. Alamos employs more than 1,900 people and is committed to the highest standards of sustainable development.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE