Peter Krauth – “Fed’s Action Could Launch Silver”

Fed Chair Jerome Powell spoke at the Brookings Institution on Wednesday…and helped launch silver.

The key takeaway came with Powell engaged in question and answer period after his speech.

Replying to a question, Powell said, “I don’t want to overtighten. Cutting rates is not something we want to do soon. So that’s why we’re slowing down and we are going to try to find our way to what that right level is.”

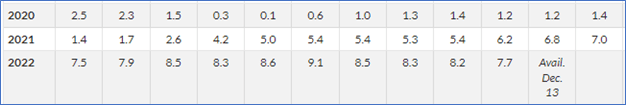

It’s interesting that he highlighted that monetary policy acts with a lag, admitting that the full force of the Fed’s aggressive rate hiking had yet to kick in. I find it interesting, because the Fed didn’t seem to appreciate that lag when they waited, and waited, to first start raising rates despite inflation having soared to a multi-year high of 4.2% in April 2021, and then remained well above 6% since October of last year.

In response to those comments, the US dollar index lost 100 basis points, while gold jumped 1.1% to $1,770, and silver spiked 4.4% to $22.18. The next day, Thursday, these two metals rallied even harder, with gold breaking the $1,800 level and silver crossing the $22.50 level. Within just two days, gold is up 2.9% while silver gained 6.2%. And this despite US Core Personal Consumption Expenditures (PCE) Price Index levels, while up 0.2% in the past month, were lower than the expected 0.3%. On an annual basis, core PCE was up 5% in October, down from 5.2% in September. And precious metals still rallied hard as they continued to digest Powell’s remarks the day prior.

And speaking of lag effects, here’s a doozie.

Bank of America just warned that the US economy will begin losing 175,000 jobs per month starting in the first quarter of 2023, and a “hard landing” (recession) is likely versus a “soft landing” economic slowdown. That’s because they expect the Fed to accept some labor market weakness in order to slow inflation in a notable way.

I think we may have seen a peak in inflation, but a peak that will eventually be revisited. That’s because central bank rate hikes have already begun having an effect. Higher mortgage rates dramatically slowed housing, with pending home sales having declined for 5 straight months into October. And that’s going to have a ripple effect as related jobs take a hit. That’s also likely to help slow demand on all kinds of consumer and commercial goods and services.

The Institute for Supply Management’s (ISM) manufacturing PMI dropped to 49% for November, down from October’s 50.2% and below the forecast 49.7%. This also helped bolster precious metals in the last couple of days.

As inflation rates dial back, we’ll be comparing them with rates of a year ago onward, when they really kicked into high gear. So weakening inflation will look more impressive, thanks to this “base effect.”

Source: usinflationcalculator.com

Source: usinflationcalculator.com

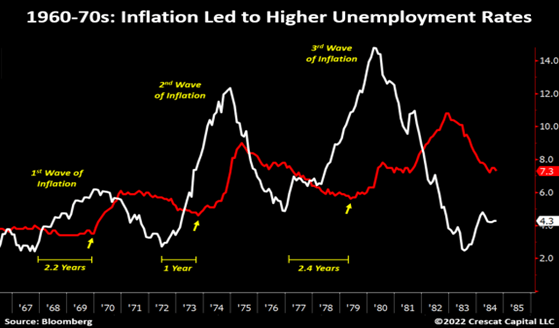

But remember the lag effect. I think we’re going to revisit to some degree the cycles of the last big inflationary period – the late 1960s to early 1980s.

As I describe in my book, The Great Silver Bull, in Chapter 18: Silver, Gold, and Commodities Sensing Inflation, there were three successive rising inflationary waves in the 1970s. As you can see in the chart below, unemployment started to climb close to when inflation peaked.

I explained further:

“As the U.S. Federal Reserve and government tried to alternate between fighting inflation and supporting economic growth, the boom-and-bust cycle wreaked havoc on the economy.”

So, as the Fed backs off its rate hikes, the lag means inflation may also back off for a while. But the lag feeds into the labour markets as well. And when compensation agreements come up for review, you can bet employees will want raises commensurate with the price inflation they’ve been enduring for the past two years.

And so a new rising inflation wave starts again, prompting the Fed to want to kick off a new rate hiking cycle. But as I also point out in my book:

“What’s different about that period is debt-to-GDP levels were close to 35% – where today they’re closer to 130%. With such massive debt at the government, corporate and personal levels, central banks find it nearly impossible to raise rates without crushing the economy.”

My point is, I’m not sure the Fed and other central banks will have much, if any, ability to fight future waves of inflation. And that bolsters the case for silver even more.

Right now goods, services, and labour markets are tight. But once the “hard landing” recession becomes undeniable, central bankers will back off. The reaction we saw on Wednesday in gold and silver are likely pricing in this scenario. A pivot/pause from the Fed could be as little as 1 or 2 calendar quarters away.

I also think that central bankers will have little choice but to deem higher inflation rates, closer to 4%, as the “new normal.” This will provide the cover they need to exert “financial repression” on citizens as extended negative real rates will help lessen huge and growing government debt burdens.

These drivers, and a lot more, are all covered in my recent book The Great Silver Bull.

If you haven’t picked up a copy yet, it’s easy.

CLICK HERE to order The Great Silver Bull

The clearly bullish action of the last few days suggest silver may be at a turning point. I think odds are improving considerably that silver is kick off a new rally.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE