ALLIED COPPER INTERSECTS 4.26% COPPER OVER 1.06 METRES AT WEST GRABEN FAULT TARGET IN COLORADO

- First modern drill test of the Klondike Property, funded by Allied under earn-in agreement in partnership with Alianza Minerals Ltd. and Cloudbreak Discovery PLC

- Management interpretation of results indicates strong potential for copper mineralization on the main strand of the West Graben Fault

- West Graben Fault target is a priority for the next phase of drilling at Klondike

Allied Copper Corp. (TSX-V: CPR) is pleased to announce results of the first modern drill test of the Klondike Property, funded by Allied and in partnership with Alianza Minerals Ltd. (TSX-V: ANZ) (OTCQB: TARSF) and Cloudbreak Discovery PLC (LSE: CDL), under the terms of an earn-in agreement with the Alliance.

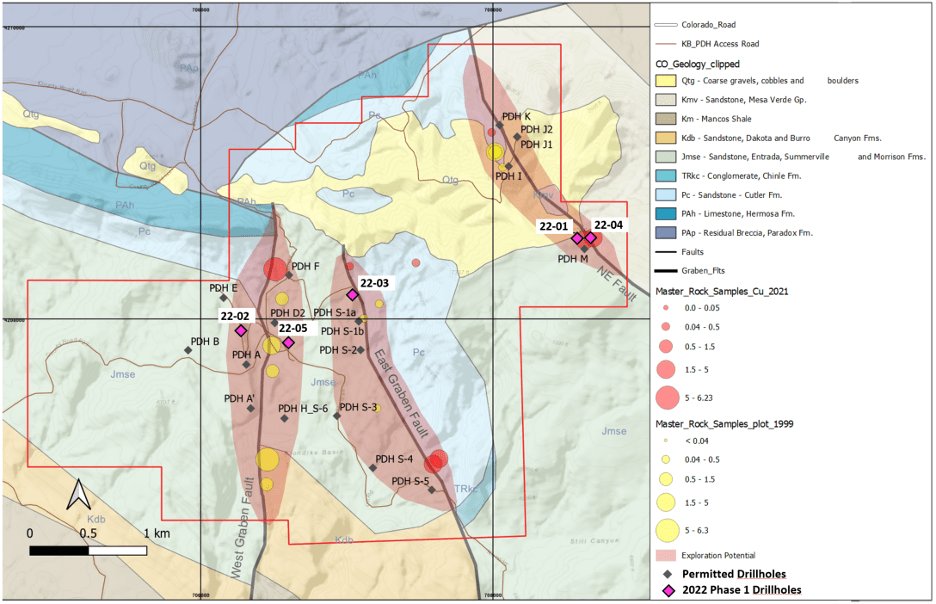

Five holes were completed, testing targets at the Northeast Fault (two holes), West Graben Fault (two holes) and East Graben Fault (one hole), the results of which are outlined in the table below. At the West Graben Fault, hole ‘KDB22-05’ yielded a 42 metre long (core length) section with strong alteration and anomalous copper mineralization in a halo surrounding a fault intersection of 4.26% copper over 1.06 metres. Management interprets this as a strong indication of the potential for copper mineralization in the main strand of the West Graben Fault. With 76 unpatented mining claims, a State of Colorado Exploration Permit and an exclusive right to a State lease, the Klondike property affords Allied and the Alliance extensive runway to define additional copper exploration targets. Combined with the Company’s recent acquisition of Volt Lithium Corp, active exploration of these copper assets supports Allied’s goal of becoming a meaningful and responsible contributor to the world’s battery metals supply.

“We are very pleased with the results of this first drill test, which intersected a strand of the West Graben Fault featuring a large alteration footprint and the presence of high-grade copper mineralization,” stated Warner Uhl, Executive Chairman of Allied. “This represents an important milestone in our journey to build a battery metals-focused company with the size and scale to deliver critical inputs needed for a clean energy future. Further, by focusing on assets within high integrity jurisdictions, such as Colorado for copper and Alberta for our lithium assets, stakeholders can be confident we are adhering to robust regulatory regimes with strong environmental regulation, all of which are important ingredients in the generation of long-term value for shareholders.”

Table 1 – Klondike 2022 Drill Intercepts

| Hole | Target | From (m) | To (m) | Interval (m) | Copper (%) |

| KDB22-01 | North East Fault | 3.41 | 14.81 | 11.40 | 0.34 |

| Incl. | 7.19 | 13.99 | 6.80 | 0.51 | |

| KDB22-02 | West Graben Fault | 3.05 | 3.93 | 0.88 | 0.13 |

| KDB22-03 | East Graben Fault | 11.64 | 14.33 | 2.69 | 0.21 |

| and | 24.69 | 25.30 | 0.61 | 0.66 | |

| KDB22-04 | North East Fault | 14.57 | 17.65 | 3.08 | 0.24 |

| Incl. | 15.85 | 16.89 | 1.04 | 0.57 | |

| KDB22-05 | West Graben Fault | 44.96 | 46.02 | 1.06 | 4.26 |

| and | 68.88 | 70.41 | 1.53 | 0.39 | |

| and | 74.07 | 75.13 | 1.05 | 0.17 |

North East Fault Target

Two holes were drilled in a scissor pattern to test the trace of the North East Fault, however problems with the drill rig prevented both holes from reaching target depth.

- KDB22-01 was collared on Salt Wash Member sandstone that is strongly mineralized in the target area, including previous chip samples in 2021 that included 4.6 metres averaging 1.56% copper and 1.4 g/t silver. The first 3.4 metres of malachite and copper oxide mineralization were not recovered due to broken ground and setting casing, with the next 6.8 metres averaging 0.51% copper.

- KDB22-04 intersected 3.08 metres of 0.24% copper from 14.57 metres depth.

Given the targeted North East Fault was ultimately not tested here, the presence of significant copper mineralization at the tops of both KDB22-01 and -04 is particularly encouraging. Copper mineralized sandstones at the North East Fault target can be traced along the fault and outboard from it into the adjacent sandstones over an area 200 metres long by 100 metres wide before becoming obscured beneath gravel cover. Further anomalous copper, including 2.1 metres of 463 ppm copper, was encountered over one kilometre (“km”) to the northwest where the structure and host strata next appear from beneath the same gravel cover.

West Graben Fault

Two holes, KDB22-02 and -05, were located to test the West Graben Fault target.

- KDB22-05 intersected an eastern strand of the West Graben Fault, which contained native copper and chalcocite at a depth of 44.96 metres. This interval returned 4.26% copper over 1.06 metres within a broad interval of anomalous copper mineralization (chalcocite and copper oxide) over 42 metres. This -05 hole exhibits extensive alteration and bleaching, with chalcocite and copper oxides within four different sedimentary units in the hole. Strong copper mineralization within the fault strand and the extent of alteration and bleaching within adjacent units suggests the main strand of the fault remains a highly prospective target.

East Graben Fault

One hole, KDB22-03, targeted the East Graben Fault, where surface sampling returned anomalous copper over 2 km of strike length, including 2.8% copper with 37.8 g/t silver and 1.5% copper with 24.3 g/t silver in rock samples.

- KDB22-03 encountered patchy malachite and copper oxides throughout the section cutting sandstones of the Salt Wash Formation. Drill rig difficulties again prevented the fault itself from being intersected and the target remains untested. However, the presence of patchy copper mineralization, particularly in the Salt Wash Formation, indicates the potential for copper mineralization between the two graben-bounding faults (East and West Graben Faults), a distance of 600 metres from KDB22-05.

About the Klondike Property

The Klondike property is located approximately 25 km south of Naturita, Colorado. This property lies within the Paradox Copper Belt, which includes the producing Lisbon Valley Mining Complex, located 50 km to the northwest.

The 2022 drilling program followed a 2021 reconnaissance program that consisted of mapping, stream sediment sampling and rock sampling at the Klondike property to help define drill targets at the West Graben Fault and East Graben Fault. Rock sampling and mapping successfully expanded the footprint of both targets and identified a new target, named the North East Fault.

The Klondike property features year-round access, being situated approximately two km along a gravel road off of a paved highway. The Project is comprised of 76 mining claims on Federal mineral rights managed by the US Bureau of Land Management (“BLM”), in addition to an Exploration Permit and the exclusive right to a State lease from the State of Colorado.

Figure 1. Klondike Geology and Drill Plan with Copper Results

About Allied Copper

Allied Copper is a growth-oriented, battery-metals focused exploration company whose strategy is to acquire and develop low-cost and potentially high-growth battery metals assets that represent key inputs needed to support the global energy transition, located in ESG-friendly jurisdictions. Allied’s core assets include a partnership agreement to earn-in on the copper-focused Klondike Property in Colorado, and via the Company’s wholly-owned subsidiary, Volt Lithium Corp., approximately 400,000 acres of mines and minerals permits in the Rainbow Lake area of Alberta, specifically targeting lithium found in the brines of the Keg River formation. Deploying a development model grounded in science, the Company will leverage the Volt team’s oil and gas chemical extraction and fluid management experience. Allied is committed to operating efficiently and with transparency across all areas of the business and are sharply focused on creating long-term, sustainable value for shareholders.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE