Mako Mining On Track For Record Q4 Gold Sales, Announces Plant Capacity Expansion to 600tpd With No Additional Capex and Provides Corporate Update

Mako Mining Corp. (TSX-V: MKO) (OTCQX: MAKOF) is pleased to provide an interim Q4 2022 production update from its San Albino gold mine in northern Nicaragua, the announcement of a plant expansion to 600 tonnes per day with no additional capex, and a general corporate update. Financial results for Q3 2022, including detailed reporting of our operating costs, are expected to be released on November 21, 2022. All dollar amounts herein are expressed in US dollars.

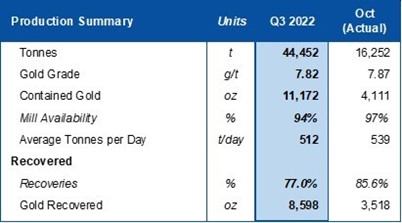

In the Company’s Q3 2022 production results update (see October 21st, 2022 press release), Mako announced that it had rectified the issues which led to reduced recovery rates from March through August 2022 (77% Q3 2022 recoveries vs. 86% expected), and lower throughputs for the quarter which were implemented in order to observe the effects of increased plant residence time on recovery rates (481tpd, including availability, vs. 500tpd expected). The Company is pleased to announce that the plant is now operating significantly above nameplate capacity, with recoveries at expected levels. During October, the mill operated at 539 tpd at 97% availability (4.6% above nameplate capacity), with 85.6% recoveries, and 3,518 ounces of recovered gold (see Table 1).

The Company sold a total of 5,455 ounces of gold in the first half of Q4 2022 (from October 1st through November 15th), putting the Company on track for record gold sales in Q4 2022.

In November, the Company commissioned a pre-leach thickener circuit that will allow for higher material density, allowing increased throughput rates without sacrificing any residence time. The pre-leach thickener will also result in optimized cyclone performance due to a reduced cyclone feed density which will improve leach circuit performance. By the end of the quarter, Mako expects to be operating at 600 tpd with no additional capex and minimal recovery losses.

Akiba Leisman, Chief Executive Officer of Mako states that, “Q4 is starting out very strong, and we now expect record gold sales at San Albino. Now that the recovery issues from March through August have been fully resolved, it is clear that the plant can operate at substantially higher throughputs than what it was originally designed for without the need for any additional capital. After the relatively weak Q2 and Q3 quarters, this will have a significantly positive impact on costs, cash flow and earnings beginning this quarter.”

Q3 Financial Results

The Company’s Q3 2022 financial statements and management discussion and analysis are expected to be filed on Monday November 21, 2022. As mentioned above, the 9% reduction in recoveries vs. expectations, the 4% reduction of plant throughput in order to increase plant residence time, and the last shipment of gold being sold after quarter end, meant Q3 gold sales were approximately 1,700 ounces less than what they would have otherwise been, lowering mine operating cash flow by 15-20%, and increasing AISC1 to approximately $1330/oz, including corporate overhead.

Given the performance of the plant in the current quarter, which we expect to continue for the foreseeable future, AISC will be reduced by approximately $200 per ounce beginning in Q4 2022.

| (1) Refers to a Non-GAAP financial measure within the meaning of National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure. For further details and a reconciliation to the closes IFRS measure, please refer to information under the heading “Non-IFRS Measures” in the Company’s Management’s Discussion and Analysis for Q3 2022 available at www.sedar.com. |

Depletion and Depreciation Expense

In October 2020, Mako published its National Instrument 43-101 Technical Report and Estimate of Mineral Resources for the San Albino Project. A portion of that published mineral resource formed the basis of our non-cash depletion and depreciation calculation through Q3 2022.

Subsequently, the Company has added certain previously delineated mineral resources into a mine plan and identified additional mineral resources within the San Albino mine area, which are expected to increase the base of the estimated tonnes to be depleted going forward. In addition, we expect that a maiden mineral resource at Las Conchitas (which currently has no carrying value) will be incorporated into a separate mine plan beginning early next year. In this context, we expect to see a materially lower depletion and depreciation expense, and a significant increase in net income starting in Q4 2022.

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako’s primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

Table 1 – October Production Results (CNW Group/Mako Mining Corp.)

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE