Nighthawk Gold Reports 916.00 g/t Au over 0.50 m (with 232.18 g/t over 2.00 m) at the Cass Deposit

Nighthawk Gold Corp. (TSX: NHK) (OTCQX: MIMZF) is pleased to report assay results from drilling at the Cass Deposit, part of the Kim and Cass Deposits, which are within 15 kilometres of the Colomac Centre Area.

|

Table 1 – Highlight Drill Assay Results from the Kim and Cass Deposits

|

||||

| Hole ID | Deposit | Highlight Assay Result | ||

| CM22-22 | Cass | 232.18 grams per tonne over 2.00 metres

(including 916.00 g/t Au over 0.50 m) |

||

| CM22-07 | Cass | 125.50 g/t Au over 0.50 m | ||

| CM22-31 | Cass | 2.67 g/t Au over 33.50 m (38.57 g/t Au over 1.50 m) | ||

| CM22-29 | Cass | 3.15 g/t Au over 24.00 m (including 21.05 g/t Au over 2.00 m) | ||

| CM22-10 | Cass | 1.58 g/t Au over 34.50 m (including 23.60 g/t Au over 0.50 m) | ||

| CM22-21 | Cass | 3.92 g/t Au over 14.00 m (including 84.70 g/t Au over 0.50 m) | ||

| CM22-34 | Cass | 3.21 g/t Au over 15.50 m (including 48.40 g/t Au over 0.50 m) | ||

| CM22-25 | Cass | 2.75 g/t Au over 13.50 (including 31.00 g/t Au over 0.50 m) | ||

Note: True widths remain undetermined at this stage. All assays are uncut. Further statistical analysis will be required prior to establishing a suitable cut grade.

Nighthawk President & CEO Keyvan Salehi commented, “The results from the Cass Deposit drilling are some of the most impressive high-grade, near-surface intercepts we have seen from all the deposits that make up the Colomac Gold Project. We intersected these high-grade intercepts mostly outside the current Mineral Resource Estimate1 pit-shells, suggesting the expansion of known mineralization and a potential improvement of the open-pit grade profile of the Cass Deposit.”

“With the 40 km drill database completed and disclosed for 2022, we have all the information needed to update the 2022 MRE, which we plan to deliver in early 2023.”

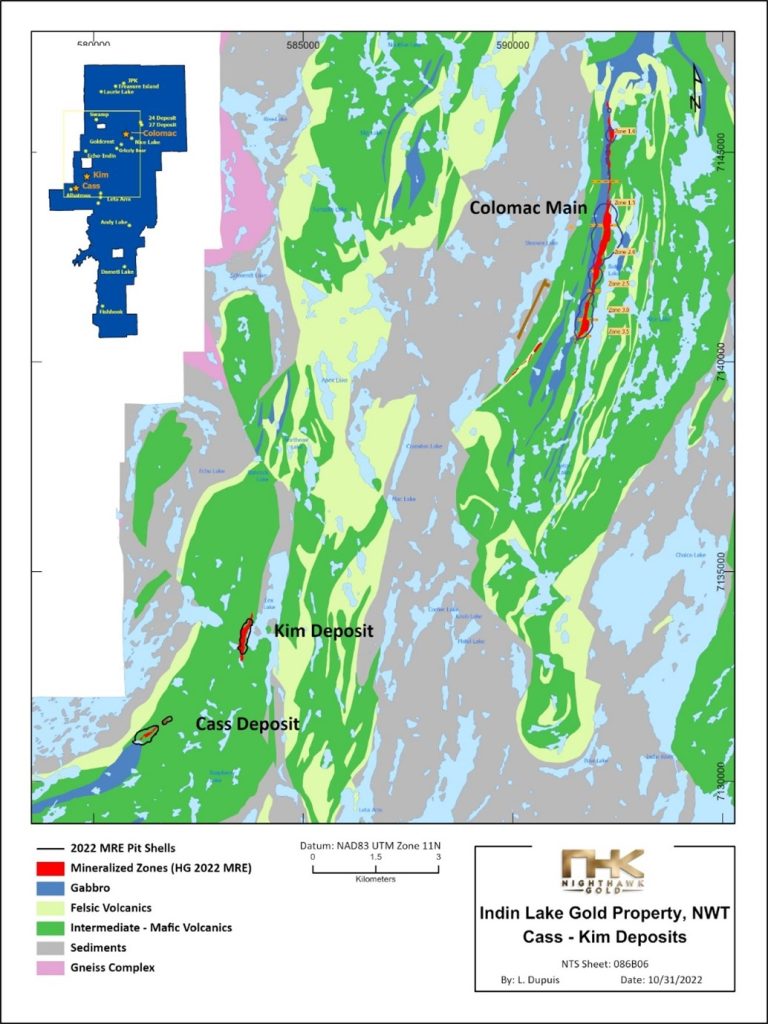

Kim and Cass Deposits

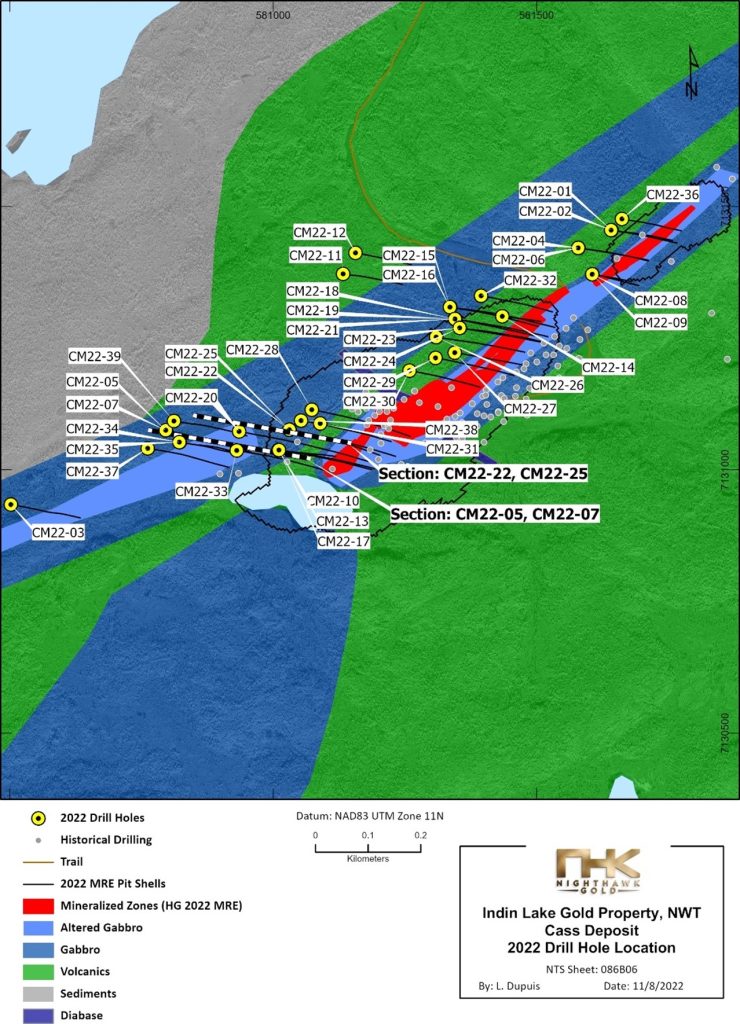

The Kim and Cass Deposits are high-grade, potential open-pit deposits that are located within 15 km southwest of the Colomac Centre. Exploration at the Kim and Cass Deposits focused on understanding the structural controls of the mineralization and expanding the near-surface mineral resources of these deposits. Please refer to Figures 3 and 4 for the District-Scale Regional Map and Local Map of Cass Deposit drilling, respectively.

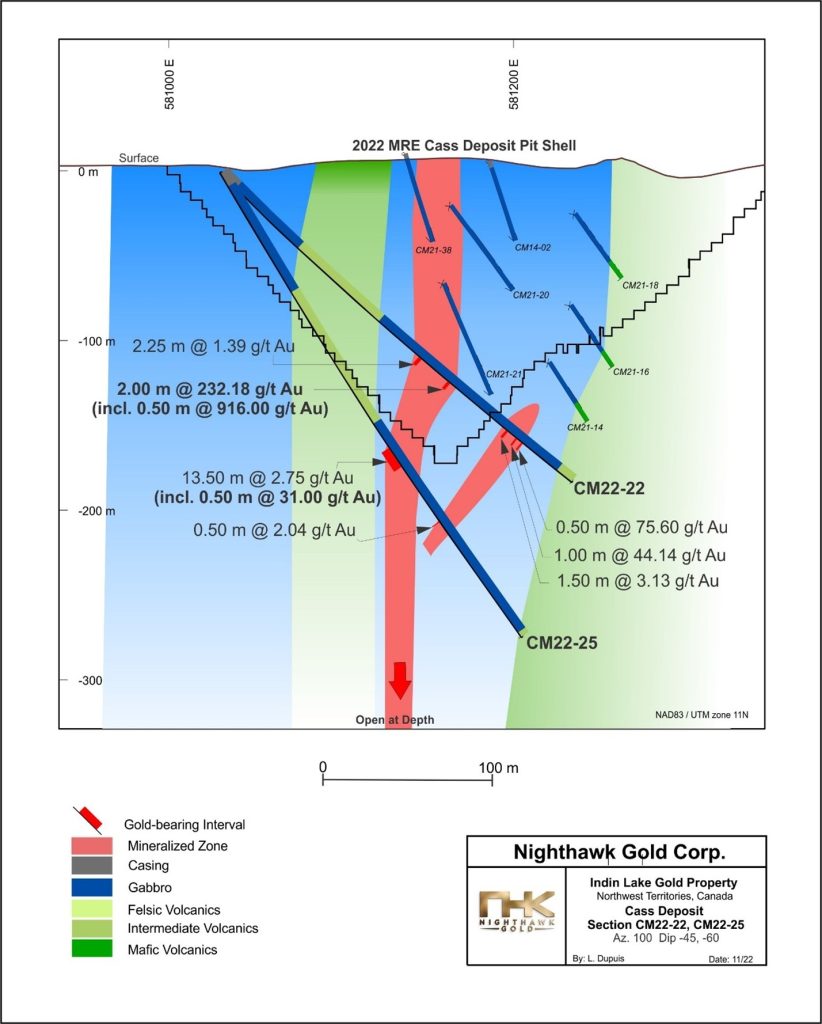

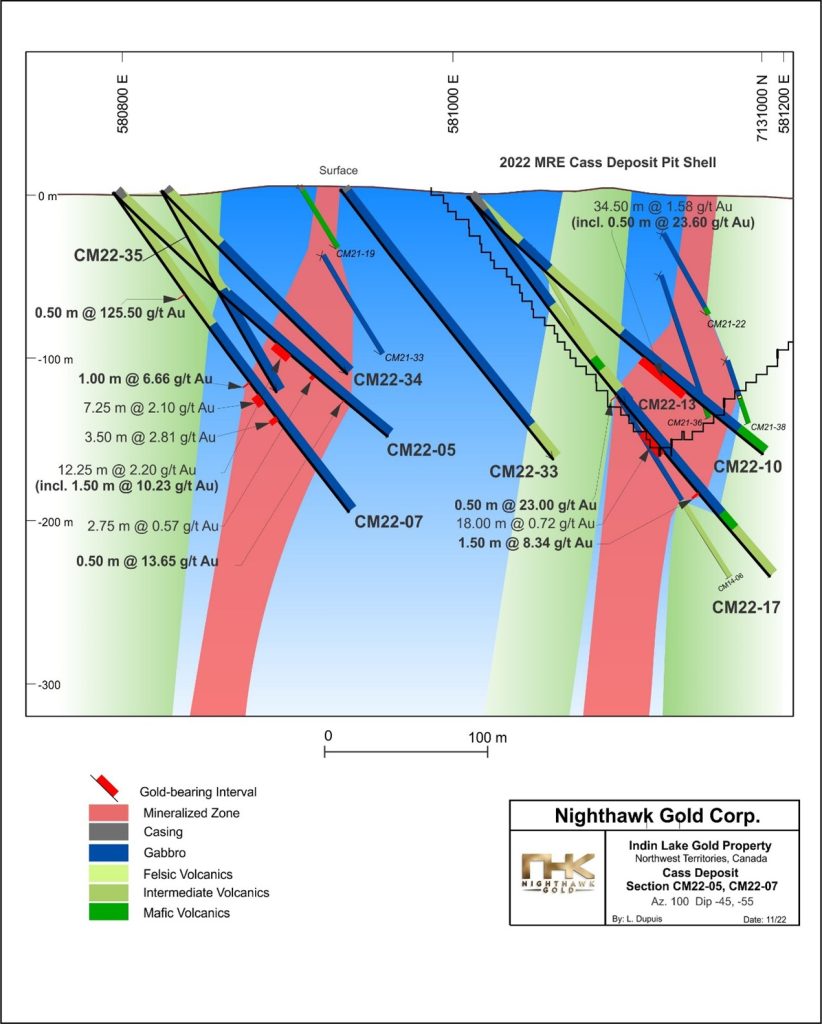

Cass Deposit

The Cass Deposit is located approximately 2 km southwest from the Kim Deposit. The Cass Deposit area is underlain by subvertical pillowed-to-massive mafic flows and turbiditic meta- sediments which are intruded by gabbroic sills. The majority of the gold mineralization at the Cass Deposit is hosted along the eastern boundary of the Cass-area gabbro and metavolcanics units and associated with multiple sets of steeply-dipping, quartz-carbonate-sulphide veins.

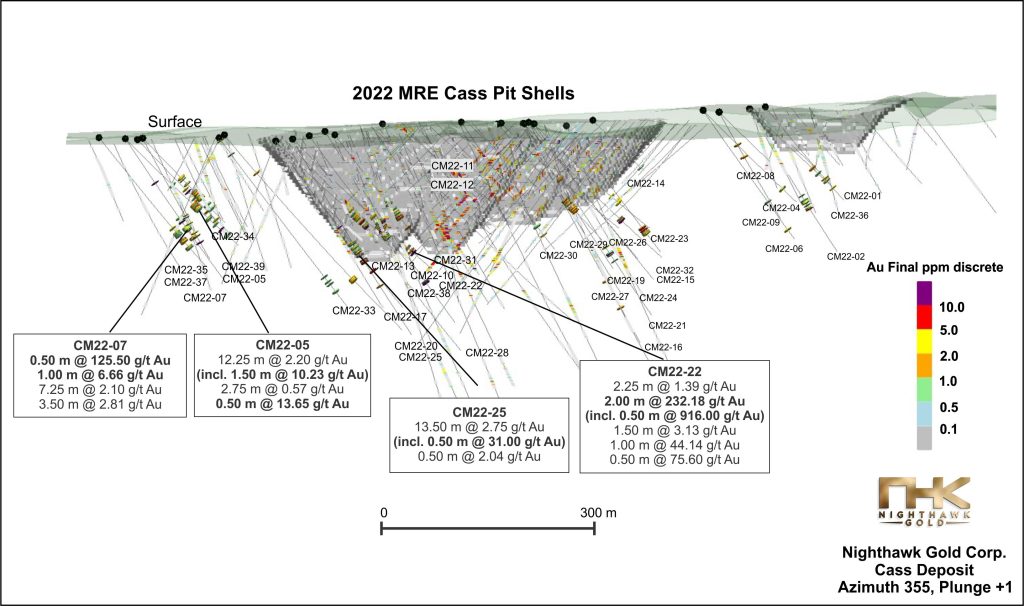

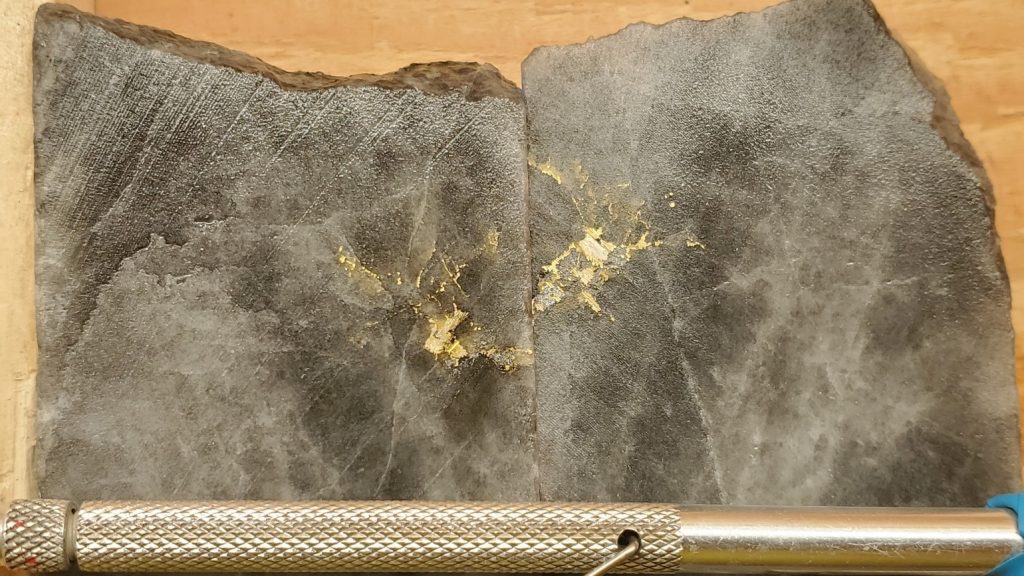

The known mineralization of the Cass Deposit occurs over a 30 m width and a strike length of 960 m. 2022 drilling focused on high-grade, near-surface mineralization to expand the 2022 MRE1 Cass pit-shells. Drilling successfully extended the mineralized zone an additional 150 m on strike to the southwest (approaching the highly prospective Albatross exploration target). The highest-grade intercept of the drill program (and one of the highest-grade intercepts to-date) was drilled at Cass in hole CM22-22 (See Figure 6 is a picture of the high-grade intercept from hole CM22-22). Approximately 26 of the 39 holes drilled intercepted coarse, visible gold.

Please refer to Tables 1 and 2 for the Highlight Drill Assay Results and Drill Assay Results Summary of the Cass Deposit, respectively. Please refer to Figures 1, 5 and 6 for the Isometric, Section #1 and Section #2 views of the Cass Deposit Highlight Drill Assay Results, respectively.

| Table 2 – Drill Assay Results Summary – Cass Deposit | ||||||||

| Hole ID | From | To | Interval Core

Length (m) |

Au (g/t) | ||||

| Cass Deposit | ||||||||

| CM22-01 | 121.50 | 123.00 | 1.50 | 3.26 | ||||

| CM22-02 | 150.00 | 165.25 | 15.25 | 0.76 | ||||

| including | 64.75 | 165.25 | 0.50 | 7.29 | ||||

| CM22-03 | No Significant Intervals | |||||||

| CM22-04 | 158.00 | 159.50 | 1.50 | 26.14 | ||||

| including | 158.50 | 159.00 | 0.50 | 76.30 | ||||

| CM22-05 | 135.50 | 147.75 | 12.25 | 2.20 | ||||

| including | 142.00 | 143.50 | 1.50 | 10.23 | ||||

| and | 165.00 | 167.75 | 2.75 | 0.57 | ||||

| and | 190.00 | 190.50 | 0.50 | 13.65 | ||||

| CM22-06 | 207.50 | 208.50 | 1.00 | 1.05 | ||||

| CM22-07 | 75.50 | 76.00 | 0.50 | 125.50 | ||||

| and | 142.50 | 143.50 | 1.00 | 6.66 | ||||

| and | 151.50 | 158.75 | 7.25 | 2.10 | ||||

| and | 169.00 | 172.50 | 3.50 | 2.81 | ||||

| CM22-08 | No Significant Intervals | |||||||

| CM22-09 | 52.50 | 54.00 | 1.50 | 1.92 | ||||

| and | 72.00 | 73.50 | 1.50 | 2.26 | ||||

| CM22-10 | 145.00 | 179.50 | 34.50 | 1.58 | ||||

| including | 159.00 | 159.50 | 0.50 | 23.60 | ||||

| CM22-11 | No Significant Intervals | |||||||

| CM22-12 | No Significant Intervals | |||||||

| CM22-13 | No Significant Intervals | |||||||

| CM22-14 | No Significant Intervals | |||||||

| CM22-15 | 195.00 | 197.00 | 2.00 | 8.43 | ||||

| CM22-16 | 250.50 | 252.00 | 1.50 | 5.00 | ||||

| and | 293.50 | 295.00 | 1.50 | 2.39 | ||||

| CM22-17 | 151.50 | 152.00 | 0.50 | 23.00 | ||||

| and | 179.00 | 197.00 | 18.00 | 0.72 | ||||

| and | 229.00 | 230.50 | 1.50 | 8.34 | ||||

| CM22-18 | No Sampling | |||||||

| CM22-19 | No Significant Intervals | |||||||

| CM22-20 | 70.50 | 71.50 | 1.00 | 3.07 | ||||

| and | 273.25 | 279.00 | 5.75 | 2.09 | ||||

| CM22-21 | 206.50 | 220.50 | 14.00 | 3.92 | ||||

| including | 219.50 | 220.00 | 0.50 | 84.70 | ||||

| CM22-22 | 159.25 | 161.50 | 2.25 | 1.39 | ||||

| and | 181.50 | 183.50 | 2.00 | 232.18 | ||||

| including | 182.50 | 183.00 | 0.50 | 916.00 | ||||

| and | 226.75 | 228.25 | 1.50 | 3.13 | ||||

| and | 234.00 | 235.00 | 1.00 | 44.14 | ||||

| and | 238.50 | 239.00 | 0.50 | 75.60 | ||||

| CM22-23 | 150.00 | 151.00 | 1.00 | 1.37 | ||||

| and | 163.50 | 165.00 | 1.50 | 1.60 | ||||

| CM22-24 | No Significant Intervals | |||||||

| CM22-25 | 190.00 | 203.50 | 13.50 | 2.75 | ||||

| including | 190.50 | 191.00 | 0.50 | 31.00 | ||||

| and | 243.00 | 243.50 | 0.50 | 2.04 | ||||

| CM22-26 | 114.00 | 117.00 | 3.00 | 2.96 | ||||

| CM22-27 | No Significant Intervals | |||||||

| CM22-28 | 147.65 | 153.25 | 5.60 | 4.45 | ||||

| including | 152.75 | 153.25 | 0.50 | 37.20 | ||||

| and | 258.50 | 259.50 | 1.00 | 27.60 | ||||

| CM22-29 | 143.50 | 167.50 | 24.00 | 3.15 | ||||

| including | 158.00 | 160.00 | 2.00 | 21.05 | ||||

| CM22-30 | No Significant Intervals | |||||||

| CM22-31 | 118.25 | 151.75 | 33.50 | 2.67 | ||||

| including | 148.50 | 150.00 | 1.50 | 38.57 | ||||

| and | 168.50 | 169.00 | 0.50 | 3.81 | ||||

| CM22-32 | 179.50 | 191.75 | 12.25 | 2.06 | ||||

| CM22-33 | 4.50 | 5.00 | 0.50 | 1.99 | ||||

| CM22-34 | 77.00 | 79.25 | 2.25 | 2.44 | ||||

| and | 89.50 | 91.00 | 1.50 | 3.93 | ||||

| and | 104.75 | 120.25 | 15.50 | 3.21 | ||||

| including | 04.75 | 105.25 | 0.50 | 48.40 | ||||

| CM22-35 | 124.50 | 125.00 | 0.50 | 1.76 | ||||

| and | 137.00 | 138.00 | 1.00 | 1.38 | ||||

| and | 152.00 | 158.50 | 6.50 | 0.74 | ||||

| and | 167.75 | 168.75 | 1.00 | 20.05 | ||||

| CM22-36 | 132.00 | 137.25 | 5.25 | 0.77 | ||||

| CM22-37 | 166.00 | 204.75 | 38.75 | 1.23 | ||||

| including | 202.50 | 203.00 | 0.50 | 41.60 | ||||

| CM22-38 | 160.50 | 184.25 | 23.75 | 1.87 | ||||

| including | 168.50 | 170.00 | 1.50 | 13.37 | ||||

| CM22-39 | 103.00 | 103.50 | 0.50 | 33.20 | ||||

| and | 120.00 | 121.25 | 1.25 | 2.53 | ||||

| and | 142.00 | 143.00 | 1.00 | 2.69 | ||||

Note: True widths remain undetermined at this stage. All assays are uncut. Further statistical analysis will be required prior to establishing a suitable cut grade.

| Hole ID | Easting | Northing | Elevation | Length | Azimuth | Dip | ||||||

| NAD 83 Zone 11 | (m) | |||||||||||

| Cass Deposit | ||||||||||||

| CM22-01 | 581642 | 7131455 | 373 | 159 | 100 | -45 | ||||||

| CM22-02 | 581641 | 7131455 | 374 | 237 | 100 | -60 | ||||||

| CM22-03 | 580502 | 7130934 | 320 | 186 | 100 | -45 | ||||||

| CM22-04 | 581579 | 7131421 | 372 | 186 | 100 | -45 | ||||||

| CM22-05 | 580796 | 7131075 | 336 | 225 | 100 | -45 | ||||||

| CM22-06 | 581579 | 7131421 | 372 | 225 | 100 | -55 | ||||||

| CM22-07 | 580796 | 7131075 | 336 | 243 | 100 | -55 | ||||||

| CM22-08 | 581606 | 7131371 | 370 | 102 | 100 | -45 | ||||||

| CM22-09 | 581606 | 7131371 | 370 | 174 | 100 | -60 | ||||||

| CM22-10 | 581010 | 7131038 | 333 | 240 | 100 | -45 | ||||||

| CM22-11 | 581133 | 7131372 | 353 | 156 | 100 | -45 | ||||||

| CM22-12 | 581156 | 7131412 | 354 | 150 | 100 | -45 | ||||||

| CM22-13 | 581010 | 7131038 | 334 | 179 | 100 | -55 | ||||||

| CM22-14 | 581435 | 7131291 | 360 | 102 | 100 | -45 | ||||||

| CM22-15 | 581336 | 7131309 | 355 | 276 | 100 | -45 | ||||||

| CM22-16 | 581336 | 7131309 | 355 | 351 | 100 | -63 | ||||||

| CM22-17 | 581011 | 7131037 | 333 | 297 | 100 | -55 | ||||||

| CM22-18 | 581345 | 7131286 | 357 | 9 | 100 | -50 | ||||||

| CM22-19 | 581345 | 7131286 | 357 | 249 | 100 | -50 | ||||||

| CM22-20 | 580935 | 7131073 | 342 | 378 | 100 | -50 | ||||||

| CM22-21 | 581345 | 7131286 | 357 | 324 | 100 | -60 | ||||||

| CM22-22 | 581031 | 7131076 | 336 | 276 | 100 | -45 | ||||||

| CM22-23 | 581354 | 7131269 | 355 | 222 | 100 | -45 | ||||||

| CM22-24 | 581354 | 7131269 | 355 | 279 | 100 | -55 | ||||||

| CM22-25 | 581031 | 7131076 | 336 | 327 | 100 | -60 | ||||||

| CM22-26 | 581309 | 7131252 | 356 | 225 | 100 | -45 | ||||||

| CM22-27 | 581345 | 7131222 | 356 | 240 | 100 | -60 | ||||||

| CM22-28 | 581073 | 7131114 | 346 | 330 | 100 | -57 | ||||||

| CM22-29 | 581308 | 7131212 | 356 | 222 | 100 | -50 | ||||||

| CM22-30 | 581259 | 7131188 | 358 | 225 | 100 | -55 | ||||||

| CM22-31 | 581089 | 7131088 | 342 | 214.7 | 100 | -52 | ||||||

| CM22-32 | 581395 | 7131330 | 351 | 225 | 100 | -54 | ||||||

| CM22-33 | 580931 | 7131037 | 338 | 300 | 98 | -53 | ||||||

| CM22-34 | 580822 | 7131052 | 337 | 168 | 100 | -45 | ||||||

| CM22-35 | 580822 | 7131052 | 337 | 195 | 100 | -60 | ||||||

| CM22-36 | 581662 | 7131476 | 376 | 174 | 100 | -50 | ||||||

| CM22-37 | 580762 | 7131041 | 338 | 240 | 100 | -50 | ||||||

| CM22-38 | 581053 | 7131093 | 340 | 249 | 100 | -53 | ||||||

| CM22-39 | 580812 | 7131093 | 334 | 198 | 100 | -46 | ||||||

Technical Information

The pit shell outlines in Figures 1 to 6 are from the 2022 MRE1 and were completed by InnovExplo Inc. and are defined by a US$1,600/oz gold price assumption. Nighthawk has implemented a quality-control program to comply with best practices in the sampling and analysis of drill core. Drill core samples were transported in security-sealed bags for analyses at ALS Global Assay Laboratory in Vancouver, BC. ALS Global is an ISO/IEC 17025 accredited laboratory. Halved drill core is stored on site and pulps are returned and stored for record. As part of its QA/QC program, Nighthawk inserts external gold standards (low to high-grade), blanks and duplicates every 20 samples in addition to the standards, blanks, and pulp duplicates inserted by ALS Global.

Qualified Person

John McBride, MSc., P.Geo., Vice President of Exploration for Nighthawk, who is the “Qualified Person” as defined by NI 43-101 for this project, has reviewed and approved of the technical disclosure contained in this news release.

About Nighthawk Gold Corp.

Nighthawk is a Canadian-based gold exploration company with 100% ownership of more than 930 km2 of district-scale land position within the Indin Lake Greenstone Gold Belt, located approximately 200 km north of Yellowknife, Northwest Territories, Canada. The Company is advancing several highly prospective exploration targets. The Colomac Gold Project currently has a Mineral Resource Estimate1 of 58.2 million tonnes grading 1.44 g/t Au for 2.69 million ounces in the Indicated category and 19.7 million tonnes grading 2.10 g/t Au for 1.33 million ounces in the Inferred category. Nighthawk’s experienced management team, with a track record of successfully advancing projects and operating mines, is working towards demonstrating the economic viability of its assets and rapidly advancing its projects towards a development decision.

Figure 1 – Cass Deposit Isometric View Looking Northwest (Graphic: Business Wire)

Figure 2 – Cass Deposit – Picture of Hole CM22-22 Intercept 916.00 g/t Au over 0.50 m (Photo: Business Wire)

Figure 3 – District-Scale Regional Map (Graphic: Business Wire)

Figure 4 – Cass Deposit – Local Map of the Drill Hole Locations (Graphic: Business Wire)

Figure 5 – Cass Deposit – Section View #1 (Graphic: Business Wire)

Figure 6 – Cass Deposit – Section View #2 (Graphic: Business Wire)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE