Orla Mining Reports Third Quarter 2022 Results

Record Quarterly Production and Camino Rojo Sulphide Development Update

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results for the third quarter ended September 30, 2022.

(All amounts are in U.S. dollars unless otherwise stated)

HIGHLIGHTS:

- Record gold production of 28,876 ounces in the third quarter of 2022, and 77,580 ounces year to date.

- Total cash cost and all-in sustaining costs for the third quarter were $452 and $594 per ounce of gold sold1, respectively. Total cost of sales was $12.0 million.

- Gold production guidance for the full year 2022 has been increased to a range of 100,000 to 110,000 ounces from 90,000 to 100,000 ounces. AISC guidance for the year has been maintained at $600 to $700 per ounce of gold sold.

- During the quarter, cash flow from operating activities before changes in non-cash working capital was $15.5 million, and free cash flow1 totalled $25.2 million. Orla had a cash balance of $89.1 million at September 30, 2022.

- Adjusted earnings for the third quarter of $5.7 million or $0.02 per share.

- Net income of $8.9 million or $0.03 per share, which included $8.3 million in exploration expensed across the portfolio.

- Camino Rojo’s processing throughput for the third quarter achieved an average of 19,200 tonnes per day, 107% of nameplate capacity.

- Completed acquisition of Gold Standard Ventures Corp. (“Gold Standard”), the owner of the South Railroad Project (“South Railroad”), a feasibility-stage, open pit, heap leach project located on the Carlin trend in Nevada.

| 1 Cash cost, AISC, free cash flow and adjusted earnings are non-GAAP measures. See the “Non-GAAP Measures” section of this news release for additional information. | ||

“Camino Rojo’s continued outperformance has given us the confidence to increase annual production guidance in our first operating year,” said Jason Simpson, President and Chief Executive Officer of Orla. “During the quarter, we were also pleased to complete the acquisition of Gold Standard, strengthening our growth pipeline.”

FINANCIAL AND OPERATIONS UPDATE

| Table 1: Financial and Operating Highlights | Q3 – 2022 | YTD 2022 | |

| Operating | |||

| Gold Produced | oz | 28,876 | 77,580 |

| Gold Sold | oz | 28,749 | 75,064 |

| Average Realized Gold Price1 | $/oz | $1,699 | $1,810 |

| Cost of Sales – Operating Cost | $M | $12.0 | $32.1 |

| Cash Cost per Ounce1,2 | $/oz | $452 | $446 |

| All-in Sustaining Cost per Ounce1,2 | $/oz | $594 | $597 |

| Financial | |||

| Revenue | $M | $49.0 | $136.5 |

| Net Income (loss) | $M | $8.9 | $27.1 |

| Adjusted Earnings1 | $M | $5.7 | $36.5 |

| Earnings (loss) per Share – basic | $/sh | $0.03 | $0.10 |

| Adjusted Earnings per Share – basic1 | $/sh | $0.02 | $0.14 |

| Cash Flow from Operating Activities before Changes in Non-Cash Working Capital | $M | $15.5 | $56.0 |

| Free Cash Flow1 | $M | $25.2 | $70.3 |

| Financial Position | Sept 30, 2022 | Dec 31, 2021 | |

| Cash and Cash Equivalents | $M | $89.1 | $20.5 |

| Net Debt1 | $M | $77.5 | $140.8 |

| 1. | “Average Realized Gold Price”, “Cash Cost per Ounce”, “All-in Sustaining Cost per Ounce”, “Adjusted Earnings”, “Adjusted Earnings per Share – basic”, “Free Cash Flow”, and “Net Debt” are non-GAAP measures. See the “Non-GAAP Measures” section of this news release for additional information. |

||

| 2. | The Company declared commercial production at Camino Rojo effective April 1, 2022. Consequently, the “year to date” figures for cash cost per ounce and all-in sustaining cost per ounce are for the period April 1, 2022 to September 30, 2022. |

||

CAMINO ROJO OXIDE MINE UPDATE

The Company declared commercial production at Camino Rojo on April 1, 2022. Camino Rojo produced 28,876 ounces of gold in the third quarter, 2022. Year to date gold production totals 77,580 ounces and gold production guidance for the full year 2022 has been increased to a range of 100,000 to 110,000 ounces. Gold sold during the quarter totalled 28,749 ounces while year to date gold sold amounts to 75,064 ounces.

Mining rates have steadily increased, averaging 44,911 tonnes per day in the third quarter. The average grade mined, excluding low grade material that was stockpiled, was 0.77 g/t of gold during the quarter, which is in line with plan.

Camino Rojo achieved record quarterly processing throughput in the third quarter 2022. The average daily stacking rate for the third quarter was 19,200 tonnes per day, which is above the nameplate capacity of 18,000 tonnes per day. Mined ore tonnes are reconciling well to the block model and process recoveries to date are in line with the metallurgical recovery model. Additional ore is being generated from the conversion of previously modelled waste tonnes in the upper benches of the pit.

Third quarter cash costs and AISC totalled $452 and $594 per ounce of gold sold, respectively. The operations have experienced unit price increases across several key reagents and consumables, which have been largely offset by lower than budgeted consumption rates. Capital expenditures totalled $1.8 million in the third quarter which included $0.8 million in sustaining capital. AISC guidance for 2022 (Q2-Q4) remains unchanged at $600 to $700 per ounce of gold sold.

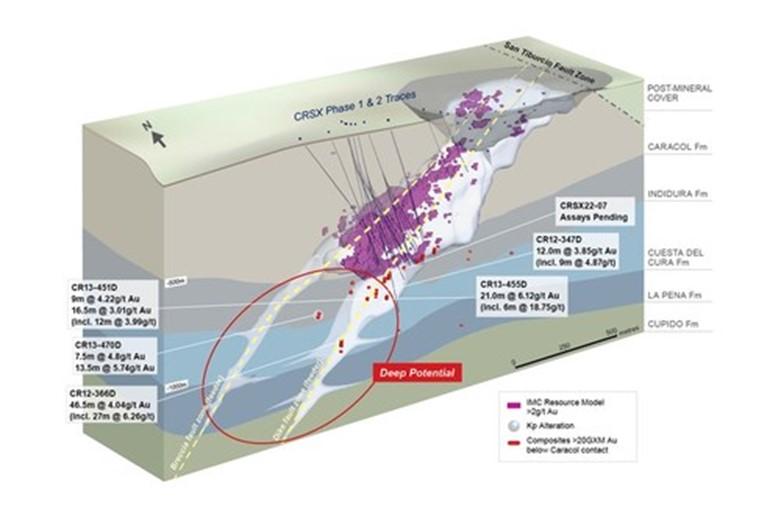

CAMINO ROJO SULPHIDE PROJECT UPDATE

Historical drilling on the Camino Rojo Sulphides, conducted by the previous project owners, indicated the gold grade of the deposit to be widely disseminated and a large, open-pit mining scenario was the favoured development pathway. A lower grade open pit development scenario would necessitate higher capital expenditures for a large processing facility and extensive material handling. To understand if an alternative, more targeted development approach was possible, the presence of higher grades had to be confirmed. It was interpreted that portions of the deposit were comprised of higher grade steeply northwest dipping vein sets. To test for the higher grades and to confirm the geological model, Orla began drilling into the Camino Rojo Sulphides in the opposite (south) orientation of historical drilling. Since the fourth quarter 2020, two phases of drilling have been conducted with the results indicating the presence of continuous, higher-grade gold domains which could be amenable to underground mining, allowing for a smaller processing facility and less material handling. Most recently, the south oriented Phase 2 drill program has returned higher-grade gold intercepts (>2 g/t) over wide widths (>30m). These results are derived from an 8,750-metre drill program being conducted in 2022, to reinforce the geologic model and to continue to confirm the continuity of wide zones of higher-grade gold mineralization. Ten of the 15 diamond drill holes have been completed. Results from the first five drill holes are available on the Company’s website and in the news release dated September 12, 2022 (Orla Mining Advances Exploration & Growth Pipeline). Results from the remaining drill holes are expected in early 2023. Selected significant results from the first five holes include:

- Hole CRSX22-05: 1.95 g/t Au over 61.2m, incl. 2.05 g/t Au over 19.5m

- Hole CRSX22-06: 2.56 g/t Au over 41.5m, incl. 4.00 g/t Au over 19.5m

- Hole CRSX22-07A: 3.20 g/t Au over 36.6m

- Hole CRSX22-07B: 2.13 g/t Au over 27.0m, incl. 4.43 g/t Au over 9.5m

- Hole CRSX22-08A: 3.08 g/t Au over 52.5m, incl. 4.37 g/t Au over 28.5m

The first metallurgical results from the Phase 2 drilling confirm the potential for a standalone processing option for the Camino Rojo Sulphides, thereby conserving the potential for the Company to retain 100% ownership in a potential project2. Metallurgical testing will continue as each new phase of drill core becomes available.

| 2 In the event a project at the Camino Rojo Sulphides has been defined by the Company through a pre-feasibility study outlining a development scenario using the existing infrastructure at Peñasquito, Newmont Corporation (“Newmont”) may, at its option, enter into a joint venture where it would own 70% of the project, with Orla owning 30%. See the Company’s Management’s Discussion and Analysis of the Company as at and for the year ended December 31, 2021, for additional information. | ||

Most of the gold mineralization at Camino Rojo has been defined in the Caracol Formation where auriferous veins are mostly constrained to a broad envelope of potassic alteration (Kp). Gold mineralization extends deeper into the underlying Indidura and Cuesta del Cura formations (and potentially deeper into other underlying units) along the Dike Zone and Breccia Fault Zone, suggesting these faults may be feeder-like structures for the Camino Rojo deposit.

| All drill results presented in Figure 1 are historical in nature and are not treated by the Company as current. Such results were completed by Goldcorp Inc., a prior owner of the Camino Rojo Project. |

During the ongoing Orla Phase 2 drill program, selected holes were extended to test the continuity of gold mineralization where the Dike Zone crosscut the Indidura Formation. These drill holes have returned encouraging visual results (assays pending) of the sulphide veins crosscutting bedding and associated calc-silicate alteration within the Indidura Formation. Compilation of historical drill data has confirmed significant gold intercepts over significant widths with a similar style of mineralization elsewhere in the Indidura formation, as well as skarn and calc-silicate alteration associated with manto-type mineralization with semi-massive to massive sulphides replacing bedding in the Cuesta del Cura Formation.

Based on the positive results encountered in the Phase 1 and 2 programs, more closely spaced, south-oriented drilling will be required to fully capture the extent of a potential underground resource. To date, approximately 13,868 metres of directional drilling has been completed which has continued to inform Orla’s perspective on the development approach to the deposit. Orla expects to provide details of a Phase 3 south-oriented drill program and metallurgical testwork program in early 2023. This drilling is expected to strengthen the confidence for a Preliminary Economic Assessment (“PEA”) that contemplates underground mining. Upon the completion of additional south oriented directional drilling and testwork programs, a PEA is expected to be completed based on the optimal development method for Orla.

Drilling during the planned Phase 3 drill program will focus on infilling the Caracol hosted mineralization (existing resources) and also follow-up on this new and historical drill data, testing the down plunge extension potential of the Camino Rojo Sulphide deposit into the Indidura and Cuesta del Cura formations along the Dike and Breccia zones as well as further Orla’s metallurgical planning.

GOLD STANDARD ACQUISITION / SOUTH RAILROAD PROJECT

On August 12, 2022, Orla completed the acquisition of Gold Standard by way of court-approved plan of arrangement.

Gold Standard’s key asset is the 100%-owned South Railroad Project, a feasibility-stage, open pit, heap leach project located on the Carlin trend in Nevada. A Feasibility Study on South Railroad was completed in February 2022 and permitting activities are currently underway. As part of the Transaction, Orla also acquired the Lewis Project (“Lewis”), a large, strategically located, prospective land package on the Battle Mountain trend in Nevada. Orla has begun integrating South Railroad into the Company’s growth plans with key priorities for South Railroad to include project permitting, review of project schedule including critical path activities, and assessment of current exploration supporting resource expansion.

Through the remainder of the year, Orla will continue with Gold Standard’s 2022 planned program of resource expansion and exploration drilling at key targets on the South Railroad Project. The Company will also commence an additional 5,000 metre RC and core drill program at South Railroad for an additional $1.5 million, bringing the total 2022 planned direct drilling cost spending to $3.0 million across 11,370 metres of drilling. The current and primary objectives are to upgrade and increase oxide resources at the Pinion SB, LT, POD, Sweet Hollow, Jasperoid Wash, and Dixie targets.

EXPLORATION PROGRAM

This year, drilling across the portfolio began in April after preparations and operational ramp-up during the first quarter.

Regional exploration work at Camino Rojo includes reverse circulation drilling and continued target definition activities. RC drill testing of near-mine target areas near the Camino Rojo Oxide Mine is underway, with 40% of the program completed at September 30, 2022. The highest priority targets are expected to be drilled along the mine trend in the fourth quarter, 2022, subject to drill permits being issued. Phase 2 of the sulphide drill program is underway, with ten oriented diamond drill holes completed since the program began in April, the details of which are discussed above.

In the second quarter 2022, the planned drill program at Cerro Quema commenced with two diamond drill holes completed in La Pelona target and three holes in La Prieta targets. Drilling in both target areas has returned encouraging results and additional drilling will be planned for 2023. Assay results are available in Orla’s news release dated September 12, 2022 (Orla Mining Advances Exploration & Growth Pipeline).

In the third quarter 2022, infill and expansion drilling at Caballito focused on converting resources from the inferred resource to the indicated resource category, providing material for metallurgical testing, and testing the continuity of mineralization and potential extensions of this deposit. This drilling, along with more limited drilling planned at La Pava and Quemita sulphide deposits, will continue through the fourth quarter 2022.

The initial 2022 exploration budget totalled $15 million, with $10 million allocated to Mexico and $5 million allocated to Panama. Supported by the recent exploration success and following the completion of the acquisition of Gold Standard, Orla increased the 2022 spending to $18.0 million.

GUIDANCE

On October 11, 2022 the Company issued a press release increasing production guidance for the full year 2022 (Orla Mining Provides Third Quarter 2022 Operational Results and Increases 2022 Annual Production Guidance). The Company also issued a press release on September 12, 2022, increasing annual exploration spending for 2022 to $18.0 million (Orla Mining Advances Exploration & Growth Pipeline). AISC guidance for the year is maintained at $600 to $700 per ounce of gold sold.

| Table 2: 2022 Operational Guidance and Outlook1 | |||||

| Original | Updated | ||||

| Gold Production | oz | 90,000 – 100,000 | 100,000 – 110,000 | ||

| All-in Sustaining Costs (“AISC”)2,3 | $/oz Au sold | $600 – $700 | $600 – $700 | ||

| Capital Expenditures3 | |||||

| Sustaining Capital Expenditures | $M | $5 | $5 | ||

| Non-Sustaining Capital Expenditures | $M | $20 | $20 | ||

| Total Capital Expenditures | $M | $25 | $25 | ||

| Exploration3 | |||||

| Mexico | $M | $10 | $10 | ||

| Panama | $M | $5 | $5 | ||

| Nevada | $M | NA | $3 | ||

| Total Exploration | $M | $15 | $18 | ||

| 1. | The outlook includes full-year 2022 figures except for AISC which is calculated from Q2-Q4 2022. | ||||

| 2. | AISC is a non-GAAP measure. See the “Non-GAAP Measures” section of this news release for additional information. | ||||

| 3. | Exchange rates used to forecast cost metrics include MXN/USD of 20.0 and CAD/USD of 1.25 | ||||

CONSOLIDATED FINANCIAL STATEMENTS

Orla’s unaudited interim financial statements and management’s discussion and analysis for the three and nine months ended September 30, 2022, are available on the Company’s website at www.orlamining.com, and under the Company’s profiles on SEDAR and EDGAR.

Qualified Persons Statement

The scientific and technical information in this news release was reviewed and approved by Mr. J. Andrew Cormier, P. Eng., Chief Operating Officer of the Company, and Mr. Sylvain Guerard, P. Geo., Senior Vice President, Exploration of the Company, who are the Qualified Persons as defined under NI 43-101 standards.

About Orla Mining Ltd.

Orla is operating the Camino Rojo Oxide Gold Mine, a gold and silver open-pit and heap leach mine, located in Zacatecas State, Mexico. The property is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo oxide gold project entitled “Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico” dated January 11, 2021, is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of Cerro Quema located in Panama which includes a gold production scenario and various exploration targets. Cerro Quema is a proposed open pit mine and gold heap leach operation. The technical report for the Pre-Feasibility Study on the Cerro Quema oxide gold project entitled “Project Pre-Feasibility Updated NI 43-101 Technical Report on the Cerro Quema Project, Province of Los Santos, Panama” dated January 18, 2022, is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of the South Railroad Project, a feasibility-stage, open pit, heap leach project located on the Carlin trend in Nevada. The technical report for the 2022 Feasibility Study entitled “South Railroad Project, Form 43-101F1 Technical Report Feasibility Study, Elko County, Nevada” dated March 23, 2022, is available on SEDAR and EDGAR under Gold Standard Ventures Corp.’s profile at www.sedar.com and www.sec.gov, respectively. The technical reports are available on Orla’s website at www.orlamining.com.

Figure 1: Camino Rojo Sulphide Deep Mineralization Potential (CNW Group/Orla Mining Ltd.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE