Goldshore Intersects 62.8m @ 0.88% Copper Equivalent at North Coldstream with Significant Cobalt Assays

Goldshore Resources Inc. (TSX-V: GSHR) (OTCQB: GSHRF) (FWB: 8X00) is pleased to announce assay results from its initial scout drilling campaign testing the historic North Coldstream copper mine at the Moss Lake Project in Northwest Ontario, Canada.

Highlights:

- Initial results from one North Coldstream hole confirm significant copper, cobalt and gold mineralization hosted within a sheared volcanic massive sulphide deposit with best intercepts of:

- 62.8m @ 0.88% CuE (0.36% Cu, 0.06% Co, 0.30 ppm Au and 3.1 ppm Ag) from 8.2m depth in CND-22-006, including

- 13.35m @ 1.18% CuE (0.54% Cu, 0.07% Co, 0.39 ppm Au and 3.5 ppm Ag) from 8.2m

- 14.65m @ 1.30% CuE (0.57% Cu, 0.09% Co, 0.39 ppm Au and 4.4 ppm Ag) from 23.1m

- 62.8m @ 0.88% CuE (0.36% Cu, 0.06% Co, 0.30 ppm Au and 3.1 ppm Ag) from 8.2m depth in CND-22-006, including

- These copper and cobalt results confirm that North Coldstream has important critical mineral value and highlights multiple deposit styles in the district, which is a hallmark of important mineral districts worldwide.

- North Coldstream was mapped by last year’s VTEM survey (press release dated March 10, 2022) as a discrete magnetic conductor. There are twelve similar targets in the Moss Lake Project, highlighting the potential for similar copper-cobalt-gold deposits.

- Drilling also identified a gold only intercept of 2.1m @ 1.88 g/t Au from 98.9m in the footwall to the North Coldstream VMS deposit, which is related to the East Coldstream style of mineralization 1.6 kilometers to the east, suggesting greater continuity of the gold-bearing structures.

President and CEO Brett Richards stated: “Although we are very focused on the Moss Lake drilling and defining a higher-grade resource within the lower grade historical resource; these findings at North Coldstream are extremely encouraging and provide tremendous potential optionality in the future. As we have illustrated previously to the market, North Coldstream was a past producing copper-gold mine, so these results are not unexpected. However, I think the exciting story is the emergence and identification of cobalt in the historic mine. These drill results prove the value and priority of further drilling and exploration at the North Coldstream deposit, and could identify it as a critical mineral asset, which is important for the development of renewable energies, electrification of vehicles and global decarbonization initiatives.”

Technical Overview

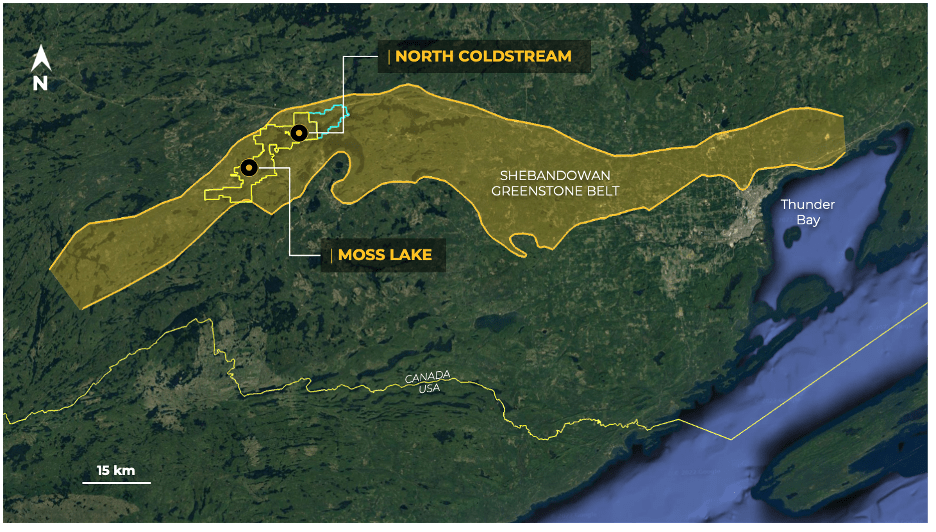

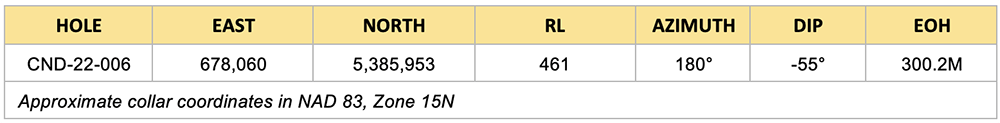

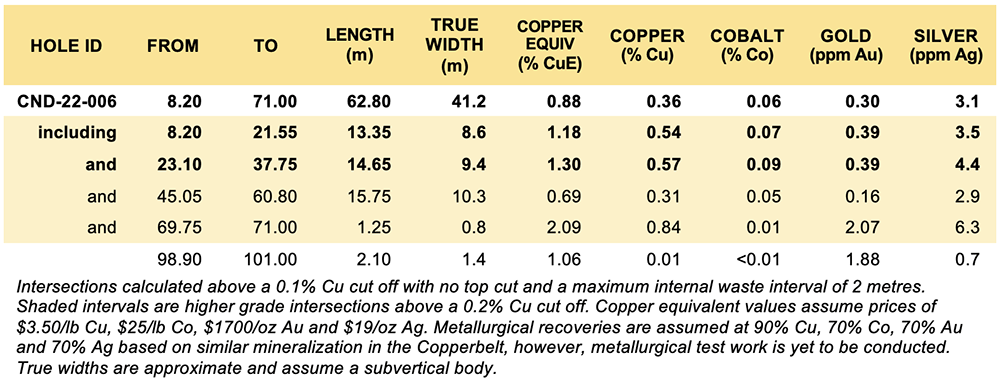

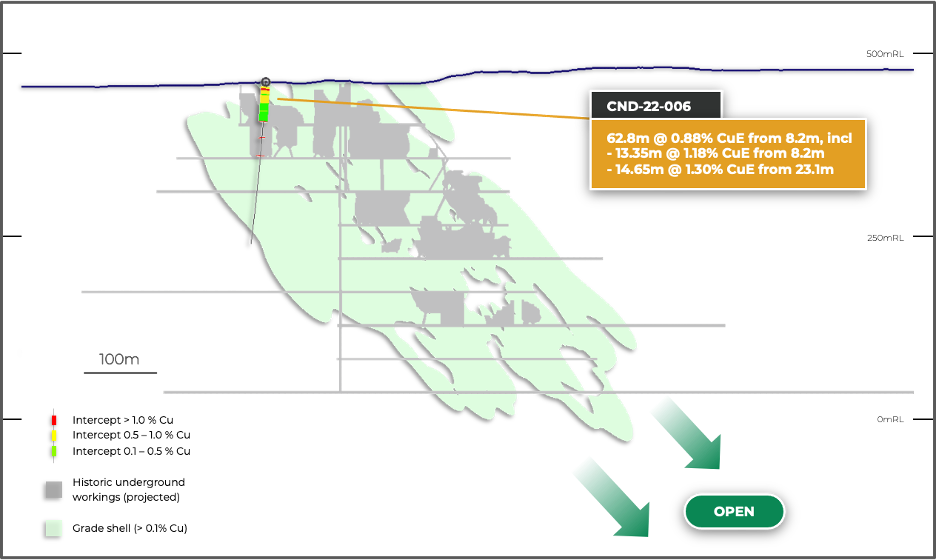

Figure 1 shows the location of North Coldstream relative to the main Moss Lake Gold Deposit. Figures 2 and 3 show a plan and long section of the historic workings, respectively, with the location of CND-22-006. Figure 4 shows a photograph of the drill core to illustrate the style of mineralization. Table 1 shows the hole details and Table 2 shows the significant intercepts.

Figure 1: Location map showing North Coldstream relative to Moss Lake

Table 1: Location of drill holes in this press release

Table 2: Significant downhole copper equivalent intercepts

Figure 2: Drill plan showing drill hole relative to the historic copper mine

Figure 3: Long section through the historic copper mine showing initial drill results

The Company has completed six scout holes to test the geology and multi-element chemistry of the North Coldstream deposit that was mined for copper between 1957 and 1967. The challenging aspect of this program has been drilling to avoid the historic stopes, which has meant, at this stage, drilling the fringes of the deposit as we target extensions to shoots.

CND-22-006 intersected a broad zone of copper mineralization associated with the western edge of the historic workings. While gold and silver credits were expected, based on historic production figures, elevated levels of cobalt in the range of 0.02 to 0.2% Co suggest previously unrecognized critical mineral value at North Coldstream.

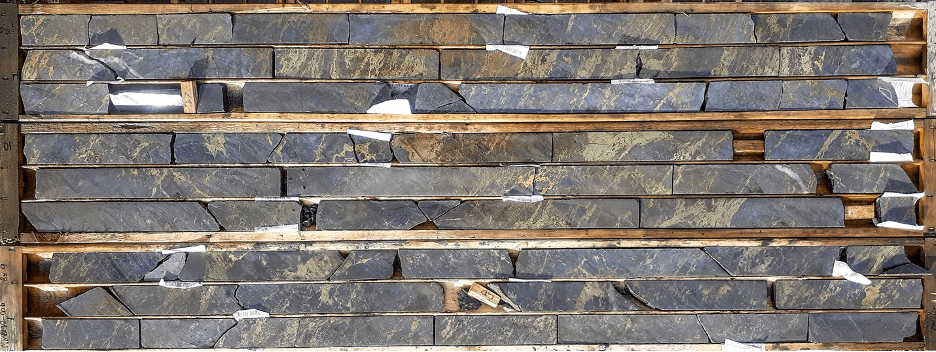

A review of the geology has confirmed that the deposit is a sheared volcanic massive sulphide deposit with chalcopyrite-pyrite-pyrrhotite mineralization associated with brecciated siliceous cherts containing variable amounts of syngenetic magnetite (Figure 4). Minor sphalerite mineralization defines a very distinct 40-meter halo around the main massive sulphide lens, bolstering the interpretation of a VMS setting for the mineralization. Within the massive sulphide lens copper, cobalt, gold, and silver grades track each other closely, indicating that they precipitated as part of a single event. In contrast, the narrow intervals of gold mineralization outboard of the main lens are associated with quartz-carbonate veining and have only minor silver and weak copper-cobalt values. These are likely related to the gold mineralization 1.6 kilometers along strike at the East Coldstream deposit and highlight the prospectivity of this trend for additional gold targets.

Figure 4: Photograph of drill core in the main high-grade zone (CND-22-006: 25.9-38.15m averages 1.34% CuE, including 0.59% Cu, 0.09% Co, 0.41 ppm Au and 4.5 ppm Ag)

The Company will address the backlog of North Coldstream core once it has cleared the balance of drill core from Moss Lake. Future drilling will target pillars within the deposit, potential depth extensions, and test similar targets in the district that are characterized by magnetic conductors (press release dated March 10, 2022).

Pete Flindell, VP Exploration for Goldshore, said “These drill results confirm our expectations of high-grade copper mineralization, especially as we are on the margin of the volcanic massive sulphide lens, and are extremely encouraging with respect to Cobalt grades. While the five pending holes are also around the margin of the system, and therefore likely to contain similar grades, I look forward to drilling closer to the core of the deposit to understand how the critical mineral elements may increase. These data will be invaluable in guiding our future drilling of similar, untested targets within the Moss Lake Project.”

|

|

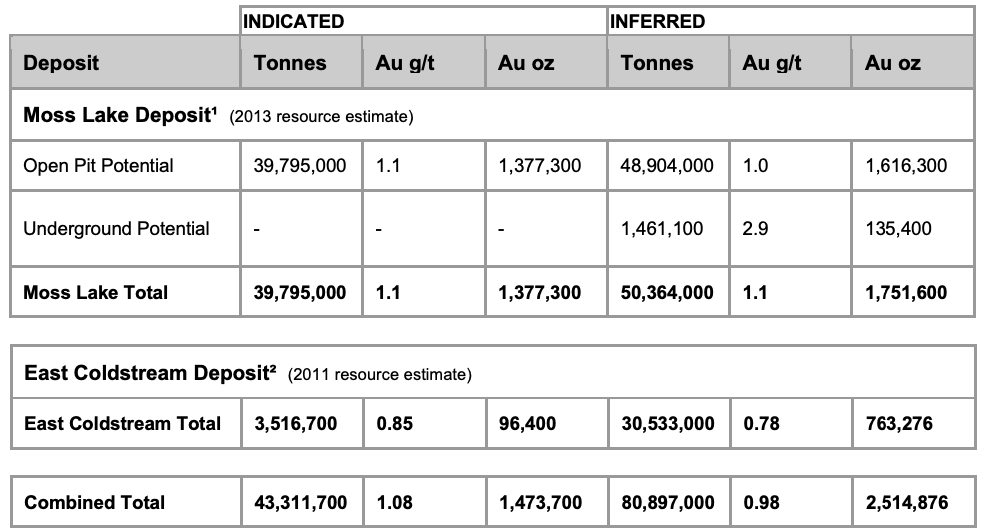

Table 3: Historical Mineral Resources¹ ² ³

Notes:

(1) Source: Poirier, S., Patrick, G.A., Richard, P.L., and Palich, J. “Technical Report and Preliminary Economic Assessment for the Moss Lake Project”, prepared for Moss Lake Gold Mines Ltd. The qualified persons for the Moss Lake Historical Estimate are Pierre-Luc Richard, MSc, PGeo (InnovExplo Inc), and Carl Pelletier, BSc, PGeo (InnovExplo Inc), and the effective date of the Moss Lake Historical Estimate is February 8, 2013. In-Pit results are presented undiluted and in situ, within Whittle-optimized pit shells. Underground results are presented undiluted and in situ, outside Whittle-optimized pit shells. The Moss Lake Historical Estimate includes 18 gold-bearing zones and 1 envelope containing isolated gold intercepts. Whittle parameters: mining cost = C$2.28; pit slope angle = 50.0 degrees; production cost = C$9.55; mining Dilution = 5%; mining recovery = 95%; processing recovery = 80% to 85%; gold price = C$1,500. In-Pit and Underground resources were compiled at cut-off grades from 0.3 to 5.0 g/t Au (for sensitivity characterization). A cut-off grade of 0.5 g/t Au was selected as the official in-pit cut-off grade and a cut-off grade of 2.0 g/t Au was selected as the official underground cut-off grade. The Moss Lake Historical Estimate is based on 352 diamond drill holes (90,978 m) drilled from 1983 and 2008. A fixed density of 2.78 g/cm3 was used. A minimum true thickness of 5.0 m was applied, using the grade of the adjacent material when assayed or a value of zero when not assayed. Capping was established at 35 g/t Au, supported by statistical analysis and the high grade distribution within the deposit. Compositing was done on drill hole sections falling within the mineralized zone solids (composite = 1 m). Resources were evaluated from drill hole samples using the ID2 interpolation method in a multi-folder percent block model using Gems version 6.4. Based on geostatistics, the ellipse range for interpolation was 75m x 67.5m x 40m. The Indicated category is defined by combining the blocks within the two main zones and various statistical criteria, such as average distance to composites, distance to closest composite, quantity of drill holes within the search area. Ounce (troy) = metric tons x grade / 31.10348. Calculations used metric units (metres, tonnes and g/t). The number of metric tonnes was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations in NI 43-101.

(2) Source: McCracken, T. “Technical Report and Resource Estimate on the Osmani Gold Deposit, Coldstream Property, Northwestern Ontario”, prepared for Foundation Resources Inc. and Alto Ventures Ltd. The East Coldstream Historical Estimate is based on a 0.4 g/t Au cut-off grade. The qualified persons for the East Coldstream Historical Estimate are Todd McCracken, P.Geo. (Tetratech Wardrop), and Jeff Wilson, Ph.D., P.Geo. (Tetratech Wardrop), and the effective date of the East Coldstream Historical Estimate is December 12, 2011. Resources are presented unconstrained, undiluted and in situ. The East Coldstream Historical Estimate includes 2 gold-bearing zones. A cut-off grade of 0.4 g/t Au was selected as the official resource cut-off grade. The East Coldstream Historical Estimate is based on 116 diamond drill holes drilled from 1986 to 2011. A fixed density of 2.78 g/cm3 was used. Capping was established at 5.89 g/t Au and 5.70 g/t Au for domains EC-1 and EC-2, respectively. This is supported by statistical analysis and the high grade distribution within the deposit. Compositing was done on drill hole sections falling within the mineralized zone solids (composite = 1 m). Resources were evaluated from drill hole samples using the ID2 interpolation method in a multi-folder percent block model using Datamine Studio 3 version 3.20.5321.0. Resource categorization is based on spatial continuity based from the variography of the assays within the drillholes. Ounce (troy) = metric tons x grade / 31.10348. Calculations used metric units (metres, tonnes and g/t). The number of metric tonnes was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations in NI 43-101.

(3) The reader is cautioned that the Moss Lake Historical Estimate East and the East Coldstream Historical Estimate (the “Historical Estimates“) are considered historical in nature and as such is based on prior data and reports prepared by previous property owners. The reader is cautioned not to treat them, or any part of them, as current mineral resources or reserves. The Company has determined these historical resources are reliable, and relevant to be included here in that they demonstrate simply the mineral potential of the Moss Lake Gold Project. A qualified person has not done sufficient work to classify the Historical Estimates as current resources and Goldshore is not treating the Historical Estimates as current resources. Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the Historical Estimates can be classified as a current resource. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. Even if classified as a current resource, there is no certainty as to whether further exploration will result in any inferred mineral resources being upgraded to an indicated or measured mineral resource category. The Historical Estimates relating to inferred mineral resources were calculated using prior mining industry standard definitions and practices for estimating mineral resource and mineral reserves. Such prior definitions and practices were utilized prior to the implementation of the current standards of the Canadian Institute of Mining for mineral resource estimation, and have a lower level of confidence.

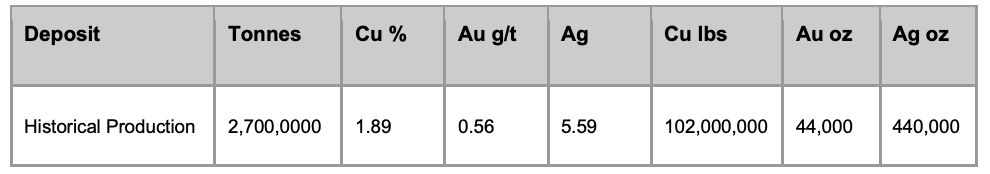

Table 4: Reported Historical Production from the North Coldstream Deposit ⁴

Note:

(4) Source: Schlanka, R., 1969. Copper, Nickel, Lead and Zinc Deposits of Ontario, Mineral Resources Circular No. 12, Ontario Geological Survey, pp. 314-316.

Peter Flindell, P.Geo., MAusIMM, MAIG, Vice President – Exploration of the Company, a qualified person under NI 43-101 has approved the scientific and technical information contained in this news release.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE