DRILLING CONTINUES TO DEFINE HIGH GRADE ZONES AT AgMR’s RELIQUIAS MINE

Highlights

- New drilling results add further confidence to the geological model with intercepts including:

-

- 9.20m @ 220.8 grams per ton silver equivalent (AgEq), including 1.33m @ 672.8g/t and 1.25m @ 706.7g/t AgEq, in drill hole SMR-03-22-MTC

- 0.70m @ 1,314.6g/t AgEq, in hole SMR-08-22-MTC

- 5.35m @ 324.0g/t AgEq, including 2.40m @ 611.2g/t AgEq, in hole SMR-08-22-MTC

- 3.78m @ 506.1g/t AgEq, including 1.50m @ 755.1g/t AgEq, in hole SMR-10-22-MTC

Silver Mountain Resources Inc. (TSX-V:AGMR) is pleased to provide an update on its underground drilling at the Reliquias silver mine in Huancavelica, central Peru. The main objective of the 12,000m program is to establish a National Instrument 43-101 – Standard of Disclosure for Mineral Projects compliant mineral resources in H1 2023 that will form the basis of our production decision in H2 2023. In addition, the Company aims to better characterize and extend the known silver-rich zones at depth.1

| _________________________________ | |

| 1 | For additional information in respect of the Castrovirreyna Project, please refer to the Company’s technical report, titled National Instrument 43-101 Technical Report—Castrovirreyna Project, Peru, dated October 6, 2021, amended November 18, 2021, effective date August 17, 2021, available at https://sedar.com/DisplayProfile.do?lang=EN&issuerType=03&issuerNo=00052252. |

Alfredo Bazo, President and CEO, commented: “The assay results from the reported drill holes confirm the continuity of high-grade Ag-Pb-Zn-Cu mineralization in the Matacaballo vein in proximity to existing mine workings at the Reliquias deposit. As was expected, the typical pinch-and-swell behaviour of the Sacasipuedes vein is shown in these drill holes, with varying vein widths and grades. We are encouraged that various bore holes have intersected more than one mineralized interval, which may represent splays of the main vein or newly identified structures. Our geological team is currently evaluating these intercepts to incorporate them in our 3D geological model.”

The drilling program is fully funded, with two rigs operating 24 hours per day. 32 holes have been completed to date, with results of 12 holes drilled to test the Matacaballo and Sacasipuedes veins included in this release (Table 1).

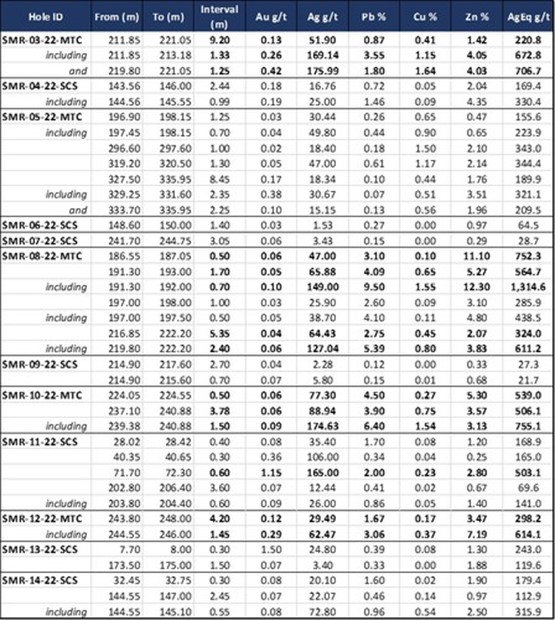

The following table provides more detail regarding the mineralized intercepts encountered in drill holes SMR-03-22-MTC to SMR-14-22-SCS.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Jose Vizquerra, a Director of the Company and a Qualified Person within the meaning of NI 43-101.

About Silver Mountain

Silver Mountain Resources Inc. is a silver explorer and mine developer planning to restart production at the Reliquias underground mine and undertake exploration activities at its prospective silver camps at the Castrovirreyna Project in Huancavelica, Peru.

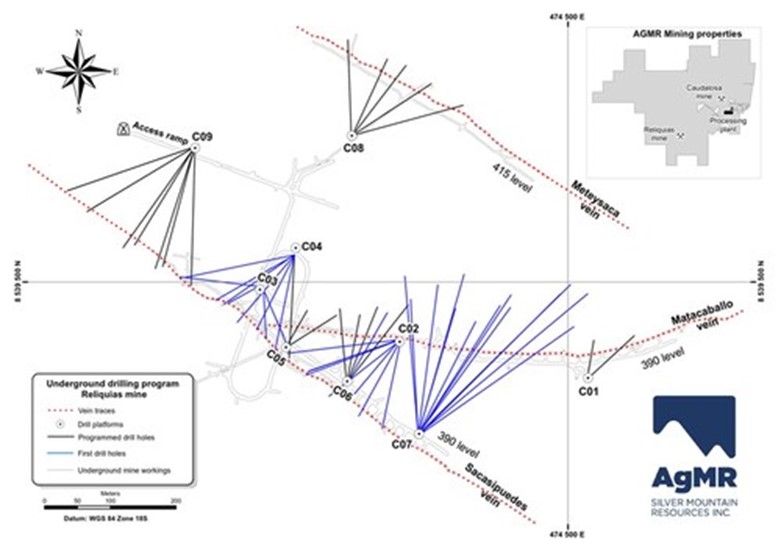

Figure1: Plan view of underground drilling program at the Reliquias silver mine, showing traces of drill holes completed to date (in blue) as well as the subsequently programmed bore holes. Additionally, underground workings, main mineralized veins, and drill platforms are displayed. Inset map shows Reliquias property block with locations of both silver mines and the processing plant (CNW Group/Silver Mountain Resources Inc.)

Table 1: Weighted assay results of drill holes SMR-03-22-MTC to SMR-14-22-SCS. MTC = Matacaballo vein, SCS = Sacasipuedes vein. AgEq values were calculated using silver, lead, zinc, copper, and gold. Metal prices utilized for the calculations are current prices as of June 9, 2022: Ag – 21.92US$/oz, Pb – 2,150US$/t, Zn – 3,754US$/t, Cu – 4.38US$/lb, and Au – 1,846US$/oz. Recovery is assumed as 100% as sufficient metallurgical data is not yet available. (CNW Group/Silver Mountain Resources Inc.)

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE