Alpha Exploration Reports 95 M of 1.30 G/t Aueq from Anagulu Porphyry Gold-Copper Prospect, Kerkasha Project, Eritrea

Alpha Exploration Ltd. (TSX-V: ALEX) is pleased to announce results of recent diamond and reverse circulation drilling at the Anagulu gold-copper porphyry prospect part of the Company’s 100% owned Kerkasha Project, Eritrea.

Highlights

- Four drill holes have significant intervals up to 95 m of gold-copper-silver mineralization (see Table 1 below) expanding the known strike length of mineralization at Anagulu to approximately 400 m.

- Last month, porphyry expert Dr. Richard Sillitoe spent six days studying and relogging the drill core and drill chips from Anagulu with Alpha geologists in Asmara, Eritrea.

- Sillitoe’s report states that “It is confirmed that Anagulu is undoubtedly a porphyry gold-copper system centered on a distinctive, dyke-like porphyry intrusion”.

- Alpha will use Dr. Sillitoe’s geological interpretation in conjunction with its extensive multi-element geochemical dataset to update its 3-D model to plan the next phase of exploration at Anagulu.

Table 1: Summary of highlight intervals from recent drilling at Anagulu.

| Hole Number | From (m) | To (m) | Interval (m)* | Au (g/t) | Cu (%) | Ag (g/t) | CuEq (%)*** |

AuEq (g/t)** |

| ANRD031 | 122 | 185.7 | 63.7 | 0.94 | 0.48 | 2.30 | 1.08 | 1.69 |

| ANRD032 | 208.6 | 293.85 | 85.25 | 0.27 | 0.16 | 1.02 | 0.33 | 0.52 |

| ANR033 | 10 | 105 | 95 | 0.65 | 0.42 | 1.65 | 0.83 | 1.30 |

| ANR044 | 140 | 210 | 70 | 0.58 | 0.38 | 1.64 | 0.75 | 1.17 |

*Note that the true width of the mineralization is uncertain, but the host structures are interpreted to be steeply dipping implying true widths are in the range of 60-80%. Intervals are based on a 0.1 g/t Au cut off and a maximum internal dilution of 2 m.

**AuEq = ((Cu%) x $Cu x 22.0642) + (Au(g/t) x $Au x 0.032151)) / ($Au x 0.032151); minor Ag grades not included.

***CuEq = ((Cu%) x $Cu x 22.0642) + (Au(g/t) x $Au x 0.032151)) / ($Cu x 22.0642); minor Ag grades not included.

Commodity prices: $Cu = US$4.00/lb and $Au = US$1,750/oz.

Factors: 22.0642 = Cu% to lbs per tonne, and 0.032151 = Au g/t to oz per tonne.

Metallurgical recovery for Cu and Au is assumed to be 100%

Michael Hopley, Alpha President and CEO said, “We are very happy with these latest drill results because they extend the zone of known gold and copper mineralization with gold equivalent values of over about 1 g/t to approximately 400-meter strike length; this is very encouraging given that the rock-chip and soil-sample gold and copper results at Anagulu suggest it is at least 2,000 meters long. In addition, with Richard Sillitoe’s insights into the style and controls of mineralization at Anagulu, Alpha staff will have the knowledge to continue exploration to expand the size of Anagulu.”

- Discussion

This latest phase of drilling at Anagulu (Phase 3) consisted of fourteen drill holes totalling 3,038 meters. The drilling was a mixture of diamond drilling, reverse-circulation (RC) drilling, with some holes started with RC before being completed at depth with diamond drilling. The objective of this drilling campaign was to understand the geometry and to extend in both strike and depth previously intersected gold and copper mineralization intersected at Anagulu. In addition, several drill holes were sited to test recently defined peripheral Induced Potential geophysical anomalies.

The results of this latest drilling has expanded the envelope of higher grade (greater than 1 g/t AuEq) gold-copper mineralization to approximately 400 meters in the northeast part of the prospect. Soil geochemistry as well as rock-chip samples define the surface extent of mineralization at Anagulu to have a strike length of at least 2 km.

2 Dr. Richard Sillitoe Examination of Anagulu drill core

Dr. Richard Sillitoe spent six days in Eritrea last month with Alpha geologists examining in detail the diamond drill core and reverse-circulation drill chips from 13 holes on three key cross-sections of the Anagulu gold-copper prospect. Dr. Sillitoe has now completed a report for Alpha which summarizes the exploration potential and recommendations.

Key observations are:

“It is confirmed that Anagulu is undoubtedly a porphyry gold-copper system centered on a distinctive, dyke-like porphyry intrusion”.

“The highest-grade gold-copper mineralization is contained in a zone of porphyry-type sheeted quartz veinlets near the upper eastern margin of the intrusion” and

“The high-grade geochemical gold and copper values obtained south of the known sheeted quartz veinlet body warrant further definition, possibly by systematic channel sampling”.

Alpha will use Dr. Sillitoe’s sections and interpretations in conjunction with its extensive multi-element geochemical dataset to update its 3-D model to plan the next phase of exploration at Anagulu.

- Collar Locations

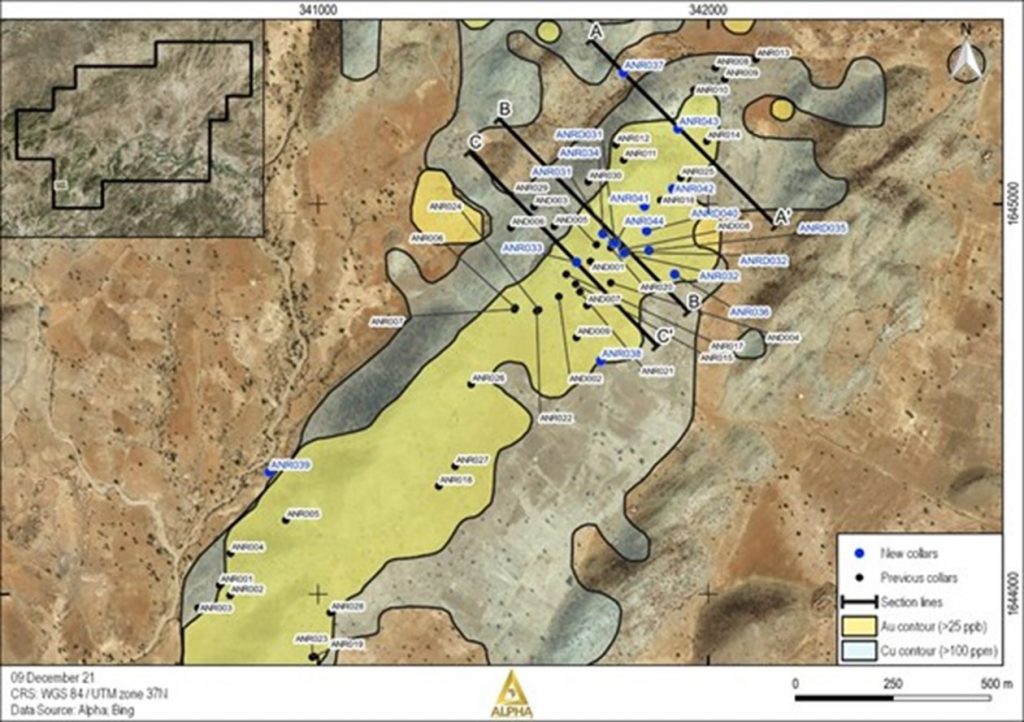

Locations of collars reported herein are presented in Figure 1, along with the locations of cross-sections (A-A’. B-B’, and C-C’) as presented in section 3.

Figure 1: Map showing location of drill hole collars reported in this release and the location of cross sections.

- Cross Sections

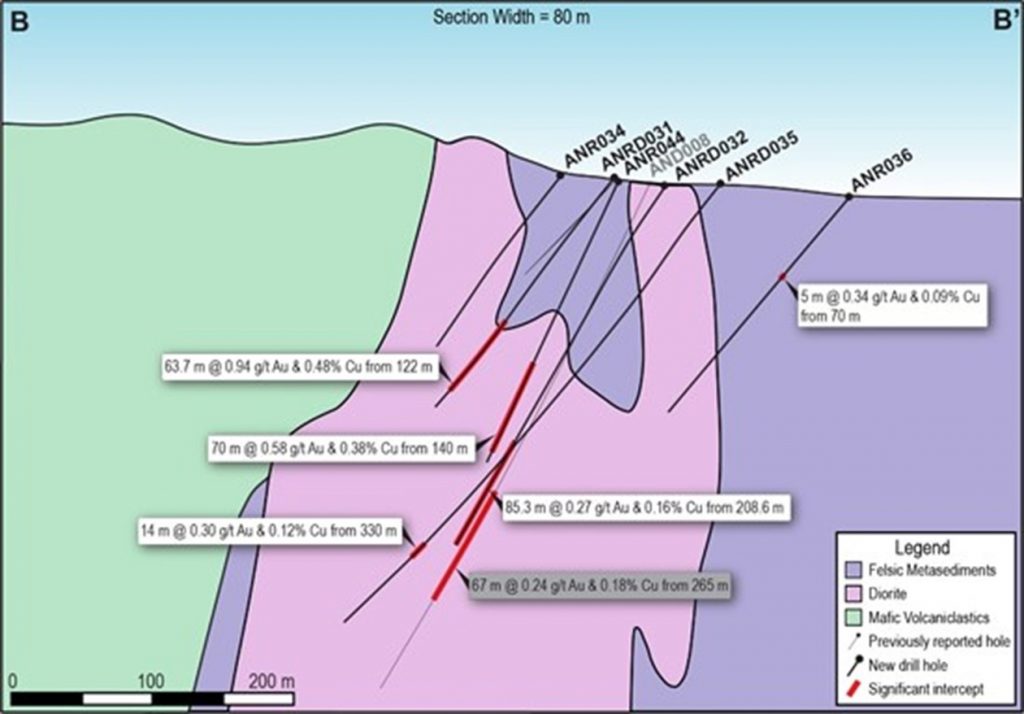

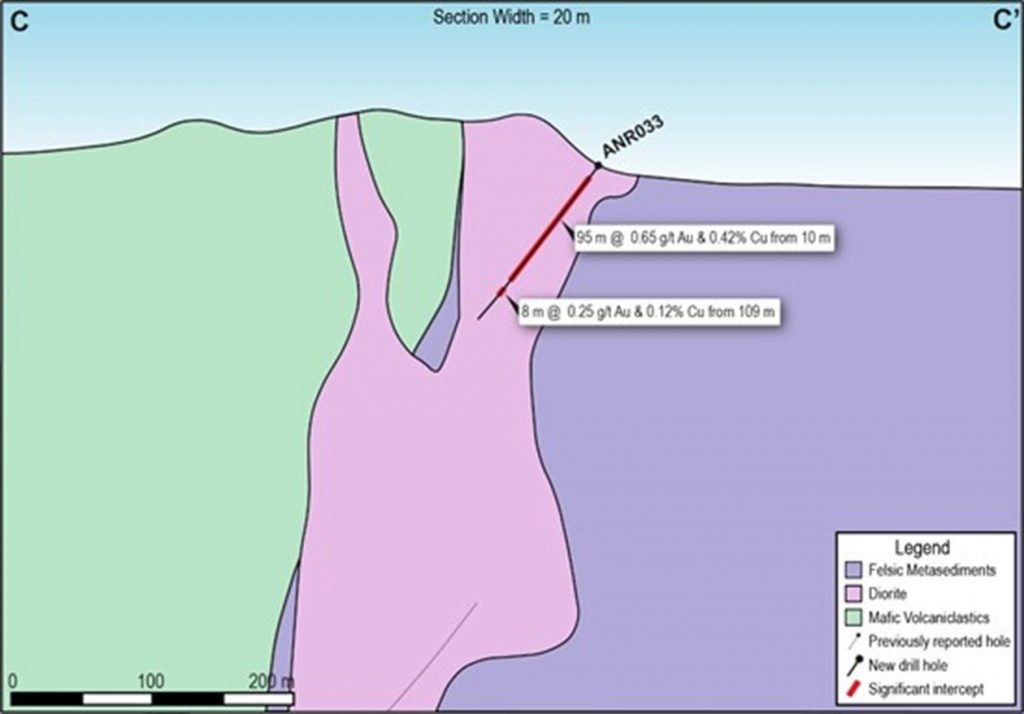

Key cross sections have been created by RSC that present the results from the significant intercepts from the drill holes reported here are found in Figure 2 (A-A’), Figure 3 (B-B’), and (C-C’). Locations of the cross-sections are indicated on Figure 1. These sections require additional updates to incorporate Dr. Sillitoe’s observations and interpretations.

Figure 2: Cross section A-A’ of drill holes ANR043 on a stylised slice through the Leapfrog model.

Figure 3: Cross section B-B’ of drill holes ANR036, ANR044, ANRD031, ANRD032, and ANRD035 on a stylised slice through the Leapfrog model. AND008 results have been previously reported.

Figure 4: Cross section C-C’ of drill holes ANR043 on a stylised slice through the Leapfrog model.

- Drill Hole Results

A summary of all assay results reported in this release is included in Table 2, and collar, azimuth, dip, and depth information for each hole is included in Table 3.

Table 2: Summary of assay results in this release.

| Hole Number | From (m) | To (m) | Interval (m)* | Au (g/t) | Cu (%) | Ag (g/t) | CuEq (%)*** |

AuEq (g/t)** |

| ANR033 | 10 | 105 | 95 | 0.65 | 0.42 | 1.65 | 0.83 | 1.30 |

| and | 109 | 117 | 8 | 0.25 | 0.12 | 0.67 | 0.28 | 0.44 |

| ANR034 | NSI | – | – | – | – | – | – | – |

| ANR036 | 70 | 75 | 5 | 0.34 | 0.09 | 0.49 | 0.30 | 0.48 |

| ANR037 | NSI | – | – | – | – | – | – | – |

| ANR038 | NSI | – | – | – | – | – | – | – |

| ANR039 | NSI | – | – | – | – | – | – | – |

| ANR041 | NSI | – | – | – | – | – | – | – |

| ANR042 | NSI | – | – | – | – | – | – | – |

| ANR043 | 120 | 132 | 12 | 0.43 | NA | NA | – | – |

| ANR044 | 140 | 210 | 70 | 0.58 | 0.38 | 1.64 | 0.75 | 1.17 |

| ANRD031 | 122 | 185.7 | 63.7 | 0.94 | 0.48 | 2.30 | 1.08 | 1.69 |

| ANRD032 | 208.6 | 293.85 | 85.25 | 0.27 | 0.16 | 1.02 | 0.33 | 0.52 |

| ANRD035 | 330 | 344 | 14 | 0.3 | 0.12 | 0.67 | 0.31 | 0.49 |

| ANRD040 | NSI | – | – | – | – | – | – | – |

NSI = No significant intervals. NA = not analysed. ANRXXX are drill holes completed by reverse-circulation method. ANRDXXX are drill holes completed by initial RC methods and completed with diamond drilling.

*Note that the true width of the mineralization is uncertain, but the host structures are interpreted to be steeply dipping implying true widths are in the range of 60-80%. Intervals are based on a 0.1 g/t Au cut off and a maximum internal dilution of 2 m.

**AuEq = ((Cu%) x $Cu x 22.0642) + (Au(g/t) x $Au x 0.032151)) / ($Au x 0.032151); minor Ag grades not included.

***CuEq = ((Cu%) x $Cu x 22.0642) + (Au(g/t) x $Au x 0.032151)) / ($Cu x 22.0642); minor Ag grades not included.

Commodity prices: $Cu = US$4.00/lb and $Au = US$1,750/oz.

Factors: 22.0642 = Cu% to lbs per tonne, and 0.032151 = Au g/t to oz per tonne.

Metallurgical recovery for Cu and Au is assumed to be 100%

Table 3: Details of drill holes reported in this release. CRS = UTM 37N.

| Hole Number | UTM Easting | UTM Northing | Azimuth (°) | Dip (°) | Depth (m) |

| ANR033 | 341662 | 1644851 | 315 | -50 | 138 |

| ANR034 | 341730 | 1644924 | 315 | -50 | 150 |

| ANR036 | 341914 | 1644820 | 315 | -50 | 198 |

| ANR037 | 341782 | 1645337 | 315 | -50 | 210 |

| ANR038 | 341724 | 1644598 | 315 | -50 | 180 |

| ANR039 | 340875 | 1644313 | 135 | -50 | 186 |

| ANR041 | 341836.4 | 1644994 | 315 | -50 | 182 |

| ANR042 | 341909 | 1645039 | 315 | -50 | 220 |

| ANR043 | 341922 | 1645193 | 315 | -50 | 200 |

| ANR044 | 341763 | 1644900 | 315 | -65 | 218 |

| ANRD031 | 341760 | 1644903 | 315 | -50 | 201.7 |

| ANRD032 | 341787 | 1644877 | 315 | -50 | 293.85 |

| ANRD035 | 341848 | 1644881 | 315 | -50 | 410.5 |

| ANRD040 | 341842 | 1644931 | 315 | -50 | 250.1 |

- Sampling, Sub-sampling and Analysis

Geological consultants from RSC were responsible for the design of a strict QA/QC program consistent with industry best practice. Drill core was typically HQ in diameter, and NQ at the tail of deeper holes dependent on ground conditions. Drill core was delivered to a secure location for logging and sampling. All drill core was logged and marked for cutting and sampling. Samples from RC drilling were split at the rig using a Metzke splitter, before being transported to a secure location for logging.

All samples were submitted to Nabro Laboratories Limited (Nabro), Asmara, Eritrea, for sample preparation. Samples were crushed (to 90% passing 2.8 mm) and pulverised (to 85% passing 75 µm). Two scoop samples were taken from the pulveriser bowl: approximately 120 g for laboratory analysis, and approximately 100 g for portable X-ray fluorescence (pXRF) analysis. The coarse and pulp rejects were stored in a warehouse in Asmara. The Company inserted a certified reference material from OREAS (www.ore.com.au) into the sample stream, while Nabro inserted a barren granodiorite material into the sample stream as a blank.

Drill samples were shipped to ALS Geochemistry (ALS), Loughrea, Ireland, for analysis. ALS analyzed all drill samples for gold by method Au-AA25 (30 g charge fire assay, AAS finish). After receipt of the gold results, samples with Au >0.1 g/t or >900 ppm Cu (pXRF) were selected to be analyzed by method ME-MS61 (four-acid digest, ICP-MS/OES finish). ALS is independent of the Company and its quality management systems framework is accredited to ISO/IEC 17025:2005 or certified to ISO 9001:2015 standards.

- Licence relinquishment

As Alpha has previously reported, it is required by the Ministry of Energy and Mines in Eritrea to relinquish 25% of its original licence area of 1,028 km2. The areas selected for relinquishment include a military exclusion zone and other parts of the original licence that the Company considers to be of lower prospectivity – this assessment is largely based on Alpha’s extensive soil sample dataset. The new licence area is 771 km2 (Figure 5).

Figure 5: Map presenting old licence area (1028 km2) and new licence area 771 km2.

About Alpha

Alpha is an exploration company listed on the TSX-V exchange under the symbol ALEX. The company is focused on the discovery of world class economic gold and base metals deposits in the highly prospective Arabian-Nubian shield, on either side of the Red Sea. Alpha currently holds a 100% interest in the large (771 km2) Kerkasha Exploration License in southwest Eritrea, located 135 km west-southwest of the capital city of Asmara. Since acquiring the property in January 2018, the company has spent approximately CAD$11 million on exploration and identified 18 in prospects of which four have been drilled to date. The large Anagulu gold-copper porphyry system was a virgin discovery by Alpha geologists in early 2018, that was made while executing a property-wide soil sample program. The discovery diamond hole was drilled in January 2020 and reported a 49-m wide interval with an average grade of 2.42 g/t gold, 1.10% copper and 6.83 g/t silver. Work continues at Anagulu, and the Company plans to drill four other prospects later this year.

Alpha is managed by a group of highly experienced and successful professionals with many years of experience carrying out exploration and resource development programs in Eritrea and Sudan.

MORE or "UNCATEGORIZED"

Mirasol Completes the Sale of the Sascha-Marcelina Projects in Argentina for US$1.5 Million Plus Royalty

Pursuit Minerals acquires the Sascha-Marcelina Projects for a tot... READ MORE

ADYTON RESOURCES RECEIVES NON-BINDING LETTER OF INTENT (LOI) FOR THE PURCHASE OF GOLD CONCENTRATE FROM ITS WAPOLU PROJECT

Adyton Resources Corporation (TSX-V: ADY) is pleased to announce ... READ MORE

Cerro de Pasco Resources Prepares for Next Phase as Technical and Permitting Work Advances at the Quiulacocha Project

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCMKTS: GPPRF) (BV... READ MORE

Miata Doubles Mineralized Footprint at Jons Trend with a 500m Step Out in Hole 039 and Highlights 54 m at 1.04 g/t Au in Hole 043

Miata Metals Corp. (CSE: MMET) (FSE: 8NQ) (OTCQB: MMETF) is pleas... READ MORE

Viridian Releases Initial 2025 Drill Results Confirming Shallow, Continuous Sulphide Mineralization at Kraken

Viridian Metals Inc. (CSE: VRDN) is pleased to report initial ass... READ MORE