ORENINC INDEX hits high as financings rocket

ORENINC INDEX – Monday, May 18th 2020

North America’s leading junior mining finance data provider

Subscribe to our weekly updates at oreninc.com/subscribe

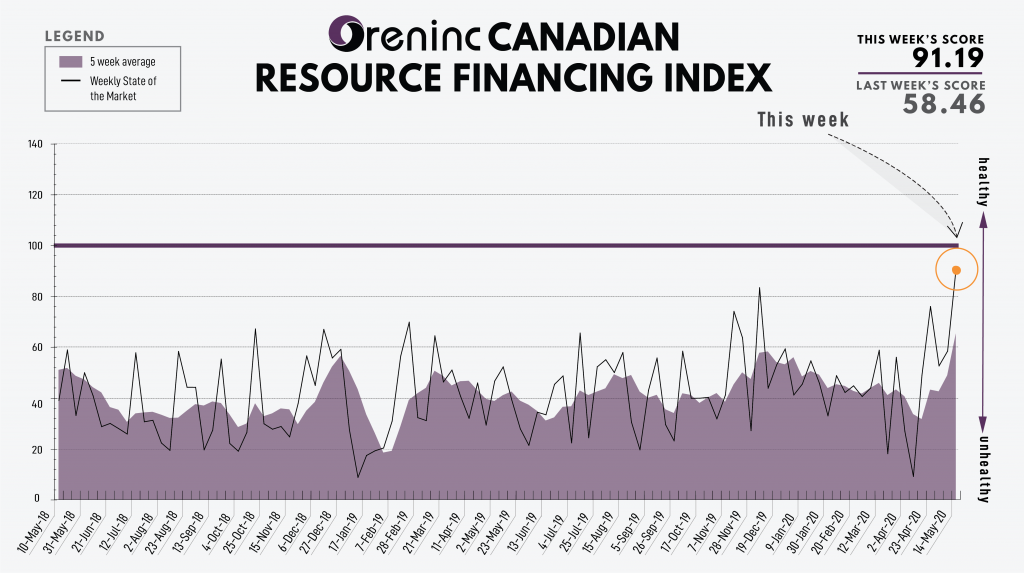

Last Week: 58.46

This week: 91.18

The Oreninc Index increased in the week ending May 15th, 2020 to 91.18 from 58.46 a week ago as financings rocketed.

The COVID-19 virus global death toll increased to over 309,000 and more than 4.5 million cases reported worldwide.

Hopes of the USA and China resolving their differences any time soon look increasingly remote as President Donald Trump said that he doesn’t want to talk to Chinese president Xi Jinping and that the country would save US$500 billion if he “cut off the whole relationship”. Trump blames China for the spread of the COVID-19 virus.

Trump threw gasoline onto this fire Friday when he would block shipments of semiconductors to Huawei Technologies from global chipmakers as well as withdrawing certain US pension funds from investing in Chinese companies.

The US central bank began purchasing ETFs holding corporate bonds for the first time ever targeting companies who have been downgraded from investment grade to speculative or junk.

The economic impacts of the virus continue to reverberate as the workforce in the USA continues to shrink with the Labor Department reporting 2.98 million people filing first-time jobless claims this past week. Continuing jobless claims rose to 22.8 million, for the week ending May 2nd.

Germany, Europe’s leading economy, is also feeling the pain having entered recession as growth fell 2.2% in the first quarter and putting the country on track for a 6.5% decline this year.

Precious metals closed the week strongly with silver making a significant move higher.

On to the money: brokered action continued as the total raises announced increased to $186 million, a 23-week high, which included three brokered financings for $97.6 million, a three-week high, and three bought-deal financings for $112.6 million, a 172-week high. The average offer size almost doubled to $3.6 million, a two-week high, while the number of financings increased to 51.

Gold saw a strong close to the week as the spot price closed up at $1,743/of from $1,702/oz a week ago. The yellow metal is up 14.92% so far this year. The US dollar index rallied again to 100.40 from 93.73 last week. The VanEck managed GDXJ continued its growth trajectory to close up at $45.92 from $43.09 a week ago. The index is now up for the year, 8.66% so far in 2020. The US Global Go Gold ETF continued to see growth as it closed up at $20.17 from $18.96 a week ago. It is up 14.86% so far in 2020. The HUI Arca Gold BUGS Index closed up again at 296.92 from 285.28 last week. The SPDR GLD ETF inventory continued to increase as it closed up at 1,1113.78 tonnes from 1,081.65 tonnes last week.

In other commodities, silver made a big jump ahead as the spot price closed up at $16.61/oz from $15.47/oz a week ago. Copper lost ground it closed down at $2.33/lb from $2.40/lb week ago. Oil continued to recover as WTI closed up at $29.43 a barrel from $24.74 a barrel a week ago.

The Dow Jones Industrial Average saw a sell-off as the week closed as it closed down at 23,685 from 24,331 a week ago. Canada’s S&P/TSX Composite Index closed down as well at 14,638 from 14,966 the previous week. The S&P/TSX Venture Composite Index closed up at 509.01 from 492.09 last week.

Summary

- Number of financings increased to 51.

- Three brokered financings were announced this week for $97.6 million, a three-week high.

- Three bought-deal financings were announced this week for $112.6 million, a 172-week high.

- Total dollars increased to $186 million, a 23-week high.

- Average offer increased to $3.6 million, a two-week high.

Financing Highlights

Fortuna Silver Mines (TSX:FVI) into a bought deal to raise US$60 million.

- 20 million shares @ US$3.

- Proceeds to fund remaining construction and preproduction related expenditures at the Lindero gold project in Argentina.

Major Financing Openings

- Fortuna Silver Mines (TSX:FVI) opened a $84.63 million offering underwritten by a syndicate led by Scotiabank on a bought deal basis. The deal is expected to close on or about May 20th.

- Great Bear Resources (TSX-V:GBR) opened a $28 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis. The deal is expected to close on or about June 2nd.

- TMAC Resources (TSX:TMR) opened a $21.06 million offering on a strategic deal basis. The deal is expected to close on or about November 30th.

- Silver Viper Minerals (TSX-V:VIPR) opened a $5 million offering underwritten by a syndicate led by Eight Capital on a best efforts basis. Each unit includes half a warrant that expires in two years. The deal is expected to close on or about June 3rd.

Major Financing Closings

- Alphamin Resources (TSX-V:AFM) closed a $43.72 million offering on a best efforts basis.

- Northern Dynasty Minerals (TSX:NDM) closed a $17.31 million offering underwritten by a syndicate led by Cantor Fitzgerald Canada on a best efforts basis.

- Fosterville South Exploration (TSX-V:FSX) closed a $15 million offering on a bought deal basis. Each unit included half a warrant that expires in two years.

- Freegold Ventures (TSX:FVL) closed a $5 million offering underwritten by a syndicate led by Paradigm Capital on a best efforts basis.

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE