ORENINC INDEX inches up again

ORENINC INDEX – Monday, November 12th 2018

North America’s leading junior mining finance data provider

ORENINC MINING DEAL CLUB

Access to high-quality, pre-vetted financing opportunities

www.miningdealclub.com

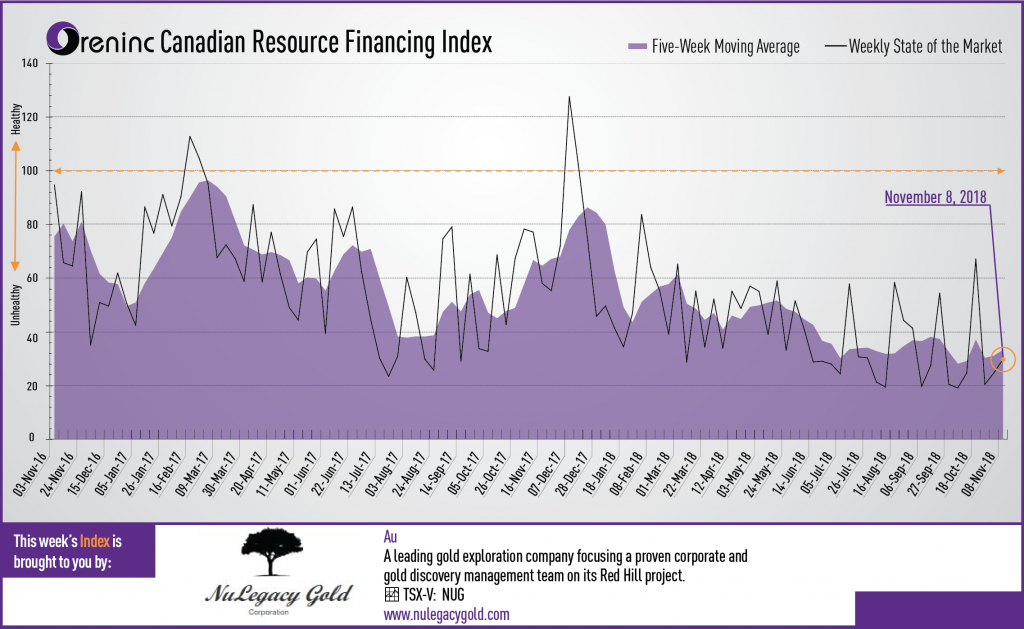

Last week index score: 24.66 (updated)

This week: 29.73

Nulegacy Gold (TSX-V:NUG) acquired strategic claims west of its VIO targets.

Nexus Gold (TSX-V:NXS) acquired the Dakouli 2 gold concession in central Burkina Faso.

Zinc One Resources (TSX-V:Z) reported additional drill results from the Mina Grande Norte zone, Bongará zinc mine in Peru.

Avrupa Minerals (TSX-V:AVU) closed the first tranche of a private placement of C$500,000 comprised of 10.0 million units @ $0.05.

The Oreninc Index picked up again in the week ending November 9th, 2018 to 29.73 from an updated 24.66 a week ago as although financings remain in short supply.

Stocks responded positively to the results of the US Mid-term elections in which the Democrats won back control of the House of Representatives (the Republicans retained control of the Senate). This, and the fact that the US Federal Reserve subsequently left interest rates unchanged, setting the stage for another interest rate increase in December, took the shine off gold, which gave up some of its recent gains.

The WTI oil benchmark price formerly entered a bear market having fallen 20% from recent highs, thus ending its longest bull market since 2008. Oil prices have been chipped away by increased supply expectations in 2019 with the US having record crude output and indications that production growth in Iraq, Abu Dhabi and Indonesia will be quicker than expected.

On to the money: total fund raises announced decreased to C$48.6 million, a two-week low, which included one brokered financing for C$5.0 million, a three-week high, and one bought-deal financing for C$5.0 million, a two-week high. The average offer size fell to C$2.3 million, a two-week low, whilst the number of financings increased to 21, a three-week high.

Gold fell back to US$1,209/oz from US$1,232/oz a week ago. It is now down 7.15% this year. The US dollar index increased slightly to 96.90 from 96.54 last week. The van Eck managed GDXJ pulled back again, giving up almost a dollar as it closed down at US$27.13 from US$28.06 a week ago. The index is down 20.51% so far in 2018. The US Global Go Gold ETF also closed down at US$10.48 from US$10.87 a week ago. It is now down 19.43% so far in 2018. The HUI Arca Gold BUGS Index also closed down at 143.41 from 149.44 last week. The SPDR GLD ETF saw another sell off in inventory closing down at 755.23 tonnes from 759.06 tonnes a week ago.

In other commodities, silver sold off to close down at US$14.16/oz from US$14.71/oz a week ago. Copper also sold off to close down at US$.68/lb from US$2.80/lb last week. Oil continued its slide as WTI again closed down at US$60.19 a barrel from US$63.14 a barrel a week ago.

The Dow Jones Industrial Average saw a volatile week of growth as it made up for recent losses to close up at 25,989 from 25,270 last week, although down from its mid-week high of 26,191. Canada’s S&P/TSX Composite Index also closed up at 15,274 from 15,119 the previous week. The S&P/TSX Venture Composite Index also saw a gain as it closed up a smidge at 651.42 from 651.35 last week.

Summary

- Number of financings increased to 21, a three-week high.

- One brokered financing was announced this week for C$ 5.0m, a three-week high.

- One bought-deal financing was announced this week for C$ 5.0m, a two-week high.

- Total dollars decreased to C$48.6m, a two-week low.

- Average offer size fell to C$2.3m, a two-week low.

Financing Highlights

Lumina Gold (TSX-V:LUM) announced a C$16.0 million financing @ $0.56 that was subsequently increased to $20.0 million.

- Short form prospectus offering of up to $9.5 million to be conducted on a reasonable efforts agency basis by led by Haywood Securities, subsequently increased to $10.8 million.

- Concurrent non-brokered private placement of up to $6.5 million on the same terms subsequently increased to $9.2 million.

- The net proceeds will be used to fund infill and step-out, geotechnical, hydrology and metallurgical drilling; environmental, permitting and social programs; updating the resource estimate for its Cangrejos Au-Cu project in Ecuador.

Major Financing Openings

- Lumina Gold (TSX-V:LUM) opened a C$16 million offering on a best efforts

- Rupert Resources (TSX-V:RUP) opened a C$8.0 million offering on a best efforts

- Denison Mines (TSX:DML) opened a C$5.0 million offering underwritten by a syndicate led by Cantor Fitzgerald Canada on a bought deal

- Noront Resources (TSX-V:NOT) opened a C$75 million offering on a best efforts basis.

Major Financing Closings

- Bonterra Resources (TSX-V:BTR) closed a C$82 million offering underwritten by a syndicate led by Sprott Capital Partners on a best efforts basis.

- White Gold (TSX-V:WGO) closed a C$15.0 million offering on a bought deal

- Integra Resources (CSE:ITR) closed a C$5 million offering underwritten by a syndicate led by Raymond James on a bought deal basis.

- Osisko Metals (TSX-V:OM) closed a C$46 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis.

Company News

Nulegacy Gold (TSXV:NUG) acquired strategic claims west of its VIO targets.

- The company staked 64 mining claims adjacent and to the west of its Red Hill property in the Cortez gold trend of Nevada.

- The Coal Canyon land package encompasses about 5.1km2, just 4.5km directly south of Barrick Gold’s 10 million-ounce Goldrush deposit. The claims are prospective for Carlin-type sediment hosted gold deposits and epithermal gold-silver deposits.

Analysis

Acquisition of these claims that increase its land package to about 108km2, is a real coup for the company given the proven gold-bearing potential of the district, even though proximity to deposits such as Goldrush is not necessarily indicative of the gold mineralization in the company’s Red Hill project. The additional claims provide the company with even more exploration potential.

Nexus Gold (TSX-V:NXS) acquired the Dakouli 2 gold concession in central Burkina Faso.

- 198km2 gold exploration permit on the Boromo-Goren Greenstone Belt.

- Immediately south of Nexus’ 178-sq km Niangouela concession that has been explored over the past two years and where sampling returned bonanza-grade gold values up to 2,950g/t Au. The maiden drill program returned high-grade intercepts including 4.85m @ 26.69g/t Au.

- Nexus identified a large orpaillage situated on the permit’s eastern border that is actively exploited by artisanal miners.

Analysis

The addition of Dakouli 2 adds to the potential of the company’s high-grade Niangouela project by increasing its exploration area in a proven gold belt. With the company initiating early stage exploration right away it aims to get a better handle on the potential of this new ground in the near term.

Zinc One Resources (TSX-V:Z) reported additional drill results from the remaining holes in the Mina Grande Norte zone, Bongará zinc mine in north-central Peru.

- Drilling focused on the eastern edge of the zone mined by the previous operator and west of the high-grade zinc-oxide mineralization outlined by the pit sampling.

- High-grade intercepts included 39.6m @ 37.0% zinc in hole MGN18010.

- The drill program at Mina Grande Norte encountered multiple high-grade intercepts in the western sector and, along with the results from pit sampling, establish that the mineralization covers an area of about 175m in an east-west direction and 100m in a north-south direction.

Analysis

Numerous high zinc grades associated with the Mina Grande Norte zone are a very positive indication for the future potential of the deposit, partiucularly given the thickness and grade of mineralization seen along the western edge of the deposit. These latest results will make an important contribution to the upcoming resource estimate.

Avrupa Minerals (TSX-V:AVU) closed the first tranche of a private placement of C$500,000 comprised of 10.0 million units @ $0.05.

- Each unit is comprised of one share and a warrant exercisable @ $0.10 for three years.

- Avrupa will now begin its 2,500-3,000m drilling program at the Alvalade Cu-Zn VMS project in Portugal to expand currently known mineralized areas and outline higher grade Cu-Zn mineralization within the massive sulphide lenses.

MORE or "UNCATEGORIZED"

KOOTENAY SILVER CLOSES BROKERED PUBLIC OFFERING FOR GROSS PROCEEDS OF C$10.35 MILLION

Kootenay Silver Inc. (TSX-V: KTN) is pleased to announce that the... READ MORE

U.S. Gold Corp. Closes $4.9 Million Non-Brokered Registered Direct Offering

U.S. Gold Corp. (NASDAQ: USAU), is pleased to announce that it h... READ MORE

Getchell Gold Corp. Announces Final Tranche of Debenture Financing

Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) (FWB: GGA1) is ple... READ MORE

Imperial Reports Production Update for 2024 First Quarter

Imperial Metals Corporation (TSX:III) reports quarterly copper an... READ MORE

ALX Resources Corp. Intersects Additional Uranium Mineralization at the Gibbons Creek Uranium Project, Athabasca Basin, Saskatchewan

ALX Resources Corp. (TSX-V: AL) (FSE: 6LLN) (OTC: ALXEF) is pleas... READ MORE