Rick Mills – “Lithium deals gathering pace”

As a general rule, the most successful man in life is the man who has the best information

The United States currently imports most of the lithium that it consumes – with import reliance today pegged at over 70%. Due to junior lithium explorers having a hard time raising funds in North America, most have signed agreements with battery-makers in Asia. All except one – Cypress Development Corp (TSX-V:CYP), which has a monster lithium deposit in the Clayton Valley of Nevada, right next to Albemarle’s Silver Peak Mine – the only producing lithium mine in the United States. This gives Cypress a compelling advantage over its competitors, in the race to tie up US lithium and create a supply chain that can feed a burgeoning electric battery and car industry, in North America.

Meanwhile, deal-making in the South American salars (evaporated salt lakes), where three-quarters of the world’s lithium is produced, has never been more active. With 50% of the world’s lithium resources in Chile, as well as the country being the lowest-cost producer of the mineral, if you’re a junior resource company in the lithium space, Chile is the place to own lithium projects. And if you’re a buyer in need of lithium, Chile is most likely on your radar.

Lithium Chile (TSX-V:LITH) has spent the last few years quietly amassing a huge collection of properties in the “lithium triangle” of Chile, Argentina and Bolivia – where about 75% of the world’s lithium comes from, given its abundance and high quality. Chile is currently the second largest producer of the main ingredient of lithium-ion batteries installed in electric vehicles, behind only Australia, home to the Greenbushes hard rock lithium and tantalum mine owned by Talison Lithium. The small-cap lithium junior holds 152,900 hectares across 14 salars and one “laguna” (lagoon in Spanish), surrounding the world’s most important lithium reserves in the Salar de Atacama.

LITH’s land package (video) is the largest privately-owned lithium amassment in Chile.

In this article, we’ll do a round-up of recent hand-shakes in both Chile and North America where, despite having significant lithium deposits, most of the lithium will be going to Asia for processing into lithium hydroxide or lithium carbonate. Unless Cypress can turn the tide. We should find out soon in its upcoming PEA.

Chile: Record foreign investment

The tripling in lithium prices over the last three years has hastened a rush of new deals between lithium miners/ explorers and major players in the electric battery and vehicle space. As mentioned many are looking at Chile to lock up offtake agreements.

Mining lithium in the salars of Chile and Argentina is much more cost-effective than hardrock mining where the lithium is blasted from granite pegamite orebodies containing spodumene, apatite, lepidolite, tourmaline and amblygonite. The biggest hard-rock lithium mine in the world is Greenbushes in Australia.

Chile has become recognized as an excellent mining country, with a low risk of resource nationalism (the tendency of governments to assert control, for strategic and economic reasons, over natural resources located on their territory), a new mining code, and clear permitting rules – all major pluses for mining and exploration companies hoping to do business there.

Lithium Chile has the advantage of being in a country with significantly higher grades and reserves than its neighbor, Argentina, due to geography. The Salar de Atacama has just the right amount of heat, wind and lack of rain to ensure high evaporation rates, making it the ideal location for lithium mining.

A recent report from InvestChile notes that foreign investment has grown by a record 655% in the first four months of 2018. According to the Central Bank of Chile, US$8.4 billion entered the country between January and April, over six times more than the same period in 2017. The total is the highest amount ever recorded since record-keeping began in 2003, and is 24% more than total foreign investment last year of $6.4 billion.

“This is a figure that is, without doubt, marked by large operations in our country, both as regards new investment and the acquisition of existing companies, and indicates the confidence of overseas companies in our market,” said Ian Frederick, acting director of InvestChile. “Chile has an important track record as a destination for foreign investment and has attributes that stand out in the region. To this, we have added a greater capacity to attract investment and the political will – led by the Economy Ministry – to accelerate and facilitate the development of international businesses in the country. This is what we see reflected in these figures which invite us, as an agency, to continue working.”

Among the recent foreign involvements in Chilean lithium:

- Minera Salar Blanco, the joint-venture company that operates the Maricunga lithium project, in March secured an export permit. Lithium export permits are tightly controlled by the Chilean Nuclear Commission.

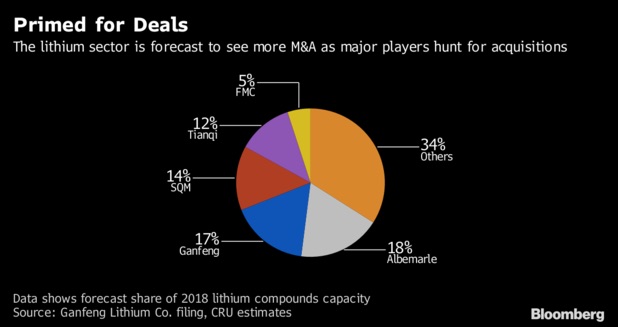

- Nutrien, a company born of the merger between PotashCorp and Agrium, sold its stake in Chile’s top lithium producer, SQM, to China’s Tianqi Lithium, for $4.1 billion – although the sale is being blocked by Chile’s development agency, Corfu.

- Under a recently signed memorandum of understanding, Hong Kong-listed Prosper One International Holding Company Limited has the opportunity to earn 55% of Lithium Chile’s Pintadas Norte project by spending $3 million in exploration in the next three years.

- Samsung SDI, the battery-maker arm of the South Korean conglomerate, and metals supplier Posco plan to build a battery materials plant in Chile in exchange for a lithium offtake from SQM and Albemarle.

North America: The great lithium tie-up

The Clayton Valley in Nevada started producing lithium in 1966 and the Silver Peak lithium brine operation owned by Albemarle is currently the only producing lithium mine in the US.

In 2008 the National Research Council saw lithium as potentially becoming a critical mineral due to the expected growth of hybrid vehicle batteries. Two years later the US Department of Energy’s Critical Materials Strategy included lithium as one of 16 key elements. Lithium is among 23 critical metals President Trump recently deemed critical to national security, and signed a bill that would encourage the exploration and development of new US sources of these metals. It’s unfortunate for the United States that its dependence on lithium coincides with the ramping-up of demand for the white metal. But it’s also an extraordinary opportunity for Cypress.

That’s because all of the other prospective lithium projects in North America (including Mexico) are either too small, too early-stage, or have already inked deals with off-shore suppliers to be of any help to North America in securing a domestic supply of lithium that would reduce US and Canadian dependence on foreign (ie. South American, Australian or Chinese) raw or processed lithium needed for the new electrified economy. Let’s take a run through the options. Note the size of each deposit, compared to what Cypress has, in the section below the list. (Note: in all cases except Nemaska Lithium, the numbers refer to contained lithium, not lithium tonnage).

- Nemaska Lithium. Japan’s SoftBank invested $100 million into Nemaska’s Whabouchi mine and electrochemical plant in northern Quebec. Nemaska has offtake agreements with FMC, Johnson Matthey, Korea’s LG Chem and Japanese battery chemicals trader Hanwa Corp/ General Lithium Corp of China, and Northvolt AV, a Swedish battery manufacturer.

37 million tonnes lithium, proven and probable reserves.

- Bacanora Lithium. Bacanora inked deals in 2017 with China’s NextView Capital, which took an 18.9% stake as well as an offtake agreement to supply NextView with 5,000 tonnes per annum of lithium carbonate in stage one, and 15,000 tpa in later stages; and an offtake agreement with Hanwa Corp. Bacanora, which like Cypress has a clay lithium project, earlier agreed to supply lithium hydroxide to Tesla with joint-venture partner Rare Earth Minerals.

1.9 million tonnes lithium carbonate equivalent (LCE) measured, 3.1MT indicated, 3.7MT inferred.

- Lithium Americas. Its Thacker Pass project in northern Nevada is intimately tied to Ganfeng Lithium of China. Lithium Americas collaborated with Ganfeng to do the metallurgical test work for the prefeasibility study. Ganfeng is a major investor ($174 million) in Lithium Americas’ Cauchari-Olaroz lithium project in Argentina, which it owns with SQM.

5,982,000 tonnes LCE, measured and indicated.

- Pure Energy Minerals. The company with a lithium project in Nevada’s Clayton Valley signed an agreement with Tesla Motors in 2015 to supply an unspecified amount of lithium hydroxide to Tesla for five years.

218,000 tonnes LCE, inferred.

- Global Geoscience. In June Global Geoscience, whose Rhyolite Ridge project in Nevada is composed of clay lithium and boron, did an A$53 million private placement. The underwriter is an Australian company and the shares were purchased by “high quality domestic [Australian] and offshore institutions.”

4.1 million tonnes lithium carbonate, 11.9 million tonnes boric acid, indicated and inferred.

On May 1 Cypress Development Corp put out its long-awaited maiden resource estimate for its Clayton Valley Lithium Project in Nevada. This clay-hosted lithium deposit has 1.3 billion tonnes of lithium containing 6.4 million tonnes of LCE, including 2.857 million tonnes LCE in the indicated category and 3.683MT LCE inferred. The amount of lithium contained within Cypress’ Glory and Dean claim blocks should not be underestimated. It is among the largest deposits in the world.

For more on the resource estimate, metallurgy and geology, read our Cypress has world class Clayton Valley Nevada resource estimate and The US needs Cypress’s lithium.

The main point is, compared to other North American lithium deposits, the Clayton Valley Lithium Project is larger, much larger than the projects mentioned above, and it doesn’t yet have a major financing in place whose shareholders it is beholden to, nor an offtake agreement that would lock up its lithium for years. Cypress is still free to decide who its customers will be and someone looking to build a US based lithium battery sector would have an unencumbered start.

Conclusion

The lithium space both in South and North America is heating up, in line with the increasing demand for electrical vehicles, government mandates to phase out fossil fuels, and auto manufacturers rolling out new EV models every year. From an investment point of view, it’s important to look at companies that are early-stage enough to warrant a significant shareholder return – ones that have not yet advanced to the point where offtake agreements and major financings have already been completed. Cypress Development Corp is the only lithium junior in North America that is still not only open to suitors but is only just getting started, with a preliminary economic assessment due out soon which will piggyback on its blockbuster resource estimate.

In Chile, the investment climate has become warmer thanks to a change in government, which means that a small-cap junior like Lithium Chile has removed one potential obstacle to foreign investment – country risk.

Lithium Chile has four properties, each with multiple drill-ready targets. The drills just started turning on its first prospect, Ollague. But Lithium Chile isn’t just a property owner. LITH has deep exploration and development expertise that will enable it to advance their projects to a maiden resource, PEA and beyond – giving it the option either to be a lithium miner or to hive off one or more of its projects to a major like SQM or Albemarle, a battery supplier, or even an automaker wanting to lock up a long-term lithium supply.

For these reasons, I have LITH and CYP on my radar screen.

Richard (Rick) Mills

Just read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Cypress Development Corp. (TSX.V:CYP). Both CYP and LITH are sponsors of his website aheadoftheherd.com

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE