The Prospector News

NevGold Drills 8.51 g/t Oxide AuEq Over 10.6 Meters (8.11 g/t Au And 0.10% Antimony) Within 2.32 g/t Oxide AuEq Over 86.8 Meters (1.94 g/t Au And 0.10% Antimony); Discovers High-Grade Oxide Gold-Antimony “Armory Fault” Structure At Bullet Zone

You have opened a direct link to the current edition PDF

Open PDF CloseNevGold Drills 8.51 g/t Oxide AuEq Over 10.6 Meters (8.11 g/t Au And 0.10% Antimony) Within 2.32 g/t Oxide AuEq Over 86.8 Meters (1.94 g/t Au And 0.10% Antimony); Discovers High-Grade Oxide Gold-Antimony “Armory Fault” Structure At Bullet Zone

NevGold Corp. (TSX-V:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) is pleased to announce the high-grade oxide gold-antimony discovery of the “Armory Fault” at the Bullet Zone at its Limousine Butte Project in Nevada. The discovery of the “Armory Fault” is a key, transformational development in defining the high-grade structural controls of mineralization at the evolving Bullet Zone. All drillholes at the Bullet Zone from the 2H-2025 drill program intercepted substantial oxide gold-antimony mineralization, significantly expanding the mineralization footprint at the Project. The Company continues to focus on dual track project development by advancing the near-term antimony production scenario from the historical gold leach pads at surface, while it drills the Project to define an initial gold-antimony Mineral Resource Estimate.

Key Highlights

- “Armory Fault” discovery identifies key structural control of high-grade mineralization at the Bullet Zone with oxide gold-antimony of 8.51 g/t AuEq* over 10.6 meters (8.11 g/t Au and 0.10% Sb), within 2.32 g/t AuEq* over 86.8 meters (1.94 g/t Au and 0.10% Sb):

-

- LB25-017 Lower Zone (step-out, new “Armory Fault” discovery): 12.34 g/t AuEq* over 3.0 meters (11.95 g/t Au and 0.10% Sb) within 8.51 g/t AuEq* over 10.6 meters (8.11 g/t Au and 0.10% Sb), within 2.32 g/t AuEq* over 86.8 meters (1.94 g/t Au and 0.10% Sb); due to drilling conditions, the hole terminated in 8.25 g/t oxide Au, with the highest interval up to 12.80 g/t oxide Au

- LB25-017 Upper Zone (step-out, expansion of near-surface high-grade oxide antimony-gold): 5.46 g/t AuEq* over 3.1 meters (0.82% Sb and 2.27 g/t Au) within 3.14 g/t AuEq* over 9.2 meters (0.48% Sb and 1.27 g/t Au) within 1.59 g/t AuEq* over 21.3 meters (0.25% Sb and 0.61 g/t Au) starting at 4.6 meters; high-grade antimony is concentrated along the low-angle thrust fault under the “upper plate dolomite” (Figure 2)

- LB25-016 (step-out, adds over 50 meters north of mineralization footprint): 1.25 g/t AuEq* over 10.7 meters (0.63 g/t Au and 0.16% Sb), within 0.66 g/t AuEq* over 30.5 meters (0.31 g/t Au and 0.09% Sb)

- *Gold equivalents (“AuEq”) are based on assumed metals prices of US$3,000/oz of gold and US$40,000 per tonne of antimony, and assumed metals recoveries of 80% for gold and 75% for antimony.

- “Armory Fault” is transformational to the Project as it identifies important structural controls of high-grade oxide gold-antimony mineralization (Figure 1):

-

- No prior operators of the Project ever drilled into the Bullet Zone area

- All drillholes at the “Bullet Zone” discovery have intercepted significant oxide gold-antimony mineralization (see Figure 1, 2, 3) below the older thrusted upper dolomite unit

- New NevGold geological model is further validated with discovery of “Armory Fault”

- Step-out drillholes add significant upside to the gold-antimony MRE potential

- 2026 drilling will focus on rapidly testing this new high-grade gold-antimony discovery (outlined in Figure 1)

- 30 holes completed in the current 2025-2026 drill program with 12 holes pending release

- Antimony is one of the highest priority Critical Minerals due to its strategic importance and military applications; Limo Butte is a brownfield mine site located in the State of Nevada with near-surface, high-grade antimony mineralization

Limo Butte Planned 2025-2026 Activities / Status Update

NevGold will continue its active exploration program at Limo Butte including:

- Evaluating the historical geological database with focus on gold and antimony (completed);

- Advancing metallurgical testwork (continuous activity);

- Continuing to drill test gold-antimony targets (30 drillholes completed, 2026 drill program will continue to test new high-grade Bullet Zone and Armory Fault discoveries, and identified project-wide targets);

- Advancing the Crushed and Run of Mine (“ROM”) leach pads toward near-term antimony production (Phase I sampling completed, Company has engaged sonic drill contractor to drill leach pads, metallurgical testwork is continuing);

- Completing initial gold-antimony Mineral Resource Estimate (MRE) (in progress).

NevGold CEO, Brandon Bonifacio, comments: “The discovery of the Armory Fault at the Bullet Zone is transformational from an exploration standpoint, as it identifies what is thought to be a key structural control of high-grade oxide gold-antimony mineralization. This fault was never modelled previously, and our technical team has done a tremendous job developing this target. Our geological model testing the “under the upper dolomite” target concept has been validated as we have intercepted significant gold-antimony mineralization in every single drillhole at the Bullet Zone. The mineralization footprint and upside that we have added to the future potential gold-antimony Mineral Resource Estimate (MRE) is significant, and we will start our 2026 drill program as rapidly as possible to further test this evolving, high-grade target area. We also strongly believe that this target model can be replicated project-wide, and we have many high-priority targets that are now emerging with this key transformational step-change in the project geological model. We continue to execute on all of our various work programs at Limo Butte, and the Project is one of the highest grade gold-antimony projects in the United States.”

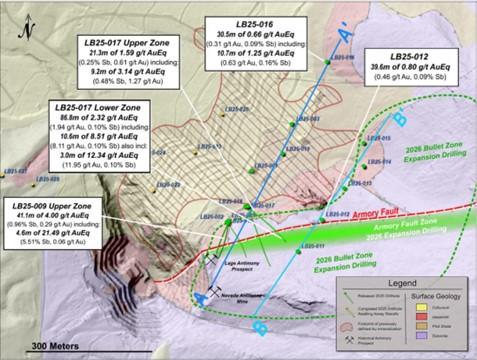

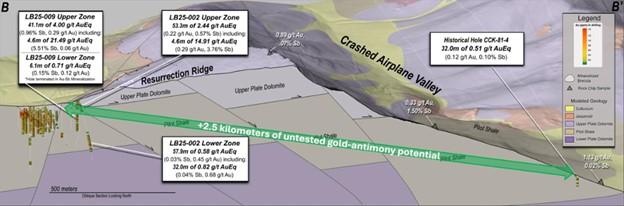

Figure 1 – Resurrection Ridge target area with the Bullet Zone discovery and newly defined high-grade Armory Fault. Figure also includes completed NevGold 2025 drilling and identified expansion areas with the thrust faulted Upper Plate Dolomite. Red outline is the previous mineralization footprint at Resurrection Ridge, and the green outline is the key expansion area for 2026 drilling.

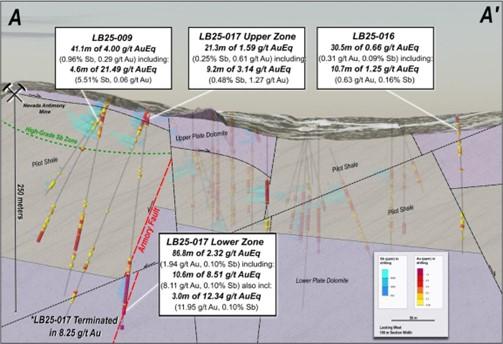

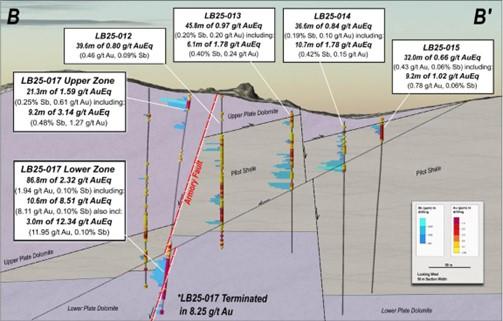

Figure 2 – Long section with results from 2025 drilling and the Bullet Zone and Armory Fault discoveries. Light blue bar graphs (left) show Antimony (Sb ppm) in drilling, and yellow to red discs (right) show Gold (Au ppm) in drilling. Transparent drillholes are from prior to 2025, with many holes not analyzed for antimony. Mineralization remains open in all directions at the Bullet Zone discovery.

Figure 3 – Long section with results from 2025 drilling and new high-grade Armory Fault discovery. Light blue bar graphs (left) show Antimony (Sb ppm) in drilling, and yellow to red discs (right) show Gold (Au ppm) in drilling. Updated geologic model shows faults with high magnitude of offset between vertical holes, which are high priority targets for 2026 drilling. All holes drilled into this area intercepted significant oxide gold-antimony mineralization adding significant growth to the mineralized footprint at the Project. Mineralization trends to surface.

2025-2026 Drill Results

| Hole ID | Length, m* | g/t Au | % Sb | g/t AuEq** | From, m | To, m |

| Resurrection Ridge & “Bullet Zone” Discovery | ||||||

| LB25-017 Upper | 21.3 | 0.61 | 0.25% | 1.59 | 4.6 | 25.9 |

| including | 9.2 | 1.27 | 0.48% | 3.14 | 13.7 | 22.9 |

| also including | 3.1 | 2.27 | 0.82% | 5.46 | 15.2 | 18.3 |

| LB25-017 Lower*** | 86.8 | 1.94 | 0.10% | 2.32 | 187.5 | 274.3 |

| including | 10.6 | 8.11 | 0.10% | 8.51 | 263.7 | 274.3 |

| also including | 3.0 | 11.95 | 0.10% | 12.34 | 263.7 | 266.7 |

| LB25-016 | 141.7 | 0.11 | 0.03% | 0.23 | 0.0 | 141.7 |

| including | 30.5 | 0.31 | 0.09% | 0.66 | 0.0 | 30.5 |

| including | 10.7 | 0.63 | 0.16% | 1.25 | 0.0 | 10.7 |

*Downhole thickness reported; true width varies depending on drill hole dip and is approximately 70% to 90% of downhole thickness.

**The gold equivalents (“AuEq”) are based on assumed metals prices of US$3,000/oz of gold and US$40,000 per tonne of antimony, and assumed metals recoveries of 80% for gold and 75% for antimony.

***Several intervals had low recovery due to drilling conditions.

Drillhole Orientation Details

| Hole ID | Target Zone | Easting | Northing | Elevation (m) | Length (m) | Azimuth | Dip |

| LB25-016 | Bullet Zone (RR) | 667291 | 4417567 | 2174 | 174 | 90 | -75 |

| LB25-017 | Bullet Zone (RR) | 667121 | 4417247 | 2177 | 275 | 130 | -60 |

Limo Butte – Updated Geological Model Summary and Discovery of Bullet Zone

The Devonian Pilot Shale is the principal local host to Carlin-type mineralization at Limousine Butte. At Limousine Butte, positive gold grades commonly coincide with silicification and jasperoid breccias within the Pilot Shale, and this alteration style is also host to elevated antimony.

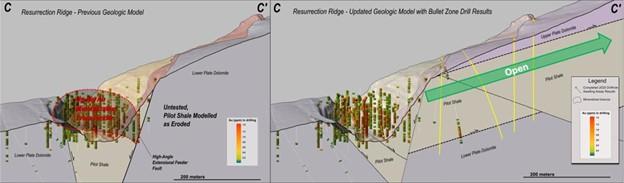

NevGold’s 2021–2025 work included integrating historical drilling, new mapping, and surface sampling which produced an updated district model and refined property-wide controls on mineralization. At Resurrection Ridge, Devonian–Silurian dolomite is exposed immediately east of known gold-antimony mineralization. Earlier explorers inferred that the overlying Pilot Shale had been eroded in this area, and they did not test eastward, despite shallow high-grade intercepts in the easternmost holes drilled at Resurrection Ridge. The new model indicates the older dolomite was thrust over the prospective Pilot Shale unit (see Figure 4), creating structural preparation and a fluid trap that preserves the favorable host at depth, the classic architecture for a Carlin-type system.

The holes drilled by the Company in 2025 with assays received have continued to validate the new NevGold geological model. Holes collared in dolomite, passed through the upper thrust plate, and intersected gold and antimony at multiple horizons within the underlying Pilot Shale validating the new geological model and materially expanding the potential mineralization footprint at the Project.

The preserved Pilot Shale extends more than one kilometer east of prior drilling at Resurrection Ridge (see Figure 5).

Figure 4 – Comparison of historical geological model (left) and new NevGold geological model (right) outlining the thesis that the older dolomite unit was thrust over the prospective Pilot Shale unit. The preserved Pilot Shale unit extends more than 1 kilometer east of prior drilling at Resurrection Ridge.

Property-wide, the updated model outlines multiple Au–Sb target corridors that track outcrops and projected subsurface positions of the Pilot Shale, where repeated faulting and thrusting provided fluid pathways and focused mineralization. NevGold’s 2025-2026 drill program continues to test these high-priority targets.

Figure 5 – Large cross section at the Project outlining the strong expansion potential between Resurrection Ridge and Crashed Airplane Valley, which spans +2.5 kilometers.

Historical records within the project boundary document two small-scale antimony prospects—the Nevada Antimony Mine and the Lage Antimony Prospect (Figure 1). The Nevada Antimony Mine extracted stibnite (Sb₂S₃) from a hydrothermal breccia via shallow pits; the Lage prospect similarly reports limited antimony production. Complementing these records, rock-chip sampling from the Golden Butte pit (Brigham Young University thesis) returned numerous assays exceeding 1% Sb in jasperoid breccias, with several over 5% Sb, including a sample grading 9.6% Sb with visible stibnite and stibiconite (BYU Thesis Report ).

Together, these datasets support a district-scale interpretation in which thrust repetition preserves the Pilot Shale at depth east of Resurrection Ridge and focuses Au–Sb mineralization along structurally prepared horizons, establishing multiple high-priority targets for step-out drilling and follow-up work.

Importance of Antimony

Antimony is considered a “Critical Mineral” by the United States based on the U.S. Geological Survey’s 2022 list (U.S.G.S. (2022)). “Critical Minerals” are metals and non-metals essential to the economy and national security. Antimony is utilized in all manners of military applications, including the manufacturing of armor piercing bullets, night vision goggles, infrared sensors, precision optics, laser sighting, explosive formulations, hardened lead for bullets and shrapnel, ammunition primers, tracer ammunition, nuclear weapons and production, tritium production, flares, military clothing, and communication equipment. Other uses include technology (semi-conductors, circuit boards, electric switches, fluorescent lighting, high quality clear glass and lithium-ion batteries) and clean-energy storage.

Globally, approximately 90% of the world’s current antimony supply is produced by China, Russia, and Tajikistan. Beginning on September 15, 2024, China, which is responsible for nearly half of all global mined antimony output and dominates global refinement and processing, announced that it will restrict antimony exports. In December-2024, China explicitly restricted antimony exports to the United States citing its dual military and civilian uses, which further exacerbated global supply chain concerns. (Lv, A. and Munroe, T. (2024)) The U.S. Department of Defense (“DOD”) has designated antimony as a “Critical Mineral” due to its importance in national security, and governments are now prioritizing domestic production to mitigate supply chain disruptions. Projects exploring antimony sources in North America play a key role in addressing these challenges.

Perpetua Resources Corp. (NASDAQ:PPTA) (TSX:PPTA) has the most advanced domestic gold-antimony project in the United States. Perpetua’s project, known as Stibnite, is located in Idaho approximately 130 km northeast of NevGold’s Nutmeg Mountain and Zeus projects. Positive advancements at Stibnite including technical development and permitting has led to US$75 million in Department of Defense (“DOD”) awards, over $1.8 billion in indicative financing from the Export Import Bank of the United States (“US EXIM”) (see Perpetua Resources News Release from April 8, 2024) (Perpetua Resources. (2025)), and recent strategic investments of US$180 million from Agnico-Eagle Mines Limited (“Agnico”) and US$75 million from JPMorganChase’s $1.5 trillion Security and Resiliency Initiative. (see Perpetua Resources News Release from October 27, 2025)

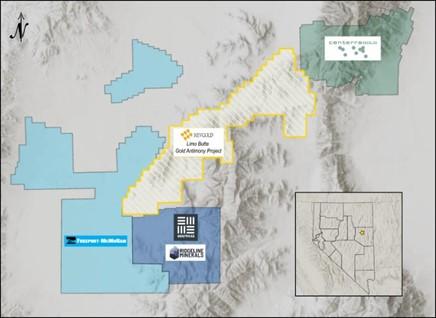

Figure 6 – Limousine Butte Land Holdings and District Exploration Activity

Sampling Methodology, Quality Control and Quality Assurance

NevGold QA/QC protocols are followed on the Project and include insertion of duplicate, blank and standard samples in all drill holes. A 30g gold fire assay and multi-elemental analysis ICP-OES method was completed by ISO 17025 certified American Assay Labs, Reno.

The historic data collection chain of custody procedures and analytical results by previous operators appear adequate and were completed to industry standard practices. For the Newmont and US Gold data a 30g gold fire assay and multi-elemental analysis ICP-OES method MS-41 was completed by ISO 17025 certified ALS Chemex, Reno or Elko Nevada.

Geochemical ICP (5g) analysis for the Wilson, Christianson and Tingey report was completed by Geochemical Services Inc. and the XRF analyses (glass disk or pellets) by Brigham Young University.

Technical information contained in this news release has been reviewed and approved by Greg French, CPG, the Company’s Vice President, Exploration, who is NevGold’s Qualified Person under National Instrument 43-101 and responsible for technical matters of this release.

About NevGold

NevGold is an exploration and development company targeting large-scale mineral systems in the proven districts of Nevada and Idaho. NevGold owns a 100% interest in the Limousine Butte and Cedar Wash gold projects in Nevada, and the Nutmeg Mountain gold project and Zeus copper project in Idaho.

MORE or "UNCATEGORIZED"

ADYTON DISCOVERS NEW AU-CU MINERALIZED ZONES AND DOCUMENTS RESOURCE CONTINUITY

Adyton Resources Corporation (TSX-V: ADY) is pleased to announce success... READ MORE

Trident Closes $18.6 Million Offering

Trident Resources Corp. (TSX-V: ROCK) (OTCQB: TRDTF) is pleased ... READ MORE

Monument Announces Additional Assay Results from the Buffalo Reef / Felda Areas of Selinsing Gold Mine

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) is pleased to an... READ MORE

Aldebaran Announces Closing of Concurrent Private Placement

Aldebaran Resources Inc. (TSX-V: ALDE) (OTCQX: ADBRF) is please... READ MORE

QGold Reports Results from Its Drilling Campaigns at Its Mine Centre Gold Project

Presented are results of the June and November 2025 drilling camp... READ MORE