Alamos Gold Reports Mineral Reserves and Resources for the Year-Ended 2025

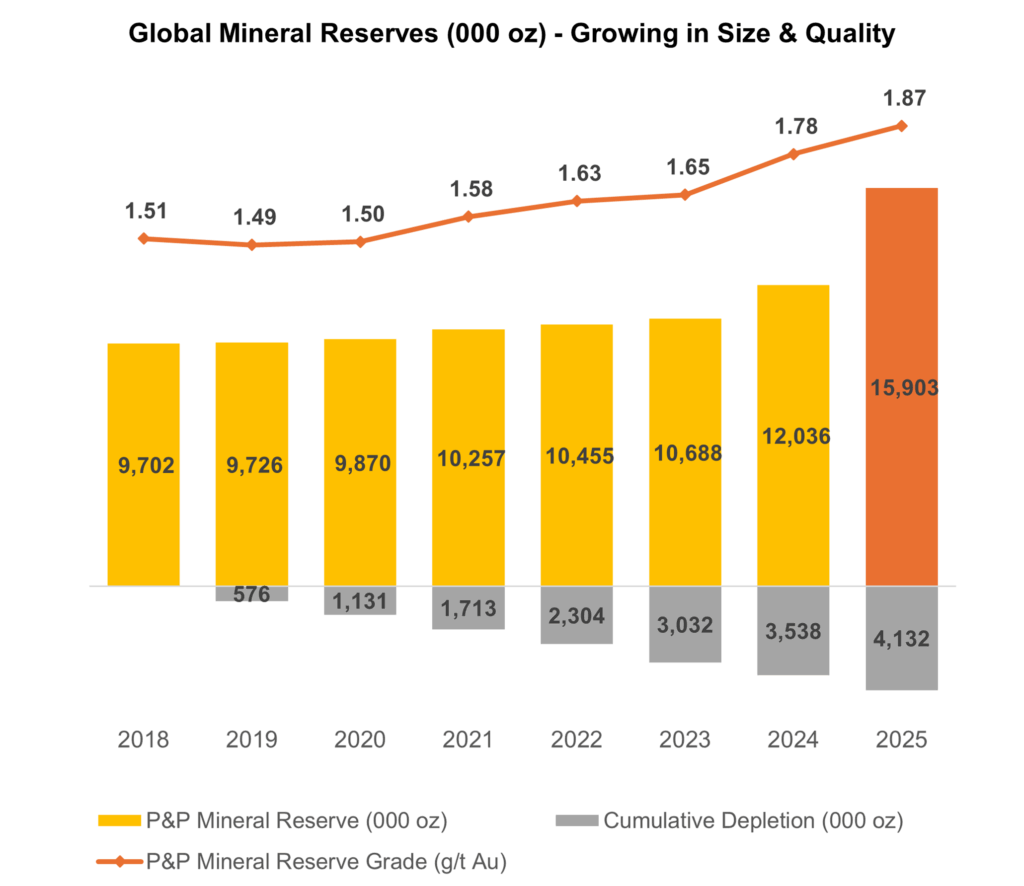

Global Mineral Reserves Increase 32% with Grades also Increasing 5%, Driven by 125% Growth in High-Grade Mineral Reserves at Island Gold

Alamos Gold Inc. (TSX:AGI) (NYSE:AGI) reported its updated Mineral Reserves and Resources as of December 31, 2025. For a detailed summary by asset, refer to the tables below.

Highlights

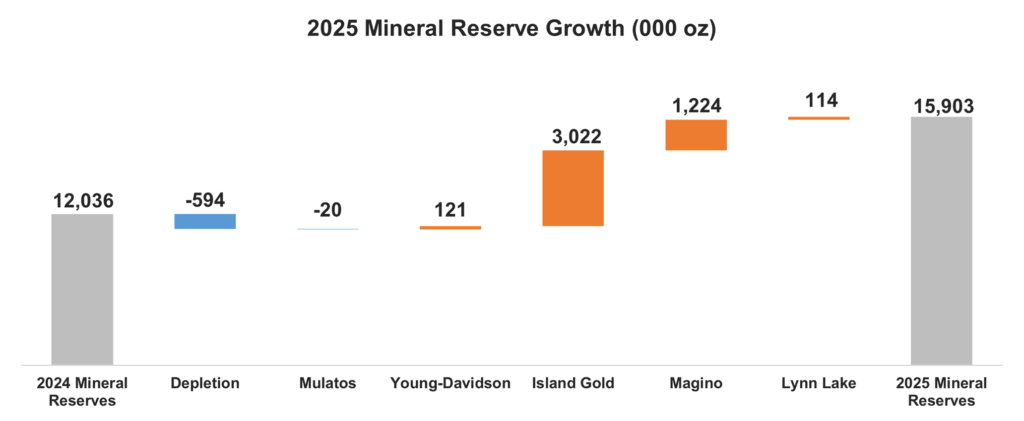

- Global Proven and Probable Mineral Reserves increased 32% to 15.9 million ounces of gold (265 million tonnes) with grades also increasing 5% to 1.87 grams per tonne of gold. This was driven by the successful conversion of a large portion of the Island Gold District’s Mineral Resource base into Mineral Reserves

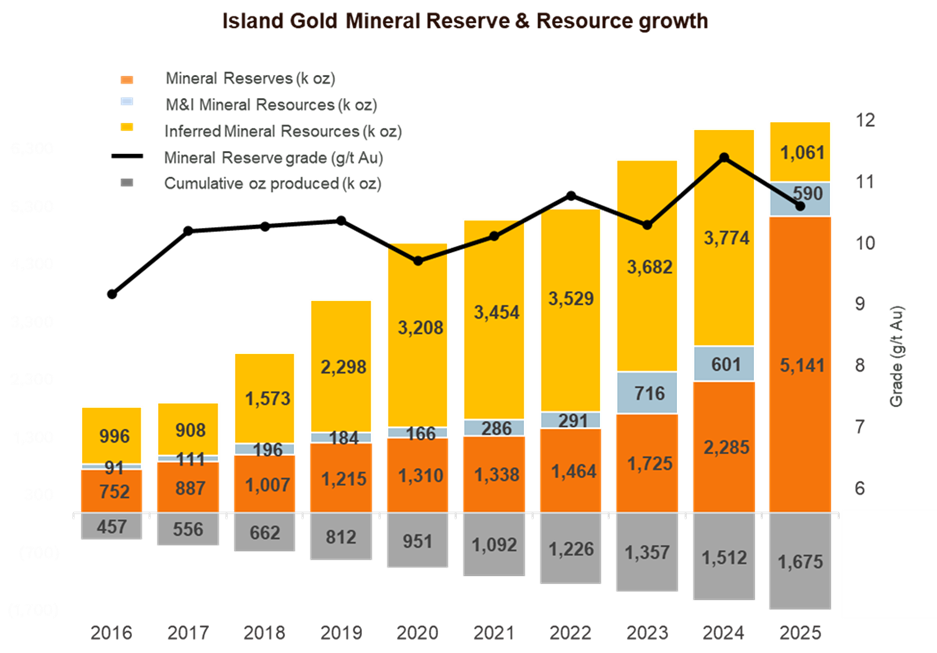

- Island Gold’s Mineral Reserves more than doubled, increasing 125% to 5.1 million ounces (15.1 mt grading 10.61 g/t Au), reflecting the conversion of existing and newly defined Mineral Resources to Mineral Reserves

- Magino’s Mineral Reserves increased 56% to 3.1 million ounces (113 mt grading 0.86 g/t Au), primarily reflecting the successful conversion of Mineral Resources to Mineral Reserves

- Global Measured and Indicated Mineral Resources increased 6% to 5.5 million ounces of gold (119 mt grading 1.44 g/t Au), driven by additions at Young-Davidson, Lynn Lake and Mulatos, more than offsetting Mineral Resource conversion at Magino

- Global Inferred Mineral Resources decreased 63% to 2.0 million ounces of gold (35.0 mt grading 1.82 g/t Au), reflecting the successful conversion of Inferred Mineral Resources at both Island Gold and Magino to Mineral Reserves

- Gold price assumption of $1,800 per ounce used for estimating Mineral Reserves and $2,000 per ounce for estimating Mineral Resources, up from $1,600 and $1,800 per ounce, respectively, in 2024, reflecting the significantly higher gold price environment. Both remain conservative relative to the three-year trailing average gold price of approximately $2,592 per ounce

- Record global exploration budget of $97 million in 2026, up 37% from the $71 million spent in 2025 with expanded programs at the Island Gold District, Young-Davidson and Lynn Lake. The expanded exploration budget is underpinned by broad-based success across the Company’s asset base in 2025

“Our long-term investment in exploration continues to create value with another substantial increase in Mineral Reserves to 16 million ounces, and at higher grades. The majority of this growth was within the Island Gold District, with the larger Mineral Reserve serving as the foundation for the Island Gold District Expansion announced earlier this month. This marks the seventh consecutive year of growth, with grades increasing 24% over that time frame as our Reserves continue to grow in both size and quality. We also demonstrated significant exploration success across our asset base over the past year. We expect this ongoing success will serve as the foundation for further Mineral Reserve and Resource growth in the years ahead with a record exploration budget of nearly $100 million planned for 2026,” said John A. McCluskey, President and Chief Executive Officer.

| Proven and Probable Gold Mineral Reserves1 | |||||||||

| 2025 | 2024 | % Change | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | |

| Island Gold | 15,072 | 10.61 | 5,141 | 6,232 | 11.40 | 2,285 | 142% | -7% | 125% |

| Magino | 113,141 | 0.86 | 3,141 | 68,400 | 0.91 | 2,008 | 65% | -5% | 56% |

| Total Island Gold District | 128,212 | 2.01 | 8,282 | 74,632 | 1.79 | 4,293 | 72% | 12% | 93% |

| Young-Davidson | 42,184 | 2.20 | 2,983 | 41,756 | 2.26 | 3,030 | 1% | -3% | -2% |

| La Yaqui Grande | 3,293 | 1.35 | 143 | 7,710 | 1.34 | 331 | -57% | 1% | -57% |

| Puerto Del Aire | 6,050 | 5.45 | 1,060 | 6,050 | 5.45 | 1,060 | – | – | – |

| Total Mulatos | 9,343 | 4.00 | 1,203 | 13,760 | 3.14 | 1,391 | -32% | 27% | -14% |

| MacLellan | 41,158 | 1.31 | 1,732 | 39,379 | 1.35 | 1,711 | 5% | -3% | 1% |

| Gordon | 10,440 | 2.02 | 679 | 10,006 | 2.09 | 671 | 4% | -3% | 1% |

| Burnt Timber | 13,934 | 1.00 | 449 | 14,352 | 1.02 | 469 | -3% | -1% | -4% |

| Linkwood | 19,906 | 0.90 | 576 | 16,318 | 0.90 | 472 | 22% | 0% | 22% |

| Total Lynn Lake | 85,438 | 1.25 | 3,436 | 80,056 | 1.29 | 3,322 | 7% | -3% | 3% |

| Alamos – Total | 265,176 | 1.87 | 15,903 | 210,203 | 1.78 | 12,036 | 26% | 5% | 32% |

|

Measured and Indicated Gold Mineral Resources (exclusive of Mineral Reserves)1 |

|||||||||

| Island Gold | 2,093 | 8.77 | 590 | 2,133 | 8.76 | 601 | -2% | 0% | -2% |

| Magino | 56,798 | 0.79 | 1,439 | 62,689 | 0.94 | 1,905 | -9% | -17% | -24% |

| Total Island Gold District | 58,891 | 1.07 | 2,029 | 64,823 | 1.20 | 2,506 | -9% | -11% | -19% |

| Young-Davidson – Surface | 1,739 | 1.24 | 69 | 1,739 | 1.24 | 69 | – | – | – |

| Young-Davidson – Underground | 12,970 | 3.40 | 1,420 | 11,114 | 3.13 | 1,117 | 17% | 9% | 27% |

| Total Young-Davidson | 14,708 | 3.15 | 1,489 | 12,852 | 2.87 | 1,186 | 14% | 10% | 26% |

| Golden Arrow | 6,442 | 1.19 | 246 | 6,442 | 1.19 | 246 | – | – | – |

| Mulatos Mine | 8,190 | 0.96 | 252 | 6,772 | 0.98 | 214 | 21% | -3% | 18% |

| La Yaqui Grande | 1,462 | 0.81 | 38 | 1,523 | 0.78 | 38 | -4% | 4% | 0% |

| Puerto Del Aire | 2,403 | 3.49 | 269 | 2,403 | 3.49 | 269 | – | – | – |

| Cerro Pelon | 1,391 | 4.28 | 192 | 720 | 4.49 | 104 | 93% | -5% | 84% |

| Carricito | 3,356 | 0.74 | 80 | 1,355 | 0.83 | 36 | 148% | -10% | 122% |

| Total Mulatos | 16,802 | 1.54 | 831 | 12,772 | 1.61 | 661 | 32% | -4% | 26% |

| Lynn Lake | 21,735 | 1.27 | 885 | 16,189 | 1.13 | 587 | 34% | 12% | 51% |

| Alamos – Total | 118,578 | 1.44 | 5,480 | 113,077 | 1.43 | 5,186 | 5% | 1% | 6% |

|

Inferred Gold Mineral Resources1 |

|||||||||

| Island Gold | 2,867 | 11.51 | 1,061 | 7,106 | 16.52 | 3,774 | -60% | -30% | -72% |

| Magino | 14,045 | 0.75 | 338 | 40,383 | 0.91 | 1,177 | -65% | -18% | -71% |

| Total Island Gold District | 16,912 | 2.57 | 1,398 | 47,488 | 3.24 | 4,950 | -64% | -21% | -72% |

| Young-Davidson – Surface | 31 | 0.99 | 1 | 31 | 0.99 | 1 | – | – | – |

| Young-Davidson – Underground | 1,382 | 3.73 | 166 | 1,880 | 3.25 | 197 | -26% | 15% | -16% |

| Total Young-Davidson | 1,413 | 3.67 | 167 | 1,911 | 3.22 | 198 | -26% | 14% | -16% |

| Golden Arrow | 2,028 | 1.07 | 70 | 2,028 | 1.07 | 70 | – | – | – |

| Mulatos Mine | 761 | 0.91 | 22 | 641 | 0.91 | 19 | 19% | -1% | 16% |

| La Yaqui Grande | 41 | 2.17 | 3 | 74 | 1.74 | 4 | -45% | 25% | -25% |

| Puerto Del Aire | 281 | 4.07 | 37 | 281 | 4.07 | 37 | – | – | – |

| Cerro Pelon | 83 | 3.99 | 11 | – | – | – | – | – | – |

| Carricito | 1,499 | 0.60 | 29 | 900 | 0.74 | 22 | 67% | -18% | 32% |

| Total Mulatos | 2,665 | 1.18 | 101 | 1,896 | 1.34 | 82 | 41% | -12% | 24% |

| Lynn Lake | 11,939 | 0.80 | 308 | 5,682 | 0.94 | 171 | 110% | -14% | 80% |

| Alamos – Total | 34,958 | 1.82 | 2,044 | 59,005 | 2.88 | 5,471 | -41% | -37% | -63% |

- The Türkiye assets and Quartz Mountain were sold in 2025 and have been excluded from the 2024 year-end Mineral Reserves and Mineral Resources for comparative reporting purposes.

Mineral Reserves

Global Proven and Probable Mineral Reserves totalled 15.9 million ounces of gold as of December 31, 2025, a 32% increase from 12.0 million ounces at the end of 2024. The increase reflects the conversion of Mineral Resources into Mineral Reserves at both Island Gold and Magino. Grades also increased 5% to 1.87 g/t Au reflecting the significant increase and higher proportion of high-grade underground Mineral Reserves from the Island Gold District.

The strong growth in Mineral Reserves more than outpaced mining depletion of 594,000 ounces in 2025. This marked the seventh consecutive year Mineral Reserves have increased for a cumulative increase of 64%, with grades also increasing 24% over that time frame.

Island Gold was the largest driver of the increase with underground Mineral Reserves increasing 125% to 5.1 million ounces, net of depletion, with grades averaging 10.61 g/t Au. This marked the 13th consecutive year of growth at the operation. The key driver of the increase was the conversion of high-grade Mineral Resources in the lower portion of Island East. Mineral Reserves in this high-grade block have grown to now total 1.6 million ounces grading 15.31 g/t Au (3.3 mt). With the main structure open laterally and at depth, and a growing number of high-grade zones being defined in the hanging wall and footwall, there is excellent potential for this long-term pace of growth to continue.

Magino’s open pit Mineral Reserves also increased 56% to 3.1 million ounces, with grades averaging 0.86 g/t Au. As with at Island Gold, the majority of the increase was through the successful conversion of Mineral Resources to Mineral Reserves.

Young-Davidson’s Mineral Reserves were largely unchanged at 3.0 million ounces grading 2.20 g/t Au, with additions to Mineral Reserves offsetting the majority of depletion. Mulatos Mineral Reserves decreased to 1.2 million ounces grading 4.00 g/t Au reflecting depletion at La Yaqui Grande. With limited drilling completed at PDA, Mineral Reserves at the higher-grade underground project were unchanged. Combined Mineral Reserves at the Lynn Lake project increased slightly to 3.4 million ounces grading 1.25 g/t Au, driven by additions at the Linkwood satellite deposit.

A detailed summary of Proven and Probable Mineral Reserves as of December 31, 2025, is presented in Table 1 at the end of this press release.

Mineral Resources

Global Measured and Indicated Mineral Resources (exclusive of Mineral Reserves) increased 6% to 5.5 million ounces, at slightly higher grades of 1.44 g/t Au, as of December 31, 2025. Global Inferred Mineral Resources decreased 63% to 2.0 million ounces with grades decreasing 37% to 1.82 g/t Au, as of December 31, 2025. The decrease in Inferred Mineral Resources and grades reflects the successful conversion of higher-grade underground Mineral Resources at the Island Gold District to Mineral Reserves.

Detailed summaries of the Company’s Measured and Indicated Mineral Resources and Inferred Mineral Resources as of December 31, 2025, are presented in Tables 3 and 4, respectively, at the end of this press release.

Island Gold District

Island Gold underground

Island Gold’s long-term track record of growth continued in 2025 with total Mineral Reserves and Resources increasing 2% across all categories to 6.8 million ounces, net of depletion. This represents the 10th consecutive year total Mineral Reserves and Resources have increased, a significant achievement given the limited exploration drilling completed over the past year, with the focus on Mineral Resource conversion. Inclusive of mining depletion, over eight million ounces have been discovered to date at Island Gold as it continues to demonstrate itself as one of the highest-grade and fastest growing deposits in the world.

The primary focus of the 2025 exploration program at Island Gold was on delineation drilling to convert the large Inferred Mineral Resource base to Mineral Reserves. The program was highly successful with Mineral Reserves increasing 125% to 5.1 million ounces, net of mining depletion, marking the 13th consecutive year of growth. This significantly outpaced mining depletion, which totaled 166,000 ounces grading 11.35 g/t Au in 2025.

Grades decreased 7% to 10.61 g/t Au reflecting a mix of high-grade and relatively lower grade additions across the main structure, and within multiple hanging wall and footwall zones. One of the largest drivers of the increase in Mineral Reserves was the lower portion of Island East, an area that now contains 1.6 million ounces grading 15.31 g/t Au (3.3 mt; see Figure 2). This represents one of the highest-grade portions of the deposit, contains some of the deepest and highest-grade intercepts drilled to date, and remains open laterally and at depth, highlighting the significant potential for further growth.

Measured and Indicated Mineral Resources decreased 11,000 ounces to 590,000 ounces with grades unchanged at 8.77 g/t Au. Inferred Mineral Resources decreased 72% to 1.1 million ounces, with grades decreasing to 11.51 g/t Au, reflecting the conversion of significantly higher grade Mineral Resources in Island East to Mineral Reserves. Through further drilling, the majority of these Mineral Resources are expected to convert to Mineral Reserves. This is supported by a conversion rate of Inferred Mineral Resource to Mineral Reserves which has averaged more than 90% since the acquisition of Island Gold in 2017.

Magino open pit

Magino’s Mineral Reserves increased 56% to 3.1 million ounces, with the average grade declining slightly to 0.86 g/t Au. The main driver of the increase was the successful conversion of Mineral Resources to Mineral Reserves. A small portion of the increase was attributable to the higher gold price assumption of $1,800 per ounce.

Measured and Indicated Mineral Resources decreased 24% to 1.4 million ounces with the average grade declining 17% to 0.79 g/t Au. Inferred Mineral Resources decreased 71% to 338,000 ounces with the average grade declining 18% to 0.75 g/t Au. The decline in Mineral Resources reflects the successful conversion to Mineral Reserves.

Island Gold District Expansion – significant exploration upside

On February 3, 2026, the results of the Island Gold District Expansion Study (“IGD Expansion”) were announced. The study incorporated the significant growth in underground and open pit Mineral Reserves defined within the Island Gold District over the past year, supporting an expansion of the operation to 20,000 tonnes per day (“tpd”). The expansion is expected to create one of the largest, longest life, and most profitable gold operations in Canada. Following the completion of the expansion in 2028, average annual production is expected to increase to 534,000 ounces over the first 10 years at mine-site all-in sustaining costs (“AISC”) of $1,025 per ounce.

Given ongoing exploration success and with significant exploration potential across the Island Gold District, there are excellent opportunities for further growth and upside. This includes within the main Island Gold deposit, which remains open laterally and at depth, as well as within multiple higher-grade regional targets in proximity to the Magino mill. The North Shear and past producing Cline-Pick mines represent opportunities for further production upside as potential sources of additional higher-grade mill feed within the expanded mill. Each will be an exploration focus in 2026.

A total of $43 million is budgeted for exploration at the Island Gold District in 2026, up from $24 million spent in 2025. The exploration program will continue to build on the success from 2025 with high-grade gold mineralization extended across the Island Gold deposit, as well as within multiple structures within the hanging wall and footwall.

The 2026 budget includes 50,000 metres of underground exploration drilling focused on defining new Mineral Reserves and Mineral Resources in proximity to existing production horizons and infrastructure. This includes drilling across the strike extent of the main Island Gold deposit (E1E and C-Zones), as well as within a growing number of newly defined hanging wall and footwall zones. To support the underground exploration program, 1,090 m of underground exploration drift development is planned to extend drill platforms on multiple levels.

Additionally, 48,000 m of surface exploration drilling has been budgeted targeting the area between the Island Gold and Magino deposits, as well as the down-plunge extension of the Island Gold deposit, below a depth of 1,500 m.

Included within sustaining capital at Island Gold is 27,000 m of underground delineation drilling. The focus of the delineation drilling at Island Gold is the ongoing conversion of Mineral Resources to Mineral Reserves.

The regional exploration program at the Island Gold District includes 16,000 m of surface drilling. The focus of the regional program will be following up on high-grade mineralization intersected in the 2025 drill program at Cline-Pick, located approximately seven kilometres northeast of the Island Gold mine. Drilling will also be completed at the historic Edwards Mine, located in proximity to the Cline-Pick mines with the objective of extending mineralization beyond historically mined areas. Drilling will also be undertaken at the Island Gold North Shear target, and to the east and along strike from the Island Gold mine to test the extension of the E1E-zone.

Young-Davidson

Mineral Reserves at Young-Davidson decreased 47,000 ounces to 3.0 million ounces at slightly lower grades of 2.20 g/t Au, with Mineral Reserve additions offsetting the majority of mining depletion over the past year.

Measured and Indicated Mineral Resources increased 26% to 1.5 million ounces, with the average grade increasing 10% to 3.15 g/t Au primarily reflecting growth within multiple hanging wall zones. Inferred Mineral Resources are largely unchanged at 0.2 million ounces grading 3.67 g/t Au.

A total of $17 million has been budgeted for exploration at Young-Davidson in 2026, up from $13 million spent in 2025. This includes 48,000 m of underground exploration drilling focused on two primary areas. The first is to continue to extend mineralization within the Young-Davidson syenite, which hosts the majority of Mineral Reserves and Mineral Resources.

The second is to test and expand on higher grade gold mineralization that has been intersected within two areas of focus in the hanging wall of the deposit as outlined in a press release issued on January 30, 2026. This new style of higher-grade mineralization is located in close proximity to the existing mid-mine infrastructure, with grades intersected well above the current Mineral Reserve grade.

To support the underground exploration program, 200 m of underground exploration development is planned which includes further extension of the 9620-level hanging wall exploration drift that was completed in 2025. The regional program includes 10,000 m of drilling focused on evaluating several targets including the Otisse NE and Biralger targets, located approximately 3 km and 17 km northeast of Young-Davidson, respectively.

Based on underground mining rates of 8,000 tonnes per day, the Mineral Reserve life of the Young-Davidson mine remains at 14 years as of December 31, 2025. Young-Davidson has sustained at least a 13‑year Mineral Reserve life since 2011, reflecting a strong track record of Mineral Resource conversion. With the deposit open at depth and to the west, and new hanging‑wall zones continuing to be defined, there is excellent potential for this track record to continue.

Mulatos District

Total Mulatos District Mineral Reserves decreased 14% (188,000 oz) to 1.2 million ounces reflecting depletion at La Yaqui Grande. Grades increased 27% to 4.0 g/t Au, with higher-grade Mineral Reserves at PDA representing a larger portion of total Mineral Reserves.

Mineral Reserves at PDA were not updated from a year ago (1.1 million ounces grading 5.45 g/t Au) as limited exploration drilling was completed with the focus shifting to development of the project. Exploration and Mineral Resource expansion drilling will recommence at PDA once underground drill platforms have been established to allow for more efficient exploration drill testing below unmineralized cover rock. With the deposit open in multiple directions, there is excellent potential for PDA to continue to grow. Based on current Mineral Reserves, PDA has a nine year mine life with significant exploration upside potential.

A bigger focus of the exploration program in 2025 was on extending and defining higher-grade sulphide mineralization as sources of additional mill feed for the PDA project. The program was successful in defining additional Mineral Resources at Cerro Pelon and a new discovery at Halcon.

Total Measured and Indicated Mineral Resources increased 26% to 0.8 million ounces, with grades decreasing 4% to 1.54 g/t Au. The majority of the increase was attributable to Cerro Pelon, which nearly doubled in size to contain 192,000 ounces grading 4.28 g/t Au. Inferred Mineral Resources also increased 20,000 ounces to 101,000 ounces grading 1.18 g/t Au.

The PDA project will include the construction of a 2,000 tpd mill to process higher-grade sulphide ore from PDA, opening up new opportunities to define and incorporate additional sulphide ore from across the District. PDA remains on track for initial production mid-2027. Cerro Pelon, Halcon and other targets across the District, including La Yaqui Grande, represent upside to the PDA project as potential sources of additional higher-grade sulphide ore.

A total of $21 million is budgeted at Mulatos for exploration in 2026, consistent with the $20 million spent in 2025. The regional drilling program is expected to total 44,500 m and includes 20,000 m of surface exploration drilling at the Cerro Pelon sulphide target, 9,000 m at the Halcon target (discovered in 2025), and an additional 15,500 m planned across several early to advanced staged targets within the Mulatos District.

Lynn Lake District

Total Mineral Reserves for the Lynn Lake District increased 3% to 3.4 million ounces, with grades decreasing slightly to 1.25 g/t Au. The driver of this growth was Mineral Reserve additions within the Linkwood deposit, one of four deposits that comprise the Lynn Lake Project.

Measured and Indicated Mineral Resources increased by 0.3 million ounces to 0.9 million ounces, reflecting growth across all four deposits. Inferred Mineral Resources increased by 0.1 million ounces to 0.3 million ounces.

A total of $6 million has been budgeted for exploration at the Lynn Lake project in 2026. This is up from $3 million spent in 2025. The exploration budget includes 13,500 m to test the potential for underground mining opportunities below the Gordon and MacLellan open pits.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Senior Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Chris Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101 (“NI 43-101”). The Qualified Persons for the National Instrument 43-101 compliant Mineral Reserve and Resource estimates are detailed in the following table.

| Mineral Resources QP | Company | Project | |||

| Jeffrey Volk, CPG, FAusIMM | Director – Reserves and Resources, Alamos Gold Inc. |

Young-Davidson, Lynn Lake, Golden Arrow, Magino | |||

| Tyler Poulin, P.Geo | Geology Superintendent – Island Gold, Alamos Gold Inc. | Island Gold | |||

| Marc Jutras, P.Eng | Principal, Ginto Consulting Inc. | Mulatos Pits, PDA, La Yaqui Grande, Cerro Pelon, Carricito | |||

| Mineral Reserves QP | Company | Project | |||

| Chris Bostwick, FAusIMM | SVP Technical Services, Alamos Gold Inc. | Young-Davidson, PDA | |||

| Francis McCann, P.Eng | Director – Technical Services, Alamos Gold Inc. | Magino, Lynn Lake | |||

| Nathan Bourgeault, P.Eng | Technical Services Superintendent – Island Gold, Alamos Gold Inc. | Island Gold | |||

| Herb Welhener, SME-QP | VP, Independent Mining Consultants Inc. | La Yaqui Grande |

With the exception of Mr. Volk, Mr. Bostwick, Mr. McCann, Mr. Poulin, and Mr. Bourgeault, each of the foregoing individuals are independent of Alamos Gold.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operations in North America. This includes the Island Gold District and Young-Davidson mine in northern Ontario, Canada, and the Mulatos District in Sonora State, Mexico. Additionally, the Company has a strong portfolio of growth projects including the IGD Expansion, and the Lynn Lake project in Manitoba, Canada. Alamos employs more than 2,400 people and is committed to the highest standards of sustainable development.

MORE or "UNCATEGORIZED"

ADYTON DISCOVERS NEW AU-CU MINERALIZED ZONES AND DOCUMENTS RESOURCE CONTINUITY

Adyton Resources Corporation (TSX-V: ADY) is pleased to announce success... READ MORE

Trident Closes $18.6 Million Offering

Trident Resources Corp. (TSX-V: ROCK) (OTCQB: TRDTF) is pleased ... READ MORE

Monument Announces Additional Assay Results from the Buffalo Reef / Felda Areas of Selinsing Gold Mine

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) is pleased to an... READ MORE

Aldebaran Announces Closing of Concurrent Private Placement

Aldebaran Resources Inc. (TSX-V: ALDE) (OTCQX: ADBRF) is please... READ MORE

QGold Reports Results from Its Drilling Campaigns at Its Mine Centre Gold Project

Presented are results of the June and November 2025 drilling camp... READ MORE