1844 Announces New Option to Acquire up to 100% interest in Hawk Ridge Property and Concurrent Private Placements for Aggregate Gross Proceeds of up to $1,500,000

1844 RESOURCES Inc. (TSX-V:EFF) is pleased to announce that, further to its news release of August 13, 2024, it has entered into an option agreement with Nickel North Exploration Corp. pursuant to which Nickel North has granted options to the Company to acquire up to a 100% interest, free and clear of all encumbrances, except for an underlying net smelter returns royalty,[1] in the Hawk Ridge property in Quebec. The Option Agreement is subject to the approval of the TSX Venture Exchange. The Company also announces concurrent non-brokered private placements for aggregate gross proceeds of up to $1,500,000.

The Option Agreement is an arm’s length transaction with Nickel North and no finder’s fees are payable in connection with the Option Agreement.

Option Agreement

Upon execution of the Option Agreement, the Company paid to Nickel North a non-refundable cash payment of $12,000. Additionally, within five business days of the date that is two business days following receipt of the final acceptance by the Exchange of the transactions contemplated by the Option Agreement, the Company will pay to Nickel North $200,000 and issue to Nickel North 5,000,000 common shares in the capital of the Company.

First Option

Pursuant to the terms of the Option Agreement, the Company will earn an 80% interest in the Hawk Ridge Property by:

- Paying to Nickel North:

- $250,000 on the date that is the one year anniversary of the Effective Date (the “First Anniversary”);

- $250,000 on the date that is one year following the First Anniversary (the “Second Anniversary”);

- $250,000 on the date that is one year following the Second Anniversary (the “Third Anniversary”);

- $250,000 on the date that is one year following the Third Anniversary (the “Fourth Anniversary”); and

- $300,000 on the date that is one year following the Fourth Anniversary (the “Fifth Anniversary”);

- Issuing to Nickel North:

- 3,000,000 Common Shares on the First Anniversary;

- 3,000,000 Common Shares on the Second Anniversary;

- 3,000,000 Common Shares on the Third Anniversary;

- 3,000,000 Common Shares on the Fourth Anniversary; and

- 4,000,000 Common Shares on the Fifth Anniversary; and

- Incurring on the Hawk Ridge Property:

- $500,000 of exploration expenditures before the First Anniversary;

- $1,000,000 of exploration expenditures before the Second Anniversary;

- $1,500,000 of exploration expenditures before the Third Anniversary;

- $1,500,000 of exploration expenditures before the Fourth Anniversary; and

- $1,500,000 of exploration expenditures before the Fifth Anniversary.

A summary of the foregoing option payments is included in the chart below.

| Event | Cash Payment | Shares issued | Exploration Expenditure | Interest Earned (cumulative)* |

| Option signing | $12,000 | – | – | – |

| Exchange approval | $200,000 | 5,000,000 | – | 10% |

| First Anniversary | $250,000 | 3,000,000 | $500,000 | 20% |

| Second Anniversary | $250,000 | 3,000,000 | $1,000,000 | 30% |

| Third Anniversary | $250,000 | 3,000,000 | $1,500,000 | 40% |

| Fourth Anniversary | $250,000 | 3,000,000 | $1,500,000 | 60% |

| Fifth Anniversary | $300,000 | 4,000,000 | $1,500,000 | 80% |

| Total | $1,512,000 | 21,000,000 | $6,000,000 | 80% |

| * If 1844 does not complete the full first option, the Company will forfeit its interest in the Hawkridge Property in exchange for common shares of Nickel North at a monetary value determined pursuant to the terms of the Option Agreement. | ||||

Second Option

Additionally, the Company may earn the remaining 20% interest in the Hawk Ridge Property subject to the Underlying Royalty and the NSR Royalty (as defined below), by paying to Nickel North an additional $2,000,000 before the date that is one year following the Fifth Anniversary. If the Company exercises the Second Option, the Company will grant to Nickel North a 2% net smelter returns royalty from all mineral production from the Hawk Ridge Property.

Concurrent Private Placements

The Company intends to sell and issue by way of a non-brokered private placement: (i) up to 20,000,000 units of the Company at a price of $0.025 per Unit for aggregate gross proceeds of up to $500,000; and (ii) up to 28,571,428 flow-through units of the Company at a price of $0.035 per FT Unit for aggregate gross proceeds of up to $1,000,000.

Each Unit will be comprised of one Common Share and one half of one Common Share purchase warrant. Each Unit Warrant will entitle the holder thereof to purchase an additional Common Share at a price of $0.05 per Unit Warrant Share for a period of 24 months following closing of the Unit Offering.

Each FT Unit will be comprised of one Common Share, to be issued as a “flow-through share” within the meaning of the Income Tax Act (Canada), and one half of one Common Share purchase warrant. Each FT Unit Warrant will entitle the holder thereof to purchase an additional Common Share at a price of $0.05 per FT Unit Warrant Share for a period of 24 months following closing of the FT Unit Offering.

The Company reserves its right to reallocate the number of securities issued between the Unit Offering and the FT Offering provided that the aggregate value of the Offerings does not exceed $1,500,000.

The Company intends to use the net proceeds of the Unit Offering for mineral exploration and for general corporate purposes. The Company intends to use the net proceeds of the FT Unit Offering for exploration activities and for general corporate purposes, with the net proceeds from the issuance of the FT Shares being used to incur resource exploration expenses that will constitute “Canadian exploration expenses” and “flow through mining expenditures” as defined in the Income Tax Act (Canada).

In connection with the Offerings, the Company will pay a cash finder’s fee equal to 8% of the gross proceeds and issue a number of non-transferable Common Share purchase warrants equal to 8% of the number of Units sold under the Unit Offering to eligible persons who refer investors to the Company, where permitted by applicable law and in accordance with the policies of the Exchange. Each Finder’s Warrant will entitle the holder thereof to purchase a Warrant Share at a price of $0.05 per Warrant Share for a period of 24 months following closing of the Unit Offering. Any finder’s fees to be paid by the Company in connection with the FT Unit Offering will be payable in accordance with the policies of the Exchange.

All securities issued pursuant to the Offerings will be subject to a statutory hold period expiring four months and one day after closing of the Unit Offering or FT Unit Offering, as applicable. Completion of the Offerings is subject to a number of conditions, including, without limitation, receipt of all regulatory approvals, including approval of the Exchange.

None of the securities issued in the Offerings will be registered under the United States Securities Act of 1933, as amended (the “1933 Act”), and none of them may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act. This press release shall not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of the securities in any state where such offer, solicitation, or sale would be unlawful.

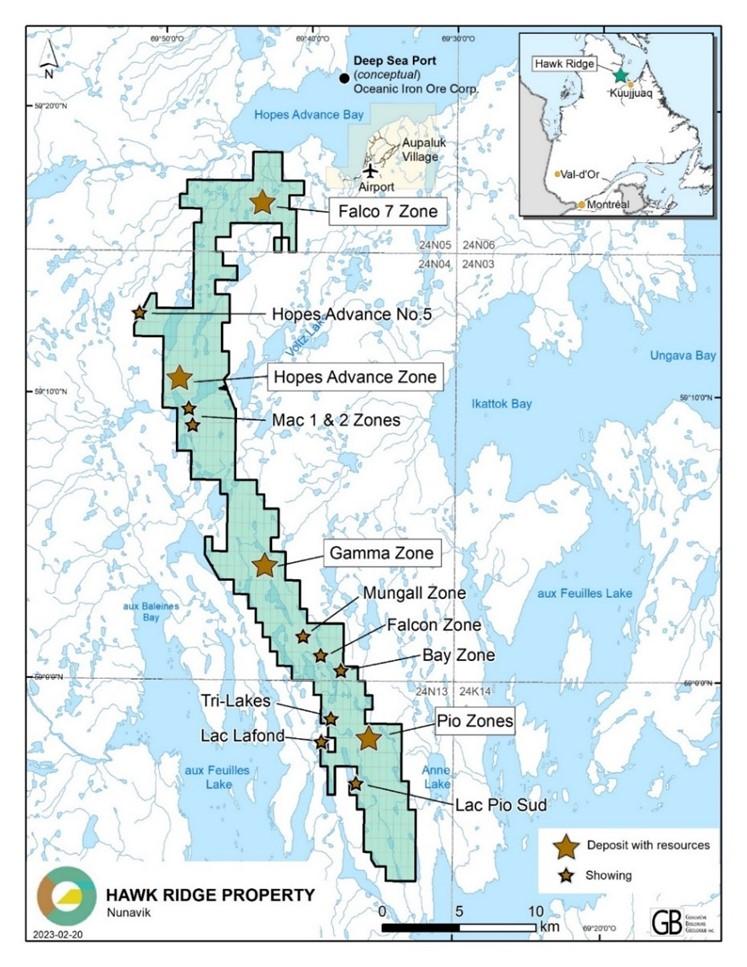

About the Hawk Ridge Property

The Hawk Ridge Property is comprised of 411 claims covering 179 km2 over a 50km belt located on the Ungava Bay, located North of Kuujjuaq, with direct access to tidewater on the east coast of Quebec. The project is known for its Ni and Cu content, specifically:

- Nickel North completed mineral resource estimates for the Falco 7, Gamma, Hopes Advance Main and Hopes Advance North deposits. Metals included in the Mineral Resource estimate are copper, nickel, cobalt, platinum, palladium and gold. The aggregate pit constrained inferred mineral resource (the “Historical Resource”) for all four deposits as reported by Nickel North using a $35/t cut-off was 29.44 Mt grading 0.20% Ni, 0.52% Cu, 0.012% Co, 0.19 g/t Pd, 0.04 g/t Pt and 0.021 g/t Au, corresponding to 0.56% NiEq. 1844 is treating the Historical Resource as a historical estimate and not a current mineral resource. Please see “Historical Resource Estimate Notes” below for further information.

- The deposit contains an additional exploration target which was defined by Nickel North in its technical report titled “Technical Report and Updated Mineral Resource Estimate of the Hawk Ridge Nickel-Copper (PGE) Property, Northern Quebec, effective July 5, 2022 with a potential range of 35Mt to 60Mt with grades ranging from 0.35% to 0.40% Cu, 0.10% to 0.20% Ni, 0.01% to 0.02% Co, 0.03 g/t to 0.05 g/t Pt, 0.15 g/t to 0.20 g /t Pd and 0.03 g/t to 0.05 g/t Au. Exploration targets are based on estimated strike length, depth and width of known mineralization supported by intermittent drill holes, geophysical data and mineralized surface exposure observations. The potential tonnage and grade of this exploration target are conceptual in nature and there has been insufficient exploration to define a mineral resource. It is uncertain whether further exploration will result in the target being delineated as a mineral resource.

- The Hawk Ridge Property hosts disseminated mineralization, and subordinate lenses of massive sulphide that are hosted in porphyritic gabbro and olivine-rich gabbro. The sulphide minerals are mainly pyrrhotite, chalcopyrite, and pentlandite, with minor violarite and cobaltite.

- Localized concentrations of massive sulphides in gabbro and in remobilized sulphide mineralization in footwall metasedimentary rock found on the Hawk Ridge Property, are associated with the presence of copper.

The majority of the Hawk Ridge Property is subject to the Underlying Royalty, of which one third (i.e. 1%) may be repurchased at any time for $1,000,000. Another 1% of the Underlying Royalty is subject to a right of first refusal.

Hawk Ridge Property Claims Map

Historical Resource Estimate Notes

The Historical Resource was reported by Nickel North in a technical report entitled “Technical Report and Updated Mineral Resource Estimate of the Hawk Ridge Nickel-Copper Property, Northern Quebec” dated effective July 5, 2022. The Company views the Nickel North Report as relevant and reliable as it was prepared to currently accepted standards. A thorough review of all historical data performed by a qualified person, along with possible additional exploration work to confirm results, would be required in order to produce a current mineral resource estimate for all deposits. A qualified person has not done sufficient work to classify the historical estimate as current mineral resource at this time.

Qualified Person

Bernard-Olivier Martel, P. Geo, the Company’s Director of Exploration, is a qualified person (as such term is defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects) and has reviewed and approved the technical disclosure contained in this news release.

About 1844 Resources Inc.: 1844 is an exploration company with a focus in strategic and energetic metals and underexplored regions “Gaspé, Nunavik Québec”. With a dedicated management team, the Company’s goal is to create shareholder value through the discovery of new deposits.

[1] Certain claims comprising the Hawk Ridge Property are subject to a 3% underlying net smelter returns royalty which is subject to the right of repurchase as provided in the underlying agreement. A copy of the Option Agreement will be posted to the Company’s SEDAR+ profile.

MORE or "UNCATEGORIZED"

Great Pacific Gold Announces Closing of Upsized $16.9 Million Private Placement Financing Led by Canaccord Genuity Corp

Great Pacific Gold Corp. (TSX-V: GPAC) (OTCQX: FSXLF) (FSE: V3H)... READ MORE

Ridgeline Minerals Provides Assay Results and Drill Program Updates for the Big Blue and Atlas Projects

Big Blue highlights: 0.6 meters grading 0.7% Cu, 3,194 g/t Ag and... READ MORE

Goldshore Intersects 42.7m of 1.09 g/t Au at the Eastern QES Zone of the Moss Deposit

Goldshore Resources Inc. (TSX-V: GSHR) (OTCQB: GSHRF) (FSE: 8X00)... READ MORE

Dios Sells K2 to Azimut

Dios Exploration Inc. (TSX-V: DOS) is pleased to report it has e... READ MORE

Northisle Announces Near Surface Intercepts and Higher-Grade Intercepts at Depth at West Goodspeed on its North Island Project

Highlights: Recent drilling at West Goodspeed supports the presen... READ MORE