Gwen Preston – “Country Risk…And Lack of Reward”

Last week’s Maven Letter was packed to the brim. I had to start with the Federal Reserve raising rates – guess what? Turns out a Fed that telegraphs its move and then does exactly what it’s expected to do doesn’t send the market into a spin.

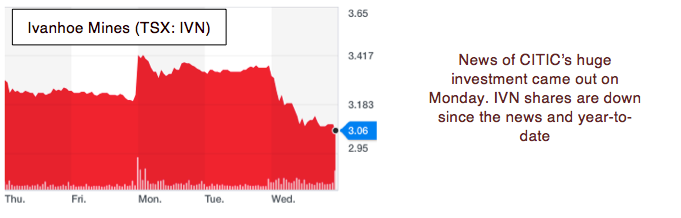

Then I discussed how the market totally dismissed an immense investment – CITIC Metals putting $723 million into Ivanhoe Mines – as an example of how certain tough jurisdictions require Chinese involvement…but even when you succeed in getting that involvement, even to the tune of three-quarters of a billion dollars, don’t expect the market to care. That’s the article I’m providing here today.

After that I took a quick tour through coal. Metallurgical coal prices have been quietly rising for the last year. The thermal market hasn’t shown the same trend, but signs of tightness are appearing. So is coal exciting – and if so, why?

Following those comments was a new recommendation – a company about to issue significant news that I really think will surprise the market with its strength – as well as updates on Maven portfolio companies that had put out news.

As always, if you like what you read here you would like the full Maven Letter even more. Sign up here for a free trial subscription. Or if you’ve already used up your free trial, subscribe here.

Country Risk…And Lack of Reward

There were a few interesting pieces of news in the mining space this week, one of which was certainly CITIC Metals, a Chinese state-owned enterprise that is the largest conglomerate in the country and one of the world’s biggest buyers of metals, investing $723 million in Ivanhoe Mines (TSX: IVN) to take a 19.9% stake in the company.

The financing really strengthens Ivanhoe, which needed a substantial cash injection to continue advancing its three incredible but huge and expensive projects: the Kamoa-Kakula and Kipushi projects in Democratic Republic of Congo (DRC) and the Platreef platinum project in South Africa.

Another Chinese group, Zijin Mining, already owns 9.9% of IVN; if Zijin wants to use its anti-dilution right to maintain its stake, it would have to cough up $78 million.

CITIC’s investment says the Chinese, at least, are confident that the DRC is a functional place to operate. That’s a significant vote of confidence, especially since the DRC just signed a new mining code that increases royalties, introduces a super profits tax, and removes a 10-year amnesty for existing miners on the new rules. Miners in the DRC have been pushing back against the new code collectively and vocally, but the government signed it into law without any changes last week.

As for Ivanhoe, the market barely blinked on the news. Let me say that again: the market had almost no reaction to news of a company investing three-quarters of a billion dollars into Ivanhoe, in support of three developing mines.

I think there are three reasons for the lack of reaction.

First, the market knew IVN needed money and an equity financing at around this price was expected. Fair enough.

Second, the investor is Chinese. The market just doesn’t react the same when money comes from China as when it comes from elsewhere. There’s some rationale: a large Chinese strategic investor makes an asset or company much less attractive to other potential partners or investors, many of whom balk at trying to work alongside Chinese entities, so the money ironically makes the story less exciting going forward. It’s kind of an asset-off-the-table situation.

Third, Ivanhoe’s assets are in hard places. The company was always going to struggle to find support to build its big, expensive mines in DRC and South Africa. That means Chinese backing was always going to be the way forward, for two reasons. First, the Chinese were far more likely to support the risk-reward inherent in IVN, given the extent of Chinese investment in Africa. Second, IVN needs the clout that comes with major Chinese backing to ameliorate permitting and operating risks in southern Africa, which is highly dependent on all that Chinese capital and investment.

The bottom line: it’s basically impossible to operate in places like DRC and South Africa without Chinese backing…but if you’re listed in North America don’t expect the market to give you any credit for securing precisely that backing! Rock and a hard place, anyone?

MORE or "UNCATEGORIZED"

Silver Mountain Announces Closing of Prospectus Offering

Silver Mountain Resources Inc. (TSX-V: AGMR) (OTCQB: AGMRF) is ... READ MORE

Mandalay Extends the Storheden Gold Deposit Adjacent to the Operating Björkdal Mine

Mandalay Resources Corporation (TSX: MND) (OTCQB: MNDJF) announce... READ MORE

Collective Mining Intercepts 632.25 Metres at 1.10 g/t Gold Equivalent in a 200 Metre Step-Out Hole to the South at Trap

Collective Mining Ltd. (TSX: CNL) (OTCQX: CNLMF) (FSE: GG1) is pl... READ MORE

Koryx Copper Intersects 207 Meters at 0.49% and 116 Meters at 0.54% Copper Equivalent

Significant copper and molybdenum intersections include: HM19: 11... READ MORE

Red Pine Intercepts Significant Mineralization at the Wawa Gold Project, including 5.34 g/t over 13.39 metres including 16.50 g/t gold over 0.97 metre and 13.62 g/t gold over 2.13 metres

Red Pine Exploration Inc. (TSX-V: RPX) (OTCQB: RDEXF) is pleased ... READ MORE